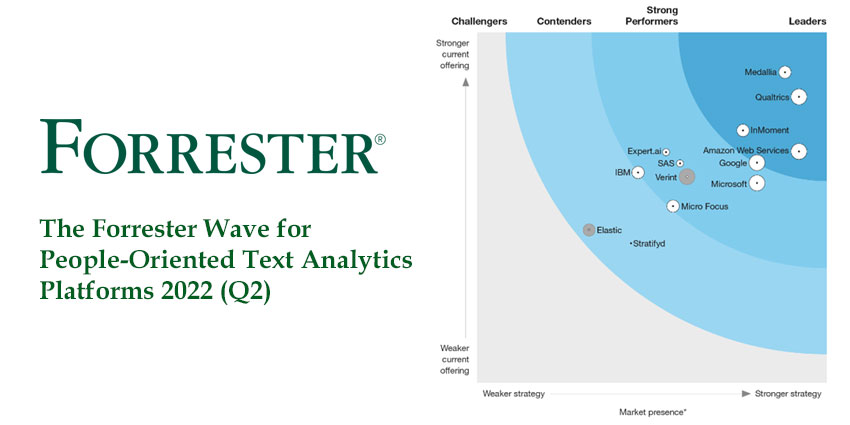

Leading analyst Forrester has published its much-awaited 2022 Forrester Wave for People-Oriented Text Analytics Platforms (Q2).

Vendors in this space aim to keep tabs on customer desires, preferences, and brand alliances, which can switch in a split second. After all, the modern consumer is always exposed to new brands through advertising and social media.

To compete in such an environment, brands must alter their experiences and products based on an advanced understanding of customer needs and behaviors in the digital space. People-oriented text analytics platforms enable companies to do so.

In this report, Forrester has assessed what its analysts believe to be the 13 most significant players in the space, isolating five market leaders.

The Definition of People-Oriented Text Analytics Platforms

People-oriented text analytics technologies transcribe customer conversations and mine insights, which companies can act on to improve products, services, and CX.

Thanks to the emergence of the cloud, the technology is rapidly evolving, delivering real-time customer insights with an increasing ease of use.

Yet, more players are entering the field, including global enterprise technology pioneers like Amazon, Google, and Microsoft. As such, it is difficult to set the major players apart.

Fortunately, Forrester helps companies navigate the crowded arena, using a 29-criterion evaluation to divide vendors into one of four segments: Leaders, Strong Performers, Contenders, and Challengers. Here, we review them all.

The 2022 People-Oriented Text Analytics Platforms Forrester Wave Leaders

Forrester Wave leaders boast a robust current offering and market presence. As such, they provide relevant, specialist use cases. These include: CX analytics, conversation intelligence, EX analytics, social listening, and market intelligence. Moreover, they excel at natural language interpretation (NLI) and have invested in transformer networks. This year’s leaders are:

- Mi

- Qualtrics

- InMoment

- Amazon Web Services (AWS)

Medallia

Since 2008, Medallia has embedded analytics into its platform. Nowadays, over 90 percent of Medallia Experience Cloud customers use its text analytics capabilities. They will soon enjoy new video insights, out-of-the-box predictive models, and a low-code automated machine learning product – highlighting how ease of use is at the forefront of its future visionsas. Forrester also pinpoints NLI, data visualization/dashboards, native video, and speech analytics as notable strengths.

Qualtrics

Following its 2021 acquisition of Clarabridge, Qualtrics has leaped to the front of people-oriented text analytics. The vendor will soon roll out interaction analytics enhancements, videoconferencing as a data source, and a conversational UI to continue this momentum. However, for now, Forrester isolates knowledge-based AI, comprehensive NLI, and document-level text analytics, while users suggest that the platform’s scalability is a significant differentiator.

InMoment

Again, InMoment has benefitted from recent acquisitions to catapult its way to market leader status, with the provider now striving to consolidate its offerings. This includes improving its insight self-service capabilities, bolstering its workflow automation functionality, and adding more out-of-the-box features. However, according to Forrester, it already boasts numerous strengths, including omnichannel data integration, embedded text analytics, and comprehensive NLI.

Amazon Web Services (AWS)

AWS packages a whole host of cloud AI services for text analytics, including Textract, Kendra, Transcribe, and many more. As such, Forrester recommends the solution for customers looking to build their own text analytics applications. Such a unique offering has allowed AWS to establish a significant market presence, with prominent strengths including machine learning-based AI, the full ModelOps cycle, and real-time digital care.

Similar to AWS, Google has built a series of cloud AI services on Vertex AI, its ModelOps platform. From this, the vendor offers contact center AI, document AI, and “Discovery Solutions” for multiple industries, creating a unique offering. Forrester pinpoints the image/video-to-text capabilities, machine learning-based AI, and complete ModelOps cycle as significant strengths. It also indicates that companies looking for CCaaS solutions or building text analytics applications on Google Cloud will realize the most value.

The 2022 People-Oriented Text Analytics Platforms Forrester Wave Strong Performers

Strong performers in the Forrester Wave exhibit a track record of implementing many successful people-oriented text analytics use cases. While they fall a little short of market leaders, they partner their robust offering with a significant global presence in the space and an innovative vision for the future. This year’s strong performers are:

- Microsoft

- Verint

- SAS

- ai

- Micro Focus

- IBM

Microsoft

Microsoft offers many text analytics capabilities through its Azure platform under the guise of cloud AI services. The prominent vendor continues to enhance these while leveraging investments in Azure Search, Microsoft 365, and Dynamics 365, challenging data scientists and app development pros to build innovative solutions. Alongside its global capacity, this challenge may appeal to many. However, those with limited IT resources may look elsewhere.

Verint

According to Forrester, the contact center technology veteran has developed “formidable” analytics across all contact center channels. It also recognizes this while lauding its omnichannel data integration and real-time digital care with complex workflow capabilities. However, the market analyst warns that beyond speech analytics and conversation intelligence, the vendor perhaps lacks depth in CX and EX use cases and applications.

SAS

As Forrester puts it: “SAS shines with an integrated analytics platform, but many tasks require a data scientist.” Deeper within the report, the market analyst indicates that its platform “shines” due to its full ModelOps cycle capability DevOps, and integrations with SAS Data Studio and SAS Visual Analytics. It also plans to no-code/low-code UIs, search-based data exploration, and NLG-powered explanatory models, which will help lower the deep expertise the platform currently necessitates.

Expert.ai

Forrester classifies Expert.ai’s knowledge-based AI as “remarkable”, while the market analyst lauds its data enrichment and labeling, NLU, and document/cross-document level text analytics capabilities. While its machine learning capabilities were once a concern, the report suggests they have “caught up” with fellow high-performers. As such, the “strong performer” only seems to trail leaders in its lack of features to mine text from speech and images.

Micro Focus

According to Forrester, Micro Focus has one of the market’s most comprehensive text analytics platforms. It plans to add to this by broadening its financial services entities, adding video summarization, and investing in global PII coverage. In doing so, it adds to its existing strengths, which – according to Forrester – include document-focused data integration, workflow orchestration, and NLU functionality. Yet, the market analyst warns that its NLI could improve.

IBM

Industry stalwart IBM receives praise for the breadth of its people-orientate text analytics capabilities and its flexibility to address all use cases within the report. Forrester also highlights that clients seemingly enjoy IBM’s professional services, alongside its machine learning, NLU, and security capabilities. However, the analyst stresses the “need” for IBM to invest in omnichannel data models and integration to enhance the platform’s video-to-text capabilities.

The 2022 People-Oriented Text Analytics Platforms Forrester Wave Contenders

While challengers may trail the rest in this report, Forrester recognizes them as significant players in the space by being included. As such, contenders may prove significant market disruptors, already achieving a global market presence and building an intelligent platform that supports people-oriented use cases. This year’s strong contender are:

- Stratifyd

- Elastic

Stratifyd

Stratifyd excels in its time to implementation, offering ready-to-go, no-/low-code tools that clients can deploy much faster than competitor solutions. Indeed, they must simply select a data source to analyze, and the technology takes care of the rest. However, such simplicity comes with a trade-off, as customization is limited, while Forrester also suggests that the vendor should invest in comprehensive data integration from multiple data sources.

Elastic

As the name suggests, Elastic offers a highly flexible solution that allows its clients to add complementary capabilities to other text analytics solutions. Indeed, it would perhaps not classify itself as a competitor to the other vendors on the list, instead offering additional capabilities, such as integrated cognitive search and investigative intelligence. Yet, to truly compete with market leaders, Forrester recommends that it enhances its machine learning, NLI, and document-level text analytics.

The 2022 People-Oriented Text Analytics Platforms Forrester Wave Challengers

In this year’s edition of the Forrester Wave for People-Oriented Text Analytics Platforms, the market analysts doe not class any vendor as a “challenger”.

What Lies Ahead for People-Oriented Text Analytics Platform Providers?

As digital transformation evolves customer experiences at a record pace, people-orientated text analytics becomes more critical to unlock insights that set customer journeys apart.

Therefore, it is little surprise to see Medallia and Qualtrics thriving. Yet, it is intriguing to see enterprise technology pioneers – such as AWS, Google, and Microsoft – quickly make ground within the space.

Although their offerings still require significant developer expertise, this is perhaps a sign for the future, as these brands look towards a single-vendor approach.

Yet, many more vendors are not included in this list – including the likes of NICE.

So, in future additions of the Forrester Wave, it will be interesting to see which vendors gain ground and investigate whether the likes of Microsoft can continue their upward trajectory.

Uncover Gartner’s findings into the leading players within the data & analytics space by reading our rundown of the Gartner Magic Quadrant for Data and Analytics Service Providers 2022