Customer turnover captures how many customers are dropping off from the business.

Also known as customer churn, attrition, and defection rates, this key performance indicator (KPI) is an excellent indicator of a company’s health.

Fortunately, customer turnover is easy to calculate within subscription-driven businesses where it is easy to quantify the percentage of active customers. However, for other business models, it is often tricky.

How to Calculate Customer Turnover

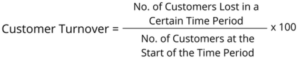

At its simplest, businesses may measure customer turnover with the following formula:

As an example of how this works, consider a business that wishes to measure customer turnover across the year. They start the year with 1,000 customers but lose 100 of these over the 365-day period.

Plugging these numbers into the formula, the business can calculate its annual customer turnover as 10%.

Customer Turnover = (100 ÷ 1000) x 100 = 10%

However, companies mostly measure customer turnover at shorter intervals to highlight how CX improvement initiatives impact turnover.

After all, spending an entire year optimizing CX only to realize that these efforts have not improved retention will likely prove a tough pill to swallow.

The Benefits of Calculating Customer Turnover

There are two significant benefits of calculating customer turnover:

- It enables businesses to manage retention actively

- It allows companies to calculate customer lifetime value

The first benefit highlights how companies can safeguard their revenues. As the Harvard Business Review reports: “Acquiring a new customer is anywhere from five to 25 times more expensive than retaining an existing one.”

These statistics highlight the value in uncovering why customers leave and addressing these reasons. Turnover rates are central to such a strategy. After all, as the adage goes: “You can’t manage what you can’t measure.”

Also, as turnover indicates how long a customer is likely to stay with the business, it is critical to lifetime value calculations.

By using turnover rates to measure lifetime value, companies can create strategies to enhance customer profitability and achieve more significant revenues.

What Is a Good Customer Turnover Rate?

What a company considers a “good” customer turnover rate will depend on the sector it belongs to and broader economic conditions.

For example, according to Statistica, the turnover rate within financial services is 25%. Meanwhile, for big-box electronic companies, the benchmark is 11%.

Of course, businesses must stay cautious of benchmarks like these. After all, Statistica may calculate turnover across a different period or in a completely different way.

So, while they may prove helpful to understand trends and best practices, avoid thinking of external benchmarks as “gospel”.

Often, the best method of benchmarking is to compare customer turnover rates internally with historical figures. By doing so, companies can monitor internal progress and goal achievement.

Discover more about how KPIs – such as customer turnover – can enhance company strategies by reading our article: How Are Business Intelligence and KPIs Connected?