Increasingly complex solutions and the introduction of chatbots, financial services, payment services and expansion into CPaaS platforms will disrupt the CPaaS market in a matter of months, vendors have been warned.

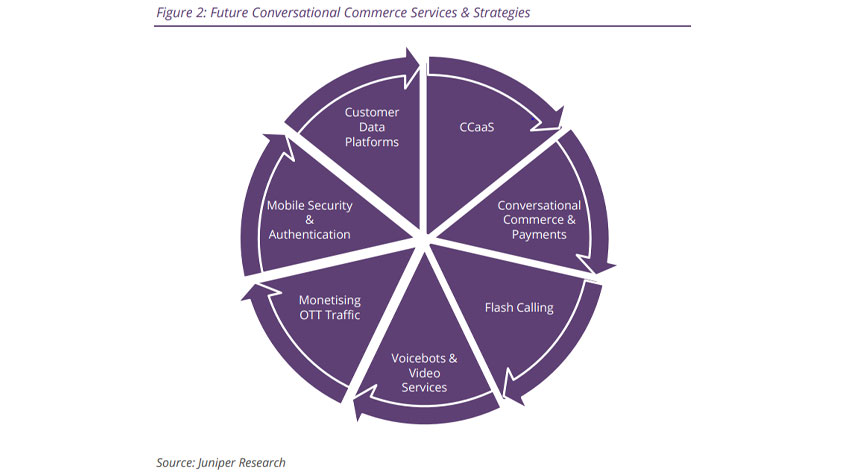

Insightful new findings from Juniper Research states the overcomplication of CPaaS solutions teamed with the introduction of CDPs (Customer Data Platforms) and CCaaS (Contact Centres-as-a-Service) as key elements that leading CPaaS platforms must look to introducing, will affect CPaaS operations in 2022.

The report reads: “Juniper Research has identified the management of chatbot flow works as a key service that CPaaS vendors will need to expand in the future.

“Many smaller enterprises, which have less need for AI-based chatbots, will be able to use flow builders to create simple chatbots. However, larger enterprises will demand chatbots that require AI to create more complex user experiences.”

The research also identified financial and eCommerce services as key new options CPaaS providers should be looking to implement within the next three years, in order to offer a unique selling point over competitors, which should be a priority for businesses next year. This is because they will provide varying degrees of opportunity for a return on investment.

The report also cited various components of business models that CX providers should include in their 2022 strategies to remain successful. These include:

- Customer Data Platforms: CDPs (Customer Data Platforms) will enable brands and enterprises to deliver a better customer experience through advanced data mining and more granular insights into consumer preferences. Good examples of this are Twilio’s acquisition of Segment in November 2020, and Link Mobility’s acquisition of Marketing Platform in April 2021. Juniper Research anticipates that this increasing usage of these platforms will create a differentiation point amongst its competitors; as communication channels become increasingly IP based and media rich, these data platforms will become more and more important

- In-messaging Payments: RCS, and subsequently RBM (RCS Business Messaging), provide notable benefits to the mobile payments market. RCS offers significant improvements over the established SMS standards, such as vendor authentication and the growing trend of ‘conversational commerce.’ However, if payments over RBM are to be successful, RCS will need to adhere to payments legislation such as PSD2 (Payments Services Directive). This EU directive ensures the provision of Open APIs to enable account details to be shared and third-party vendors to initiate payments via these details. Critically, it also requires all payments to be subject to SCA (Strong Customer Authentication), a 2FA (Two-factor Authentication) process that includes possession (such as OTPs (one time passwords)), knowledge, and inherence

- CCaaS: CCaaS (Customer Contact-as-a-Service) refers to solutions offered to brands and enterprises that enable them to run their own contact centres and manage inbound customer communications. This can be considered the opposite of CPaaS services that enable inbound consumer communications. Therefore, given the agility of CPaaS players, it was inevitable that they would look to leverage their expertise in emerging IP-based communications technologies to develop services in the CCaaS space. The COVID-19 pandemic created significant problems for brands and enterprises and hindered their ability to generate revenue through established channels. However, customer service was also impacted by ‘work from home’ orders in many countries. Remote working solutions were implemented, however, specialist software was required to enable agents to work remotely. Whilst the offer of a SaaS-like service was being slowly rolled out, the pandemic certainly accelerated demand for such services

- Online Retail: Juniper Research believes that a distinction should be made between adopting a multichannel and an omnichannel approach to customer interactions. At present, the majority of brands that claim to use an omnichannel approach to sales and customer service are actually only using a multichannel approach, as not all potential messaging channels are sufficiently covered. In addition, Juniper Research believes that multichannel approaches are built around the requirements of the business, rather than their customers. That is, brands adopt the messaging formats best suited to their business needs, often making assumptions about customer preferences and requirements. In order to move to a truly omnichannel approach, enterprises must truly reach customers on the platforms they use the most

The research also noted that with the proliferation of 5G, voice and video calling will become increasingly interlinked and supported by growing numbers of operators. The greater level of cellular mobile video calling enabled by 5G is expected to have significant applications for both consumers and industries.

The report in full can be found here.