Customer lifetime value (CLV) quantifies the total value a person will generate for an organization throughout their relationship with the brand.

The metric informs revenue forecasts, routing strategies, and overall customer management. For example, high-value customers may receive additional perks to safeguard their business.

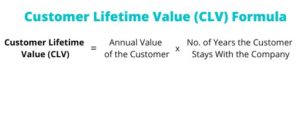

Customer Lifetime Value Formula

Here is the CLV formula:

For subscription-based companies, following this equation is straightforward. However, for a fast-moving consumer goods (FMCG) seller, the formula may change as they instead aim to calculate the profits generated per product. As such, much deeper forecasting is likely necessary.

Another consideration in the CLV formula is the impact of outliers. Since the KPI arrives at an average across the customer base, those with the highest or lowest CLV may skew its value considerably.

For this reason, it is essential to analyse specific customer segments and look at CLV trends across different product categories and business units.

How to Calculate Customer Lifetime Value

To calculate customer lifetime value (CLV), organizations can follow these steps:

Step 1. Gather the Relevant Data (Likely from the CRM)

CRM systems make it easier to monitor customer volumes, track new customers, and predict attrition. They can connect with various data sources like e-commerce stores, websites, contact center systems, etc., to extract and aggregate customer data. The CRM will also map customer acquisition and turnover rates in real-time.

Step 2. Determine the Historical Measurement Period to Base Future Forecasts

Customer lifetime value is a forward-looking metric, which means that it estimates the future lifetime value of a customer while the relationship is still ongoing. Some companies use the formula to predict CLV even before acquiring a customer to gauge if the acquisition costs are worth it. The second step is to decide the measurement period for analysis and how frequently to update the data.

Step 3. Implement a Statistical Algorithm for CLV Analysis

While it is possible to calculate a basic CLV manually, automated algorithms provide a simpler option. Companies such as Crealytics, Verfacto, and Kyros offer specialist solutions. However, many CRM providers – including Salesforce – will provide native tools to simplify the process.

Step 4. Segment Customers to Gain Deeper Insights

Customer segmentation unlocks the potential of the CLV metric. It allows companies to investigate different customer groups and demographics to understand profitability. Then, they can target prospects accordingly to gain maximum returns from customer acquisition funds.

Ideally, companies should calculate the CLV individually for each customer segment and maintain dedicated statistical models. Input variables for each segment (retention, discount, growth, net profits, etc.) should inform the analysis.

Step 5. Realign Marketing and Outbound Strategies to Maximize CLV

Finally, as per CLV insights, organizations need to realign their marketing, sales, contact center, and customer experience strategies. For example, if customers converted via a specific channel have a higher lifetime value than average, that channel should perhaps receive more attention and investment. Contact center agents should perhaps also receive training based on these insights so they understand which behaviors drive higher CLV.

Additional Tips and Best Practices

There are several tips and best practices that can aid a CLV calculation; some of these include:

- Factor in churn rate to calculate how long customers tend to stay with the business. For example, if a company’s annual churn rate is 25%, its average lifetime duration will be approximately (1 ÷ 25) x 100 = 4 years. This information typically enhances CLV calculations.

- Examining CLV in relation to various customer personas is critical as it helps the company focus on who its ideal customers are. Marketing should then work to attract this “type” of customer.

- Collaborate with finance departments to ratify the calculation. Ultimately, customer lifetime value (CLV) is as much of a finance metric as it is a CX KPI. Also, buy-in from different stakeholders is essential to unearth the best data and ensure its accuracy.

Throughout calculating customer lifetime value, particular tools and platforms can be of help. For instance, data platforms – such as Optimizely – harness integrations and a segmentation engine to calculate CLV and other metrics.

A homegrown solution using Google’s open-source AI algorithm is also an alternative for businesses with technical know-how.

Benefits of Measuring Customer Lifetime Value

There are several reasons why CLV is a top metric for organizations. First, it indicates whether a business is profitable. Estimating the metric before introducing new products/services or investing in new acquisitions enables companies to gauge their potential profitability.

Also, CLV insights can inform promotion and loyalty programs. If targeted campaigns are based on CLV, they can accrue maximum profitability for the organization.

Finally, if measured in real-time, companies can set up alerts when a particular segment’s lifetime value falls. Systems such as Tableau enable this. Then, organizations can realign investments or focus on course correction.

Discover how to calculate various other CX KPIs by reading our articles: