Customer churn is the rate at which customers abandon a product or service provider and switch to a competitor. For many, it is one of the most critical business metrics, indicating its health and how successfully a company can engage and retain its customers.

2022 is a vital year for churn measurement, as research suggests that organizations are going through a “Great Customer Resignation” of sorts. As per 2022 Sugar CRM research, more than half of companies (58 percent) have endured increased churn over the past 12 months.

The study also suggests that the average business will lose nearly one customer for every three new acquisitions in 2022.

“Companies face a daunting scenario – struggling to fill the top of the funnel with qualified leads while losing customers at the bottom of the funnel,” notes Craig Charlton, CEO of SugarCRM. This makes it crucial to pay close attention to this metric and adopt measures for churn avoidance.

Measuring Customer Churn

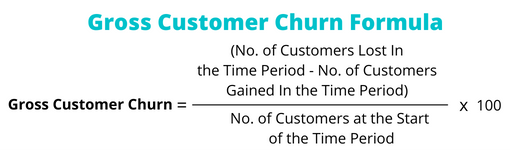

When calculating customer churn, it is important to note two widely-used customer churn formulas – gross churn and net churn.

How to Calculate Gross Customer Churn

The gross figure refers to the total reduction in the customer base without differentiating between new and old customers.

Even if new customers offset those who fell prey to churn, this metric will not highlight the issue.

Nevertheless, it is useful when organizations want to calculate the business’s overall health.

Its formula is as follows:

Let’s say the organization is calculating customer churn for 2022. It started the year with 1,000 customers, lost 300 customers along the way, but acquired 200 more.

So, the company closed 2022 with 900 customers. As a result, the net churn rate will look like this:

Net churn can also appear as a negative figure. If so, this is a prime indicator of a healthy business.

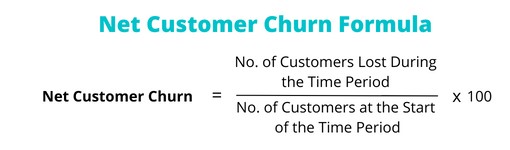

How to Calculate Net Customer Churn

Many customers choose to calculate churn without considering customer acquisition. Doing so is advantageous since, in many cases, multiple teams are responsible for customer acquisition and retention, and the success of one team should not compensate for the failure of the other.

Therefore, many companies calculate net churn in addition to gross churn. To do so, they will likely use the following formula:

The new calculation – using the aforementioned scenario – looks like this:

(300 ÷ 1000) x 100 = 30%

Net customer churn – sometimes referred to as “pure customer churn” – offers a helpful reflection of how well companies retain their customers.

As such, many choose to dig deeper into this metric to pinpoint possible reasons for churn. Breaking it up over specific time frames is helpful here.

By doing so, businesses may run targeted training, technology, and supervisory interventions to keep consumers from exiting the brand.

Tips to Avoid Customer Churn in 2022

Acquiring a new customer is almost always more expensive than retaining an old one, and the cost of customer acquisition is growing.

Between 2013 and 2019, the cost of customer acquisition increased by a staggering 60 percent, as per a ProfitWell study.

In the current work-from-home (WFH) environment, with low-touch interactions and high expectations, acquiring a new customer gets even more complex.

Luckily, the following five tips may help organizations to avoid churn:

- Explore New Sources of Customer Feedback – Consider additional feedback sources beyond traditional post-call surveys and customer complaints to gather new actionable insights. Social media, third-party review sites, and customer conversation analysis are excellent examples.

- Assess and Reengage – Flag keywords suggesting displeasure, such as “never,” “awful,” and so on. Rekindle engagement with follow-up calls, emails, and tailored marketing, among other methods.

- Revisit the Onboarding Process – Onboarding new customers is often the best place to set the groundwork for solid, churn-proof relationships. Measuring churn over the first month also allows businesses to spot whether onboarding processes need urgent revaluation.

- Improve Self-Service – A simple self-service portal offers customers another way to engage with the company, reducing the likelihood of switching.

- Consider Proactive Reminders – Is a customer’s subscription up for renewal? If so, offer them an alert that links to a simple renewals self-service journey. Making such experiences easy is likely to reduce churn.

Churn is typically a result of multiple factors, from the effort it takes to switch providers to the availability of market competition. However, customer service and experience quality are among the most significant determiners of churn.

Industry-Wise Customer Churn in 2022

It is helpful to benchmark churn against industry competitors so long as they are sure they use the same definition and formula for churn.

As per SurveySparrow’s 2022 analysis, here are some trends in customer churn across various industries:

- Insurance has the lowest churn, followed by banking, and has higher acquisition costs than other sectors. The top companies perform ten percent better in customer retention/churn compared to the industry average.

- Retail has the third-lowest churn rate because consumers prefer the same brand for their daily needs unless compelled to do otherwise. However, rising competition from eCommerce has challenged retail customer loyalty this year.

- Software-as-a-Service companies have middling churn rates, but this tends to vary hugely from one product, service, or company to another. Since it is still a growing market with a lot of competition, some churn is expected and acceptable.

- Barring education technology, the media industry has the highest churn rate.

Even as organizations compare their churn rates against industry peers, they should also plot internal trends year on year to ensure continuous improvement.

Churn rates enable companies to calculate customer lifetime value. To find out more, visit: How to Measure Customer Lifetime Value (CLV)