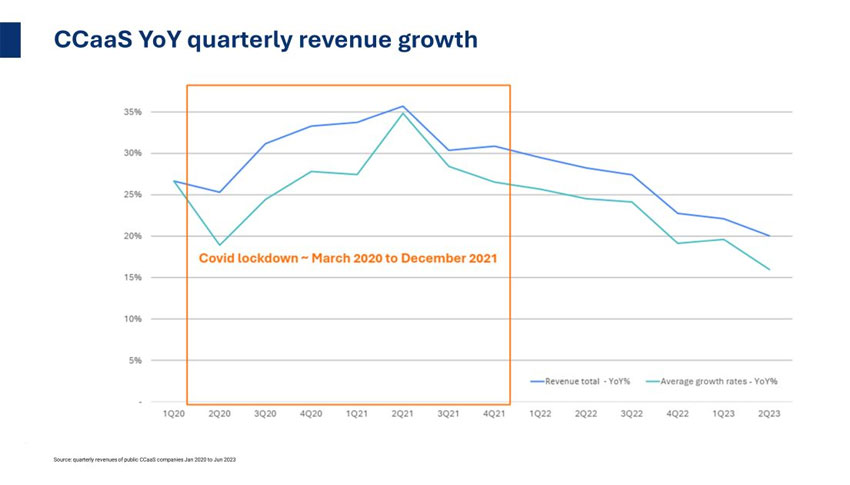

Since the close of 2021, revenue growth across the CCaaS space has slumped quarter after quarter – according to newly released Gartner research.

Indeed, across the proceeding six quarters, total year-over-year (YoY) revenue growth in the space dropped by a total of approximately ten percent.

The following graph – made public by CX analyst Nicolas de Kouchkovsky – highlights this trend.

Some may have expected a lull in 2022 after a pandemic-induced rush to CCaaS.

Yet, many anticipated a bounce back at the start of 2023. Market analysts pointed to potential growth drivers, such as the evolution of cloud-based AI and prominent legacy vendors – including Genesys – slowing their legacy innovation.

The downward trend, however, has only continued as the market returns to a steadier growth rate.

Still, it remains relatively healthy, and stalwart CCaaS providers – including NICE, Genesys, and Five9 – continue to post positive earnings results.

Nevertheless, declining CCaaS growth rates are “putting pressure on all providers to show a path to profitability,” according to de Kouchkovsky.

Consolidation In the CCaaS Market to Come?

Recent months have seen an uptick in M&A activity in the CCaaS space. For instance, NICE rolled up LiveVox last week, and Enghouse snapped up Lifesize in May after the latter entered bankruptcy.

de Kouchkovsky hinted that the drop in CCaaS revenue growth rates is a potential cause for such deals and noted that “we should expect more acquisitions to come.”

Adding fuel to this fiery take are reports of other CCaaS vendors struggling from a tricky macroenvironment where deal cycles are extending.

Moreover, several tech giants have entered the space over the past 18 months – including Microsoft, Google, and Zoom – squeezing oxygen from the CCaaS atmosphere.

Yet, Steve Blood, VP & Analyst of the Gartner Sales & Customer Service Practice, shared a more optimistic outlook on LinkedIn.

“I can’t agree this is CCaaS consolidation, at least not yet,” he said. “Leading providers are still adding capabilities to address new market adjacencies.”

To this point, Lifesize ran out of money – only then did Enghouse swoop in. It was hardly a conventional act of market consolidation.

Then, there is the NICE-LiveVox deal. While both are CCaaS vendors, LiveVox excels in its outbound capabilities and BPO specialism, which NICE wanted to bring into the business. Indeed, the deal was about much more than expanding its market footprint.

In addition, Blood suggests that there is still plenty of CCaaS business to fight for, with “at least 70 percent” of agents working from legacy infrastructures.

“There’s still much more growth to come for CCaaS providers with strong execution strategies,” he continued.

As it matures, the CCaaS market will emulate legacy premises – a few major providers and a long tail of smaller companies specializing in regions or verticals.

Indeed, many contact center infrastructure players successfully sustained their market presence for years until the cloud entered the fray and disrupted the status quo.

As such, Blood suggests that it may take a similar massive market shift for the “long tail” of smaller CCaaS providers to consolidate.

It’s Far from Doom and Gloom

CCaaS adoption is unlikely to skyrocket before the end of the year. Yet, Blood expects a steady flow of contact center migrations. He stated:

It’s our expectation that at the end of this year, 33 percent of the prem base will be CCaaS. [Although,] in discussion with CCaaS players, they tell me we’re over-optimistic.

Now, many vendors may downplay such forecasts, attempting to overestimate their total addressable market (TAM).

Yet, even at 33 percent, there is so much business left to play for – unlike in other markets, such as UCaaS, where consolidation is rife.

Indeed, RingCentral recently rolled up Hopin, and Mitel completed its acquisition of Unify just last week – in two significant UCaaS moves.

CCaaS, however, is a far less mature market – making consolidation less likely.

Of course, many business models may need to change as businesses prioritize profitability to avoid other Lifesize fiascos.

Nevertheless, growth opportunities are out there. For instance, NICE and Genesys both exceeded one million agent seats in the cloud this year – and many other vendors met the 500k milestone.

Such potential may mire more high-profile M&A activity in the short term. Yet, as Blood’s 33 percent figure increases, expect talk of consolidation to – well – consolidate.