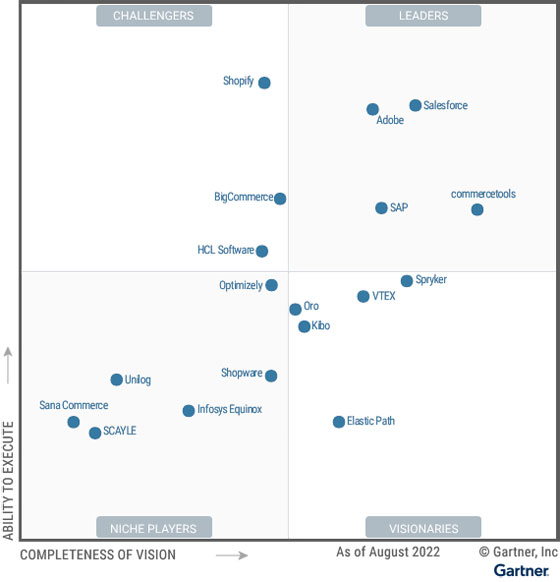

Gartner has released its long-awaited 2022 Magic Quadrant study that assesses many of the most mainstream digital commerce platforms.

Demand for such platforms surged in 2021 as enterprises endeavored to keep pace with digital disruption. Indeed, the market grew by a record 22 percent, per the market analyst.

However, many providers are striving to seize a more significant market share. As such, companies have many solutions to choose between.

Thankfully, Gartner isolates the strengths and cautions of 18 industry-leading platforms. In this year’s report, it identifies four market leaders.

The Definition of Digital Commerce Platforms

According to Gartner, a digital commerce platform is the core technology that allows online consumers to buy products and services autonomously through interactive self-service.

The platform supports customers too by informing buying decisions while harnessing data and algorithms to present complete orders for payment.

To quality for this Magic Quadrant, vendors must also enable interactive commerce experiences through empowering clients with a “storefront, product catalog navigation, product pages, shopping cart, check-out and customer account.”

Vendors can offer such capabilities either natively or through APIs.

Each of the following 18 vendors does precisely that, with Gartner splitting them into four categories: Leaders, Challengers, Visionaries, and Niche Players. Here, we review them all.

Gartner Magic Quadrant Leaders

Leaders in the Magic Quadrant offer platforms that impress in depth and breadth. They also offer solutions that cross multiple industries and use cases, each being easy to scale. Moreover, these vendors provide many integrations to native and/or third-party enterprise systems, demonstrate an impressive global footprint, and an exciting go-forward vision. This year’s leaders are:

- Salesforce

- Adobe

- commercetools

- SAP

Salesforce

Salesforce offers “Shared Lightening” services that add depth to its commerce platforms, allowing companies to efficiently utilize numerous offerings, including product recommendations and a native payments integration. Such an example hints at its impressive innovation streak, as demonstrated by its new Composable Storefront solution. Gartner notes its array of industry offerings and multisite functionality as further strengths.

Adobe

As Gartner puts it: “Adobe Commerce is rich in functionality” across both the B2C and B2C worlds. It also offers a page builder that goes hand in hand with the Adobe PWA Studio. As a result, companies can create imaginative, differentiated commerce experiences. Alongside this, the platform’s use of AI is eye-catching and enables cross-channel personalization that supports personalized discounts and dynamic recommendations.

commercetools

While it is perhaps the least recognizable name in the leader list, commercetools demonstrates the most impressive vision of all vendors within the Magic Quadrant. Moreover, it backs this up with innovative solutions already driving value across multiple sectors. Its “microservices, API-first, cloud-native, headless” (MACH) architectural approach underpins this, which receives much acclaim within the report.

SAP

Achieving market leader status for the eighth year in a row, the SAP Commerce Cloud continues to drive the right results for clients. Much of this hinges on its lauded content management application, which Gartner claims is “more complete” than most of its competitors. The analyst also highlights its decoupled storefront editor, autoscaling capacity, and enterprise support as especially noteworthy plus points.

Gartner Magic Quadrant Challengers

Challengers in the Magic Quadrant typically focus on high-growth sectors, targeting specific markets and significantly investing in technology that meets the needs of their target clientele. While such an approach often means that their platforms trail leaders in comprehensiveness, these vendors offer a robust feature set with a track record of success. This year’s challengers are:

- Shopify

- BigCommerce

- HCL Software

Shopify

From 2020 to 2021, Shopify’s revenue increased by 48 percent. Such market share growth is the fastest of any vendor in the Magic Quadrant. Gartner credits this to its expansion beyond core commerce, bulking up its portfolio with Shopify Payments, POS, Shipping, and more. The vendor also supports complex use cases and offers a broad ecosystem. Yet, its B2B digital commerce offerings “remain untested.”

BigCommerce

Gartner Peer Insights reviewers are positive about many aspects of the BigCommerce platform, especially its service and support capacity. Gartner also notes this as a particular strength, alongside its application ecosystem and the flexibility of its cloud-native platform. Unfortunately, the vendor lacks the geographical reach of market leaders, which seemingly inhibits its ability to acquire large enterprise customers.

HCL Software

Large companies with complex technologies often turn to HCL Software as the vendor provides out-of-the-box sophisticated multisite capabilities. Pricing and support are other plus points, while Gartner claims that its NLP-powered product discovery tool is among the strongest in the space. However, complex administration UIs and a lack of composability are perhaps preventing HCL from entering the leader quadrant.

Gartner Magic Quadrant Visionaries

Visionaries in the Magic Quadrant are some of the most innovative vendors in the space. As such, they win business through disruptive technologies, creative pricing plans, and identifying niche points within the market. With a strategy of this ilk, visionaries can win new customers quickly. However, they lack the resources and partner networks of leaders. This year’s visionaries are:

- Spryker

- VTEX

- Oro

- Kibo

- Elastic Path

Spryker

Spryker is one of the most forward-thinking vendors in digital commerce. Its completeness of vision is lauded by Garter and is maybe most evident in its architecture, which features over 40 independent modules. These enable a high degree of customization. Its extensibility is another considerable strength. However, for now, Spryker lacks out-of-the-box functionality as it is sometimes a struggle to build new workflows.

VTEX

The VTEX Commerce Platform is comprehensive. It features many advanced components, including search and personalization capabilities, a headless CMS, and a low-code development platform. In offering these, VTEX demonstrates its innovation, recently pushing further into conversational commerce and launching a Live Shopping app. Nevertheless, over 90 percent of its revenues stem from Latin America, highlighting its lack of growth in other markets.

Oro

Bundled together with OroCRM, OroCommerce is a solution that companies can deploy across public clouds, private clouds, and on-premises. Yet, no matter the setup, Oro has a reputation for strong multisite and multiregional support. Gartner recognizes this while commending the vendor for its catalog and workflow management. Although, the platform’s modularity is a caution, according to the market analyst.

Kibo

Kibo embeds a personalization suite into its Unified Commerce Platform. Pinpointed as a particular strength by Gartner, this enables personalized product/content recommendations, type-ahead predictive search, and layout suggestions. Kibo’s content management with workflow and scheduling, alongside its “modern” architecture, receives plaudits in the Magic Quadrant report. Yet, its lack of supporting partners is a potential concern.

Elastic Path

Elastic Path offers a support service – Composable Commerce XA (Experience Assurance) – to help its customers manage a “multivendor solution landscape.” While this does come with an additional fee, Gartner seems impressed with the service, alongside its modular pricing model and product merchandising. However, it does fall behind leaders in failing to offer a native front-end experience. This may slow down businesses looking to build a new storefront from scratch.

Gartner Magic Quadrant Niche Players

Niche players in the Magic Quadrant serve a smaller market segment, primarily working with less sizable end-user companies and targeting emerging-market opportunities. These brands demonstrate a substantial offering and a deep client base by meeting the inclusion criteria. Nevertheless, they still trail leaders and challengers in these areas. This year’s niche players are:

- Optimizely

- Shopware

- Infosys Equinox

- Unilog

- SCAYLE

- Sana Commerce

Optimizely

Deployed on AWS or Microsoft Azure, Optimizely has a geographical presence that surpasses most of its fellow niche players. High-profile partnerships are perhaps a pivotal part of this, while Gartner points to its experience management, rule engine, and B2B capabilities as notable strengths and potential success drivers. However, the analyst cautions that the platform’s core is monolithic and perhaps distanced from modern modular, composable solutions.

Shopware

Shopware makes building digital commerce journeys easier with a native no-code visual workflow builder. Users may also harness “prebuilt personalization, customer segmentation, promotions, loyalty point calculation and B2B workflows.” Guided selling and new engagement channel integrations are also plusses. However, Gartner believes that its Vue.js storefront – a cornerstone of its solution – requires updating.

Infosys Equinox

Formerly referred to as Skava Commerce, the Infosys Equinox platform benefits from a MACH architecture. Indeed, such a structure allows companies to scale, upgrade, and extend microservices better. Such a capability is advanced for the space, while the vendor also boasts a comprehensive feature set and a headless CMS. Unfortunately, it trails in its partner ecosystem, and B2B support – a common derailer for many providers in the quadrant.

Unilog

Hosted on the Google Cloud Platform, Unilog CIMM2 meets the needs of many midmarket B2B customers, bundling PIM and CMS solutions. It also offers rich catalog and content features, which impressed Gartner, alongside its mobile SDK for building native apps. Nevertheless, its innovative functionalities are mostly limited, with the analyst noting that it lacks “self-service multisite setup, multiregion capabilities and workflow.”

SCAYLE

SCAYLE has embraced the headless commerce trend, keeping its technology-agnostic and allowing customers to maintain their existing storefront and journey touchpoints. This capability is a critical strength, alongside its marketplace integrations and retail use cases. Nonetheless, its platform seems to lack depth in other sectors, including fashion, beauty, and sport. Meanwhile, Gartner notes that its client base is mainly contained to Europe.

Sana Commerce

Sana Commerce integrates seamlessly with SAP and Microsoft ERP systems, enabling almost all commerce activities. Backing this up, it also provides a data & analytics solution within its platform to surface fascinating commerce-related insights. While these are significant strengths – as well as its low total cost of ownership – the Sana Commerce Cloud relies heavily on ERP integrations. It also lacks APIs to many prominent CRM and DXP platforms.

What Changed from the 2021 Magic Quadrant?

Little has changed from Gartner’s Digital Commerce Magic Quadrant. The same four vendors occupy the leader quadrant.

HCL Software and Kibo have surged from niche players to achieve challenger and visionary status respectively after a promising 12-month period.

Meanwhile, Optimizely dropped from challenger to niche player. Although, it appears not to be far from regaining its status, lying close to the border.

New entries included Infosys Equinox, Sana Commerce, and SCAYLE, each slotted into the niche player quadrant.

Former member of this quadrant, Intershop, dropped out, as did Oracle – which is perhaps a more notable absentee, given its previous status as a visionary.

Will it return in 2023? Possibly, as many digital commerce vendors will attempt to break into the leader segment, currently dominated by Salesforce, Adobe, commercetools, and SAP.

Eager to learn who leads the bot space too? If so, then read our rundown of the report: Gartner Magic Quadrant for Enterprise Conversational AI Platforms 2022