Market analytics leader Gartner has released its highly anticipated 2022 Magic Quadrant report for Enterprise Conversational AI Platforms.

Demand for such platforms is increasing as more CX teams turn to digital innovations to keep up with market leaders. However, choosing the right Conversational AI provider is often difficult.

Thankfully, Gartner identifies the strengths and cautions of many industry-leading platforms to isolate the market leaders.

In this year’s report, Gartner has assessed the Conversational AI offerings of more than 20 global providers, isolating six market leaders in the process.

The Definition of an Enterprise Conversational AI Platform

According to Gartner, an Enterprise Conversational AI Platform harnesses the power to build, orchestrate, and support the development of multiple bot use cases within the enterprise.

There are many vendors within this space. Each varies in terms of its vision and ability to execute. However, not every vendor takes the same approach. Gartner believes that they, typically, lean in one of three strategic directions.

- Natural-language-portfolio centric

- Business automation centric

- User-experience centric

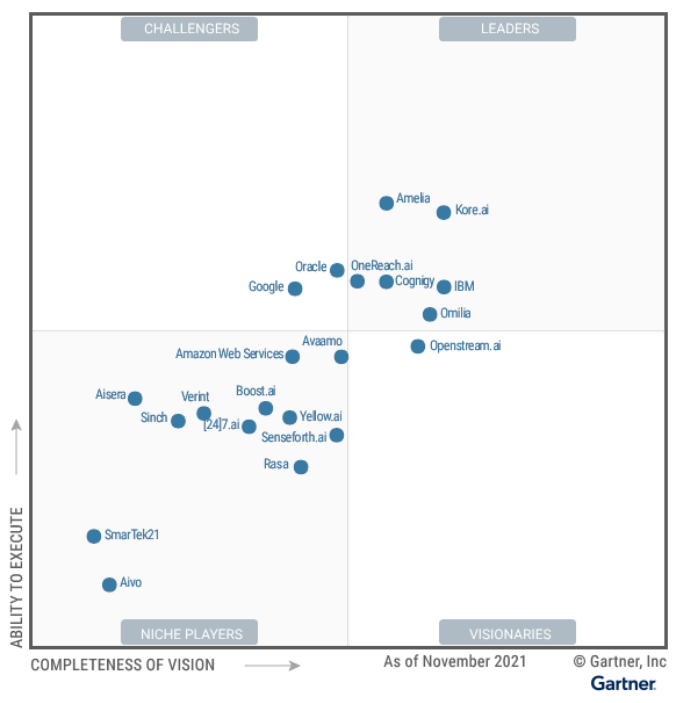

Getting to grips with the strategy of each provider, the 2022 Magic Quadrant for Enterprise Conversational AI Platforms divides each vendor into one of four segments: Leaders, Challengers, Visionaries, and Niche Players. Here, we review them all.

Leaders

Leaders in the Magic Quadrant influence the direction of the Conversational AI market. By demonstrating a complete vision and an ability to execute, they lead the pack in terms of innovation, platform features, and overall viability. This year’s leaders are:

- Kore.ai

- Amelia

- IBM

- Omilia

- Cognigy

- OneReach.ai

Kore.ai

Kore.ai placed inside the top two for both its vision and ability to execute. In achieving such an impressive ranking, Gartner highlighted the vendor’s market understanding and enterprise support, market traction, and product capabilities as notable strengths. Supporting all major channels and use cases, Kore.ai’s large portfolio of Conversational AI offerings leads the field.

Talking exclusively to CX Today, Raj Koneru, CEO at Kore.ai, says:

Customer-centric enterprises are realizing that the future of their performance essentially rests on their ability to be omni-channel, conversational and most importantly, experience-driven. Conversational AI-based automation and augmentation will play a key role in all of this. That’s why Kore.ai’s Experience Optimization (XO) Platform is a trailblazer.

Amelia

The company, once known as IPsoft, ranked highest for its ability to execute, demonstrating how its platform is driving success within many enterprises. Embedding RPA into every part of its offering, the vendor integrates and automates experiences across a whole host of channels. Gartner lauds these automation skills, alongside Amelia’s conversational experience design expertise.

IBM

Perhaps the most recognizable vendor within the “leader” quadrant, IBM has operations in over 170 countries and a global partner network to meet a vast array of enterprise requirements. As such, IBM offers a nimble, innovative proposition. For example, its virtual agent solution – Watson Assistant – can handle topic changes, suggest alternatives, and detect when to bring a human into the loop.

Omilia

Headquartered in Cyprus, Omilia differentiates itself from other providers of Conversational AI platforms through its use of “miniApps”. These are configurable natural language understanding (NLU) dialogue components, prebuilt to handle simple tasks and call center queries. Available through the Omilia Cloud Platform (OCP), the vendor customizes modules across many sectors, including banking, financial services, healthcare, and many more.

Cognigy

Praised by Gartner for its enterprise flexibility and sustainability, Cognigy.AI offers a low-code platform that provides voice capabilities through its Cognigy Voice Gateway. The vendor also boasts a stand-alone analytics offering, Cognigy Insights, which delivers a unique understanding of how the AI solution is performing. Finally, Gartner commends Cognigy for its customer references, as the company consistently achieves excellent feedback.

OneReach.ai

An early entrant to the world of conversational experiences, OneReach.ai has created a well-rounded solution with a use case for every department. As a result, the company enables businesses to create Conversational AI strategies instead of random bot-building projects. With that said, Gartner does pinpoint OneReach.ai’s voice capabilities as a particular strength, alongside its profound focus on the overall experience and impressive “architectural composability”.

Challengers

Challengers in the magic quadrant are well-placed to succeed and deliver upon the expectations of their clients. These vendors are undoubtedly market stalwarts, yet perhaps currently lack the vision to define its future and introduce truly innovative uses of Conversational AI. This year’s challengers are:

- Oracle

Oracle

The Oracle Digital Assistant (ODA) offers a complete set of out-of-the-box product functionalities, each tailored to unique industries and enterprise domains. With impressive intelligent chat and decision automation, Gartner commends Oracle’s innovation and product capabilities, alongside its experience in meeting enterprise needs. Yet, the analyst questions the visibility of its Conversational AI within its overall proposition.

Google offers an extensive Conversational AI suite, featuring Contact Center AI (CCAI), Dialogflow CX, Agent Assist AI, and much more. The innovation culture that ties these together fosters a world-leading AI research capability. However, Gartner notes that the company is still striving to mature its vision and become more than a sum of its parts.

Visionaries

For brands that are eager to innovate, visionaries offer an exciting path forwards. While these vendors are sometimes snapped up by larger players, they move the market forwards by pushing the boundaries and following a pioneering vision. Yet, their ability to execute such a vision is perhaps a cause for concern. This year’s sole visionary is:

- Openstream

Openstream.ai

Openstream.ai strives to create powerful, scalable, and flexible AI solutions, with Gartner highlighting a significant strength of expertise in modeling across cognitive sciences with a consistent vision. In addition to an exciting multimodal experience design tool, the company offers impressive natural language technology (NLT) capabilities. However, the analyst raises a reservation in regards to its lack of no-code functionality.

Niche Players

Niche players often provide an excellent solution when businesses wish to employ a well-defined use case for Conversational AI. As such, companies can often achieve an impressive ROI. Unfortunately, niche players sometimes lack functional components, continual innovation, and market presence. This year’s niche players are:

- Avaamo

- Amazon Web Services

- Senseforth.ai

- Yellow.ai

- Boost.ai

- [24]7 .ai

- Verint

- Rasa

- Sinch

- Aisera

- SmarTek21

- Aivo

Avaamo

Enabling companies to automate conversations with employees, customers, and partners, Avaamo has a unique methodology to build Conversational AI solutions quickly. Thanks to this simple but effective approach, businesses can streamline AI training and accelerate transformation initiatives. Despite such a forward-thinking approach, Gartner does – however – point towards a lack of brand awareness and market visibility in Europe as potential cautions.

Amazon Web Services

Amazon makes a splash whenever it enters a new field due to its large, worldwide customer base. Alongside this visibility and global presence, its Amazon Lex offering has enormous potential, given the company’s leading AI research team. Nevertheless, Gartner underlines potential cautions in terms of the vendor’s overriding strategy while emphasizing pricing and integration challenges.

Senseforth.ai

A relative newcomer to Enterprise Conversational AI, Senseforth.ai offers a wide array of tools. Such a product suite is not a result of acquisitions or white-labeled third-party solutions. Instead, each was developed in-house. As such, these tools are adaptable across multiple use cases, which helps to accelerate business transformation and create consistency. Unfortunately, some of the more cutting-edge features are not yet ready for productization. Although, Senseforth.ai seems to be a provider to keep an eye on.

Yellow.ai

Claiming to offer total CX automation, Yellow.ai impressed Garter with its market awareness and vision, demonstrating an “accurate” understanding of the conversational market. As a result, its strategies – in regards to geographical expansion and targeting vertical markets – appear to be key strengths. While Gartner questions the execution of such strategies, the vendor’s growth highlights its immense potential.

Boost.ai

Boost.ai offers an innovative solution to companies that want complete control over their bots. Harnessing the power of self-learning AI, Boost.ai builds each bot within a matter of days. Then, the client evaluates the solution, takes control over the project, and decides the next steps. Such an orchestration approach is highly innovative. However, the telephony-focused customer service use cases are new to the vendor’s portfolio, and Gartner suggests that they are perhaps not as advanced as its competitors.

[24]7 .ai

Highly experienced in contact center environments, [24]7 .ai uses machine learning to personalize CX. Through its intent discovery tool, companies can record customer conversations and harness AI algorithms to uncover customer intent and automation opportunities. Clients may then seize these by working with [24]7 .ai to develop bot solutions. In the customer service space, this is highly innovative. Yet, Gartner questions the capabilities of the vendor’s bots outside the contact center.

Verint

Verint offers a large-scale Customer Engagement Platform with Conversational AI and voice automation services playing a significant role within its proposition. Having a wide-scale offering enables Verint to integrate bots with its other solutions to gain a competitive advantage. Such integrations with its security and analytics capabilities are excellent examples, which Gartner highlights as key strengths. However, the analyst does warn that Verint is still developing a single identity to differentiate its AI solutions.

Rasa

Working with many notable brands – including T-Mobile, Orange, and Adobe – Rasa offers an open-source toolkit of Conversational AI solutions. As a result, Gartner recommends that companies with first-rate software engineering and application development capabilities consider the vendor. After all, it provides the ideal platform for deep customizations. However, a highly-skilled team of developers is vital to benefit fully from the solution.

Sinch

Headquartered in Sweden, Sinch has amassed an impressive portfolio of acquisitions during a phase of rapid growth. In completing these buy-outs, Sinch’s team has remained strategic in building a portfolio of complementary AI tools. Over time, the provider has become an ever more viable option for large enterprises, capturing a broad set of industry and domain models. Nevertheless, Gartner raises the concern of a mixed market focus hindering the vendor’s ability to execute.

Aisera

Providing end-to-end service automation, Aisera aims to increase productivity across the enterprise with a resolute focus on support use cases and bot orchestration capabilities. Gartner highlights its robust integration with ticketing systems as another significant strength. When it comes to the cautions, however, the analyst identifies growth pains as a particular cause for concern.

SmarTek21

Easing data integration in the enterprise is a considerable focus for SmarTek21, a vendor that offers full enterprise Conversational AI capabilities. Its platform, SmartBotHub, has a healthy presence in the Middle Eastern market, enabling an array of enterprise uses through preconfigured integrations. However, SmarTek21 is struggling – in relation to its competitors – to establish a global presence, with Gartner isolating a lack of visibility and direction as cautions.

Aivo

Headquartered in Argentina, Aivo has established a substantial customer base in Latin America, focusing primarily on improving customer service experiences with Conversational AI. Allowing clients to develop bots quickly, Gartner notes that users find it easy to get bot projects up and running. Yet, the analyst suggests that the vendor could bolster its client support, as Aivo often relies on external-facing service.

What is In Store for the Future?

With digital disruption sweeping across almost every business sector, the presence of Conversational AI within enterprises will continually increase. As the technology evolves even more rapidly, in line with this trend, the 2023 report will undoubtedly make for fascinating reading.

The prospect of additional Conversational AI heavyweights – such as Nuance, Vonage, and Ada – joining the mix is enticing. However, for now, we tip our hat to this year’s market leaders: Kore.ai, Amelia, IBM, Omilia, Cognigy, and OneReach.ai. Congratulations!

Interested in learning who Gartner recently named as leaders in contact center as a service (CCaaS)? Then, read our rundown of the report: Gartner Magic Quadrant for CCaaS 2021