Gartner has released the latest version of its Magic Quadrant for Cloud ERP focused on product-centric enterprises.

According to the analyst, product-centric organisations are rapidly investing in innovative cloud-based applications for Enterprise Resource Planning (ERP). Running parrael to this is an increased desire for multi-vendor technologies, capable of combining best-of-breed solutions.

Indeed, Gartner believes by 2024, more than 60 percent of companies will have deployed cloud ERP tools which align platforms from different vendors. Additionally, the analyst suggests 50 percent of existing ERP “megavendor” customers will begin assessing solutions from multiple vendors.

As such, there is possibly no better time for a Cloud ERP Gartner Magic Quadrant to help application leaders evaluate the available vendors.

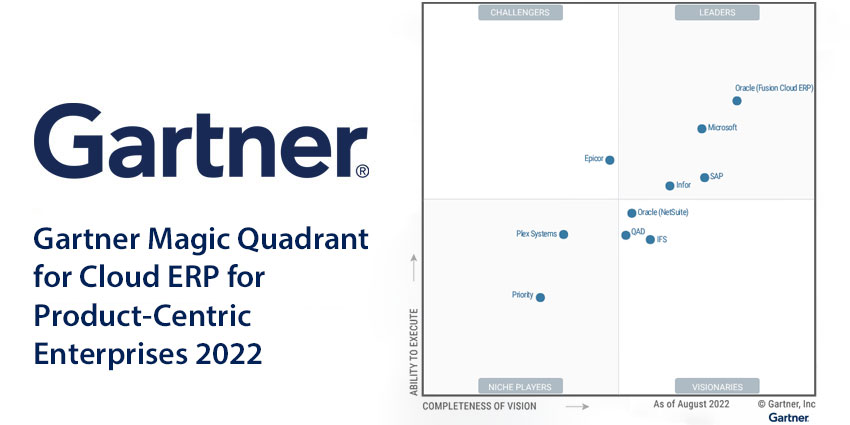

For this year’s report, Gartner has included insights into ten vendors, isolating four market leaders.

Defining Cloud ERP Tools for Product-Centric Enterprises

Gartner’s definition for Cloud ERP solutions for product-centric enterprises emphasizes a separation from the marketplace for Cloud ERP tools aimed at service-centric enterprises.

According to the analyst, tools for product-centric companies focus on the automation of financial and operational activities, related to the manufacturing, delivery, distribution, and servicing of goods.

Alternatively, the tools created for service-centric enterprises do not include functionality focused on the physical manufacture and sale of products.

According to Gartner, ERP tools are a foundational technology for operating enterprises, characterized by highly configurable processes, frequent technical and functional updates, and substantial reliance on vendor management.

The central capabilities of a Cloud ERP solution cover order management, inventory management, and demand management. Financial management capabilities for accounting, reporting, and consolidation are also mission-critical.

Optional additions that also add value to Cloud ERP solution include: HCM features, procurement capabilities, and industry-specific applications.

Based on this definition, Gartner has divided its list of ten notable vendors into four segments: Leaders, Challengers, Visionaries, and Niche Players. Here, we’ll review them all.

Leaders

Leaders in the Cloud ERP Magic Quadrant for product-centric enterprises demonstrate a clear understanding how the cloud can enhance ERP processes. These leaders can execute their vision using intelligent strategies, product, and service portfolios. They also benefit from a wide-scale market presence, consistent growth, and excellent features across all elements of administrative and operational ERP. This year’s leaders are:

- Oracle (Fusion Cloud ERP)

- Microsoft

- SAP

- Infor

Oracle (Fusion Cloud ERP)

Fusion Cloud ERP is a highly-configurable solution that effectively services upper-midsize and larger companies with global clients, offering an integrated suite of operational and administrative ERP capabilities. Gartner notes Oracle’s technology is suitable for enterprises in search of a comprehensive set of capabilities to manage a complex supply chain. The analyst also lauds the platform’s embedded AI and machine learning analytics, alongside Oracle’s extensive geographical footprint.

Microsoft

The Microsoft Dynamics 365 Supply Chain Management system aligns with Microsoft Dynamics 365 Finance for end-to-end ERP. The solution is suited to mid-size, large, and global companies with a demand for specific industry and regional capabilities. Microsoft is particularly powerful in the ERP world thanks to it’s extensibility and strong partner network. The company is also working towards a host of innovations leveraging AI-enabled collaborative demand planning and new tools for embedding sustainability into supply chains. The cloud platform also integrates seamlessly with a host of other attractive Microsoft tools and services.

SAP

SAP offers several deployment models for its SAP S/4HANA solution. However, for the purpose of this 2022 Magic Quadrant, Gartner focused exclusively on the Cloud variation. The cloud solution is suitable for companies in search of comprehensive capabilities to managing a complex supply chain, as well as finance, manufacturing, and other business processes. According to Gartner, SAP’s enterprise and industry experience makes it an excellent choice for growing companies, as do the integrated analytics capabilities within the ERP solution. Going forward, SAP plans to make improvements to its supply chain and production capabilities, as well as offering companies opportunities to embed sustainability systems into their operations.

Infor

Infor has different cores available depending on the user of the service. For instance, there’s LN for global discrete manufacturing, M3 for process manufacturing and distribution, and Syteline for smaller and mid-sized companies. Infor also offers many features well-suited to companies in complicated industries and offers robust capabilities for manufacturing and managing operational processes. The offering has several industry-specific multitenant cloud capabilities, and is currently investing in strategies to update its ecosystem using AI and Machine Learning.

Challengers

Gartner defines Challengers in the Magic Quadrant as companies with a greater market presence than Visionaries and Niche Players. Though they may have established a significant presence in one area of the market, they don’t have a broad enough vision to execute consistently at scale. However, these companies do have a deep understanding of the evolving requirements of product-centric companies embracing ERP technologies in the cloud, and have proven their reliability. This year’s only Challenger is:

- Epicor

Epicor

The Epicor Industry ERP Cloud delivers robust general-purpose operational capabilities, and can be accessed both directly, and through partners. Lately, Epicor has worked to strategically enhance its ERP offering, with the use of AI for in-depth analytics and advanced unit-of-measurement support. The solution has also introduced additional localisation options for multinational brands. Going forward, Epicor plans to introduce more curated industry expansions, alongside improvements to the UX of its ERP service, and further enhancements to composability and integration.

Visionaries

Visionaries are vendors who understand the benefits of ERP solutions in the cloud, and how the industry overall is evolving. They have a fantastic vision of technology and functionality, but may be limited in regard to execution. Often, these companies offer solutions that are attractive to companies making the migration into the cloud, yet their geographical presence sometimes restricts them. This year’s Cloud ERP Visionaries for Product-centric companies are:

- Oracle (NetSuite)

- QAD

- IFS

Oracle (NetSuite)

Oracle appears for a second time in this Magic Quadrant with the NetSuite solution, primarily sold to mid-market enterprises. Unlike most visionaries, the solution has a global footprint, with foundational administrative capabilities, and operational tools for a range of industries. Managed via Oracle data centres, NetSuite is most likely to appeal to companies seeking a single ERP suite for rapid growth in the cloud. Oracle’s NetSuite offers fantastic ease of adoption and configuration, and the solution enables continuous improvement. Oracle is currently working on developing autonomous supply chain functionalities and extended capabilities for planning and analysis for NetSuite.

QAD

QAD Adaptive ERP is a product suite that provides companies with access to various operational and administrative capabilities, through a single platform. Analytics are also available via a partnership with Logi Analytics. In particular, QAD targets six specific marketing sectors, including life sciences, industrial, high tech, food and beverage, consumer products, and automotive. The technology delivers a host of industry-specific manufacturing capabilities, with straightforward deployment and extensibility. Going forward, the company plans to enhance the solution’s composability, while integrating innovations from recent acquisitions.

IFS

The IFS Cloud (22R1) targets large and mid-size enterprises in industries across North America and the EMEA region. The solution includes a composable API integration strategy, enhanced by a partnership with Boomi, allowing companies to access a highly flexible landscape for customization. Going forward, IFS plans to continue differentiating its technology with AI-enabled demand forecasting, environmental, social and governance capabilities, and augmented collaboration tools. Gartner recommends this vendor for organizations in search of a tightly-integrated set of core operational capabilities.

Niche Players

Niche Players in the Gartner Magic Quadrant are companies that target a specific industry segment, or companies of a specific size. Gartner notes that niche players often don’t have less capable products than other brands, but may have a more focused portfolio of features. Typicallly, the also lack the market presence of Leaders and Challengers. This year’s niche players include:

- Plex systems

- Priority

Plex Systems

The Plex Smart Manufacturing platform offers a multitenant cloud environment, designed to specifically target companies from the automotive, precision metal forming, industrial manufacturing, and other industries. The technology from Plex Systems has already shown significant native strength in PLM, and integrates with various third-party applications. Going forward, Plex plans to broaden its ecosystem, extending the manufacturing modes it supports and taking advantage of the benefits its acquisition by Rockwell Automation affords.

Priority

Priority delivers a range of general administrative and mixed-model operational ERP capabilities to companies via the Priority Cloud ERP. Gartner notes the company has been successful among small and mid-sized companies in the EMEA region, as well as in the US. The technology from Priority is likely to appeal to companies wary of the complexity and costs associated with larger tools. Midsized manufacturing companies could benefit from using Priority to access a single SaaS ERP suite, with many operational capabilities to complement administrative processes. Going forward, the company aims to make further enhancements to automated configurations, following industry best practices.

Looking Ahead to the Future of Cloud ERP

ERP is one of the most significant technology areas for many growing companies.

According to Gartner, around 58 percent of companies will place their ERP technology in the cloud from 2024, making the demand for innovative and scalable tools greater than ever.

The Leaders, Challengers, Visionaries, and Niche Players in this year’s Magic Quadrant are sure to play a crucial part in the continued evolution of the cloud ERP landscape moving into 2023 and beyond.

Looking to learn the Gartner perspective on other stalwart CX solutions? If so, check out some of our other rundowns of its Magic Quadrants, which include:

- Gartner Magic Quadrant for Enterprise Agile Planning Tools 2022

- Gartner Magic Quadrant for Analytics and Business Intelligence Platforms 2022

- Gartner Magic Quadrant for Enterprise Conversational AI Platforms 2022