Ten years ago, few could have predicted the diverse channel mix that customers use to communicate with brands today.

There are new messaging apps, social media platforms, and even GenAI-powered search. All these channels have created an explosion of touchpoints across the customer journey.

In ten years’ time, the channel mix will likely swell further, presenting new opportunities for businesses to keep up with customer preferences, build new journeys, and increase engagement.

An agile foundation is pivotal to prepare for this future, and CPaaS provides it.

As such, researchers expect the market to expand rapidly. Indeed, Gartner predicts that – by 2026 – 90 percent of businesses will leverage CPaaS platforms, up from 30 percent in 2022.

Yet, the CPaaS space is swarming with vendors, making it difficult for buyers to see through the weeds and select the best solution for their business.

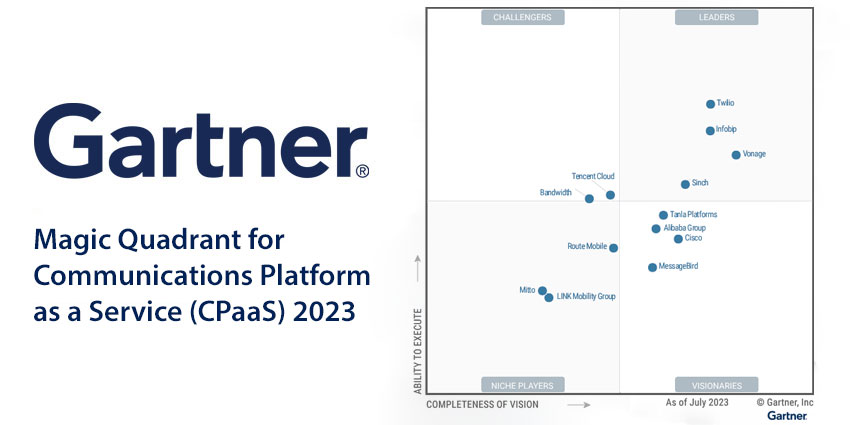

Thankfully, Gartner has evaluated the propositions of 13 leading CPaaS providers to help businesses do so. Through that evaluation, the analyst has isolated four market leaders.

The Definition of Communications Platform as a Service (CPaaS)

A CPaaS platform contains a myriad of APIs, SDKs, and cloud technologies that enable real-time communications by injecting digital channels into customer journeys.

In doing so, it facilitates access to various communication channels. Some of these are evident in Gartner’s minimum core capabilities. These include APIs to:

- Make and accept voice calls

- Route those calls via inward dialing (DID)

- Register phone numbers

- Perform identification and verification (ID&V) tasks

- Send and receive SMS messages

Gartner also stipulates that a provider must enable at least one other messaging app – such as WhatsApp, RCS, Google Business Messages, etc.

Moreover, that vendor must demonstrate rich communication capabilities across the channel – such as voice calling, image sharing, and emoji.

The analyst also expects providers to provide support services for all these core capabilities, including an onboarding program, technical care, and dashboards.

Finally, there are many optional capabilities. These include advanced voice, video, and programable wireless services. The latter includes E-SIMs and IoT-packaged solutions alongside 5G-enabled communications APIs.

Gartner assessed all these capabilities – and more – to split the 13 CPaaS providers into four groups: Leaders, Challengers, Visionaries, and Niche Players. Here’s how each performed.

Gartner Magic Quadrant Leaders

Leaders in the Gartner Magic Quadrant have the most influence on the market’s direction. In doing so, they demonstrate a defining vision for how businesses can deploy CCaaS across many use cases, which they back up with a proven ability to execute. Indeed, each can showcase how they deliver consistent business results through references and growth. This year’s Leaders include:

- Twilio

- Vonage

- Infobip

- Sinch

Twilio

Twilio CEO Jeff Lawson somewhat pioneered the CPaaS market, and since the vendor has established an expansive CPaaS platform. Gartner recognizes this, giving plaudits to its deep base of programmable communications channels and rich developer ecosystem. That ecosystem includes training programs, code samples, a developer evangelism team, and more. Finally, the analyst pays tribute to the operational experience Twilio offers its customers. That includes quality security certifications, streamlined onboarding, and global customer support.

Vonage (an Ericsson company)

Gartner highlights Vonage’s emphasis on innovation as a core strength – highlighting how it combines CPaaS with its AI studio, multichannel conversation solution, and eCommerce tools. Yet, how it links the technology with Ericsson’s 5G network APIs is perhaps the most fascinating example Gartner gives, as these APIs allow Vonage to differentiate through mobility. Other significant plus points include Vonage’s “attentive” customer support and verticalization strategy. Indeed, the vendor offers solutions across retail, healthcare, finance, and many more sectors.

Infobip

Infobip has a robust private network backbone, with 43 global data centers and 800 direct operator connections, allowing the vendor to offer delivery guarantees. Moreover, the spine supports its impressive international reach. Customers cite this as highly beneficial, alongside the vendor’s scaling capacity, flexibility, and responsive service. Finally, Gartner notes Infobip’s solution-oriented go-to-market as a strength. That focus – coupled with its professional services – allows the provider to bring CPaaS to a new audience: businesses often daunted by developer-focused initiatives.

Sinch

Few vendors rival Sinch in the depth of its CPaaS platform – according to Gartner. It includes everything from email and video to its Chatlayer conversational AI capability. That varied portfolio has enabled the vendor’s geographic spread, with its revenue and local presence crossing many markets. The analyst notes that this “bodes well” for Sinch as it works with global enterprises to meet their diverse requirements. Finally, Gartner highlights the provider’s balance between direct and indirect revenue, which signals an ability to serve developer- and solution-orientated businesses.

Gartner Magic Quadrant Challengers

Challengers in the Gartner Magic Quadrant can exhibit their ability to meet customer expectations, helping them establish market credibility and viability. In addition, they typically have robust tech capabilities. Yet, they often lag Leaders in their more limited coverage across various CPaaS use cases or in their geographic footprint. This year’s Challengers include:

- Tencent Cloud

- Bandwidth

Tencent Cloud

Scalability is a significant advantage for Tencent Cloud in CPaaS. In doing so, it supports applications that serve millions of customers – often across industries such as eCommerce, education, and gaming. Gartner also highlights the robust real-time capabilities across the platform. These include audio, codecs, noise reduction, video streaming, and WebRTC. Unfortunately, the business has a limited presence outside China and particular Asian markets. Moreover, politics restricts its ability to compete in Europe and North America.

Bandwidth

Bandwidth customer references are often complementary about the vendor’s dashboards, pricing, self-service features, and support services. These references have aided Bandwidth’s expansion, with the vendor now servicing many Global 2000 businesses. Yet, Gartner also believes that its vast voice ecosystem – which boasts high network resiliency, emergency services, and number management – has played a role here. Yet, in doubling down on this strength, its broader CPaaS offering lacks breadth and – therefore – may not fit the bill for several nonvoice use cases.

Gartner Magic Quadrant Visionaries

Challengers in the Gartner Magic Quadrant are innovators, embracing new trends that sweep the CPaaS space to deliver often sophisticated CPaaS experiences. They also demonstrate a disruptive roadmap that underlines an advanced market understanding. However, Visionaries sometimes trail leaders in their brand awareness or ability to support large customers. This year’s Visionaries include:

- Tanla Platforms

- Cisco

- Alibaba Group

- MessageBird

Tanla Platforms

With AI-powered anti-phishing technology and blockchain-based spam control – Tanla excels in its data security and privacy innovation. Garter highlights how these features underline the vendor’s “strong” focus on innovation, while the analyst also gives its “extensive” collection of advanced messaging channels plaudits. These channels include Telegram, LINE, and X direct messages (DM). Unfortunately, the vendor’s operations, revenue, and support skew heavily to APAC, with its business in Europe and North America served via partners.

[Note: Tanla snapped up ValueFirst in July, which was – unfortunately – too late for the analyst to factor the acquisition into the study.]

Cisco

Cisco entered the CPaaS space with its 2021 acquisition of IMImobile. Since then, it has rebranded the solution “Webex Connect” – which features a visual builder that customers often cite as a favorite feature. The builder allows businesses to define use cases for customer conversations, campaign marketing, and eCommerce. Gartner highlighted the solution as a core strength alongside the vendor’s rich set of APIs – which includes an array of channels. The analyst also suggests that Cisco has experience enabling customer success across each. Yet, it notes that the provider could improve Connect’s branding and offer more pre-packaged sector-specific use cases.

Alibaba Group

Alibaba Group offers customers a vibrant developer community and advanced video, security, and payments capabilities. Another excellent example is its IoT-packaged solutions, which have proven popular with its customer base. In addition, Alibaba provides “significant” ISP partnerships, local capabilities, and regional support in APAC. However, the vendor is pegged to this region – and political headwinds will constrain its adoption in Europe and North America. Its limited integrations with prominent players in adjacent markets – including CCaaS, CRM, and ERP – is also a caution.

MessageBird

Gartner describes MessageBird’s website for developers as “well-organized” with transparent pricing across its diverse offerings. Those include a “broad swath” of fundamental and cutting-edge CPaaS services – many of which MessageBird has rolled up. Acquisitions of SparkPost, 24sessions, and Hull have helped here, expanding its tech suite and global presence. Yet, the latter may still need some work. Indeed, Gartner only received one customer reference from North America to complete its analysis. Moreover, the provider must nurture its worldwide SI and VAR relationships.

Gartner Magic Quadrant Niche Players

Niche Players in the Gartner Magic Quadrant offer the core CPaaS capabilities and may prove compelling to particular users. These users will likely target an explicit use case or deploy in a specific geography. Nonetheless, vendors in this segment tend to fall behind in areas such as platform depth, proven financial success, and brand presence/awareness. This year’s Niche Players include:

- Route Mobile

- Link Mobility Group

- Mitto

Route Mobile

Route Mobile labels its customer experience platform (CXPaaS), underlining its competence across brand loyalty, engagement, and customer acquisition use cases. Gartner underscores this competence as a core strength bolstered by tight integrations with leading CRM, CDP, and CCaaS players. Other strengths include its presence in emerging markets and TruSense digital identity suite. The latter provides phone number verification and scoring. Where Route Mobile lags is in its lack of vertical-specific support and restricted payment capabilities – according to Gartner.

[Note: Proximus took a majority stake in Route Mobile in July. As it continues to operate as an independent entity, it still met Gartner’s inclusion criteria upon the Magic Quadrant’s publication.]

Link Mobility Group

LINK Mobility offers several developer- and solution-oriented buying models that produce enough revenue to suggest consistent customer success. As such, Gartner pinpoints this as a big plus – alongside its reputation for listening closely to customers and integrations with the Microsoft ecosystem. The analyst isolates its support for Azure Logic Apps and Power Automate as excellent examples of this. However, Gartner cautions of slow innovation in the last year and highlights how its Xenioo acquisition has not gone all that smoothly, with reports of overlapping client experiences.

Mitto

Mitto has had success in attracting large enterprise customers – enduring substantial global demand for voice, SMS, and 2FA – with its value proposition. Moreover, it differentiates with its continuously monitored, AI-enabled network, which enables greater reliability. Gartner shines a positive light on these strengths – alongside its dedicated sales, support, and customer success teams in the US and Europe. Nevertheless, the analyst suggests that Mitto’s marketing team lacks funding and that the provider has proven slow to react to changing demands for features like CDP and CCaaS integrations.

Delve deep into some of our other rundowns of Magic Quadrant reports below:

- Gartner Magic Quadrant for Contact Center as a Service (CCaaS) 2023

- Gartner Magic Quadrant for Unified Communications as a Service (UCaaS) 2022

- Gartner Magic Quadrant for Enterprise Conversational AI Platforms 2023