Voice of the Customer (VoC) platforms shed light on customer needs and perceptions.

In doing so, they surface valuable insights that guide cross-function actions to enhance customer experiences.

Some even suggest AI-driven actions, exemplifying how far the space has come from stale, survey-building solutions of years gone by.

Yet, particular vendors have done more than others to drive the VoC space forward.

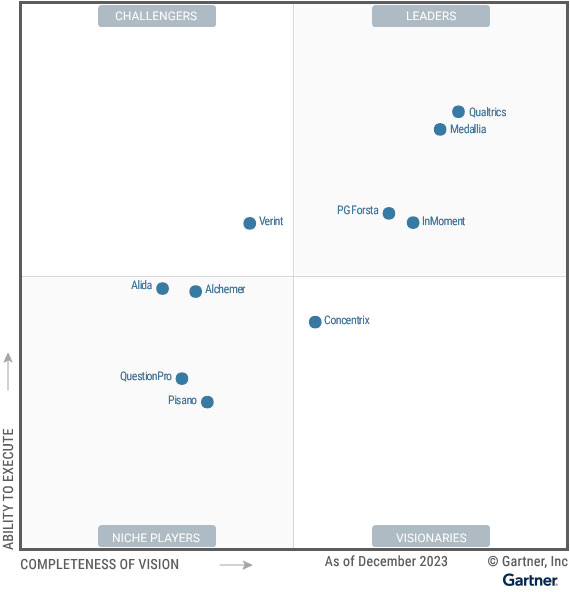

Gartner aims to segment these vendors in its Magic Quadrant report, isolating four market leaders in its evaluation of ten prominent VoC platform providers.

The Definition of Voice of the Customer (VoC) Platforms

Voice of the Customer platforms unify “feedback collection, analysis, and action” tools within a single solution – according to Gartner.

These collection tools gather direct, indirect, and inferred feedback across first-party and third-party voice, digital, and in-person channels.

Much of this now comes from conversation transcripts and recordings. Yet, VoC platforms must still provide the ability to craft and field surveys – across various platforms – and gather the responses.

The analysis tools then help to derive insights from structured and unstructured data sets – sharing those via reports, visualizations, and techniques.

Lastly, the action tools help businesses act on the insight via alerts, workflow, case assignments, and sometimes auto-generated recommendations.

By utilizing these solutions as part of a single strategy, businesses aspire to continuously improve CX, enhance customer service, bolster retention rates, drive revenue growth, and/or understand perceptions of their brand.

Alongside these must-have capabilities, many vendors offer additional features. These range from options to aggregate data from other enterprise systems and closed-loop feedback automations to sentiment analysis and the ability to collect engagement data from third-party platforms.

Gartner analyzed the depth of each vendor’s vision to bring such features to their customers alongside their deployment histories.

After, the research firm divided each VoC provider into four segments: Leaders, Challengers, Visionaries, and Niche Players.

Gartner Magic Quadrant Leaders

Leaders in the Magic Quadrant match an innovative, considered vision with a track record of “significant successful deployments” that cross various industries and sizes of businesses. In doing so, many competitors often view them as the standard bearers within the space. This year’s leaders are:

- Qualtrics

- Medallia

- InMoment

- PG Forsta

Qualtrics

Qualtrics has committed $500MN to invest in generative AI (GenAI) over the next four years. That includes the delivery of a GenAI assistant that aids contact center agents in responding in real-time to customers and managers in coaching their teams. Gartner believes this exemplifies one of Qualtrics’ core strengths: product innovation. Qualtrics also stands out for its customer experience, analysis, and insight. The vendor’s analytics suite supports the latter, which leverages advanced machine learning and includes more than 40 “out of the box” guided projects.

Medallia

Medallia supports businesses in determining critical ROI drivers and leveraging those to guide the “highest-value” customer improvements. According to Gartner, this showcases the vendor’s ability to realize greater value across VoC use cases and enterprise environments. Like Qualtrics, Medallia also excels in its product innovation, enabling sophisticated automations, workflows, and video analytics. Lastly, the analyst highlights Medallia’s deep base of consulting and ISV partners as a notable strength, with the latter including the likes of Adobe, Salesforce, and ServiceNow.

InMoment

Last year, InMoment became the first VoC vendor to release a GenAI-powered solution, leveraging ChatGPT to generate concise summaries from hundreds of disparate pieces of customer feedback. That perhaps highlights its market understanding and drive to make VoC insights more accessible. Gartner applauds this alongside InMoment’s geographic strategy, life cycle/journey approach, and impact predictor. The latter allows businesses to zoom in on phases of the customer life cycle, aiding customer journey orchestration efforts.

PG Forsta

The PG Forsta Human Experience (HX) platform is the result of several acquisitions, which have provided many differentiated features. The ability to use closed-loop discussions via forums and video to obtain deeper, transcribed feedback is an excellent example, which is particularly useful across use cases like product ideation. Gartner notes this as a core strength alongside PG Forsta’s enterprise product and vertical strategy. Exemplifying the latter, PG Forsta provides industry-specific templates and journey visualizations to accelerate implementations.

Gartner Magic Quadrant Challengers

Challengers in the Magic Quadrant outsize Niche Players. As such, they often have the product capabilities across industries to compete globally and secure significant new businesses. Yet, the vision is not quite as compelling as those at the market’s forefront. This year’s challengers are:

- Verint

Verint

Verint is in many contact centers, whether for workforce engagement management (WEM), self-service, knowledge management… the list goes on. These applications often combine, influencing service processes and agent experiences, ensuring VoC extends across the contact center. Gartner acknowledges this, alongside Verint’s mature customer success program and voice of the employee (VoE) toolkit, with the latter offering divergent capabilities like the ability for agents to link their feedback to specific interactions. However, the analyst cautions that Verint’s “menu-driven” UI lacks ease of use.

Gartner Magic Quadrant Visionaries

Visionaries in the Magic Quadrant provide customers with sometimes market-changing innovations that can influence the direction of the VoC space. However, they may lag Leaders in their geographic services, size constraints, track record, or specific solution limitations. This year’s visionaries are:

- Concentrix

Concentrix

Like PG Forsta, Concentrix stands out for its vertical strategy. Gartner recognizes this, highlighting the vendor’s “industry-specific taxonomies” and large language models that assist the analysis of unstructured feedback. Customers may also apply sentiment tagging via industry-specific lexicons and train their own LLM. In addition, Gartner pinpoints the overall ease-of-use and real-time orchestration – which allows for live intercept of a customer conversation – within Concentrix’s platform as major plus points. Nevertheless, the analyst warns that end-to-end macro journey views are “limited”.

Gartner Magic Quadrant Niche Players

Niche Players in the Magic Quadrant often exceed customer expectations, especially in enterprises of a specific size or vertical, delivering a complete portfolio for their requirements. But, they may lack particular features, service depth, and/or a broad market focus. This year’s Niche Players are:

- Alchemer

- Alida

- Pisano

- QuestionPro

Alchemer

Users on Peer Insights – Gartner’s verified customer review platform – often label the Alchemer Survey platform as “intuitive” and “easy-to-use”. Moreover, the vendor’s pricing model, coupled with the ability to scale for enterprise requirements, is a core strength. KKR – the company that acquired Alchemer in 2022 – looks likely to build upon this and accelerate innovation across the platform, as the recent acquisition of Apptentive suggests. In doing so, they may address Gartner’s cautions regarding the lack of AI within its analytics capability, small partner ecosystem, and lack of industry-specific innovation.

Alida

The Alida Total Experience Management (TXM) platform leverages community panels to simplify feedback collection regarding new products and services. When customers integrate conventional VoC data, they can build an end-to-end view of customer feedback throughout the product lifecycle. Gartner recognizes this, listing Alida’s support for new product research as a central strength alongside value engineering and journey analytics. However, the vendor primarily slides back because it cannot automatically categorize feedback by intent, emotion, and effort.

Pisano

Pisano differentiates via its pricing, with lower costs for its core VoC-gathering approaches than the other vendors evaluated. In addition, Gartner finds its EMEA sales execution, customer success, and member community to be significant advantages. The latter fixates on in-person connects and sharing best practices to drive more value from the platform. Indeed, the analyst notes that all this has enabled a “strong and passionate” customer base in the region. Yet, Pisano lags in its broader geographic strategy, limited core AI capabilities, and lack of experience within large enterprises.

QuestionPro

Like Pisano, QuestionPro stands out for its lower total cost of ownership (TCO) compared to the other vendors in the quadrant. Gartner recognizes this while pinpointing its midmarket focus and commitment to aligning VoC data to customer journeys as additional strengths. The latter allows users to build “transactional listening posts” at critical moments of truth within customer journeys. However, the analyst again warns of limited large-enterprise support, incomplete VOE tools, and missing core platform features, including few tools to combine indirect and inferred data sources.

What Has Changed from the Previous Magic Quadrant?

Gartner released the previous Magic Quadrant for Voice of the Customer Platforms in December 2021. Yet, the four leaders remain the same despite the wait of over three years.

Moreover, all the returning vendors stayed in the same category, besides Alida, which secured Visionary status in 2021.

Then, it was joined by SMG, which disappeared from the quadrant entirely in 2024, as it didn’t meet the indirect and/or inferred data collection inclusion criteria.

Former Niche Players Reputation also missed out for this reason, while CustomerGauge currently has too few employees.

However, perhaps the most notable drop-off is NICE, which also failed to meet the inclusion criteria.

The former Challenger – pushing on Leader – no longer has the market features as a stand-alone VoC solution. Instead, its capabilities tie much closer with its Magic Quadrant leading CCaaS platform.

Delve into some of our other CX-related Magic Quadrant report rundowns below:

- Gartner Magic Quadrant for Contact Center as a Service (CCaaS) 2023

- Gartner Magic Quadrant for the CRM Customer Engagement Center 2023

- Gartner Magic Quadrant for Enterprise Conversational AI Platforms 2023