Employees are leveraging more applications than ever before to help them fulfill various tasks.

While all these solutions allow workers to achieve new objectives, digital friction has become a significant employee experience blocker.

As such, brands are increasingly turning to Digital Employee Experience (DEX) management tools to ensure a thriving digital workplace.

Indeed, Gartner predicts that 50 percent of digital workforce leaders will have a DEX strategy and tool in place by 2026, up from 30 percent in 2024.

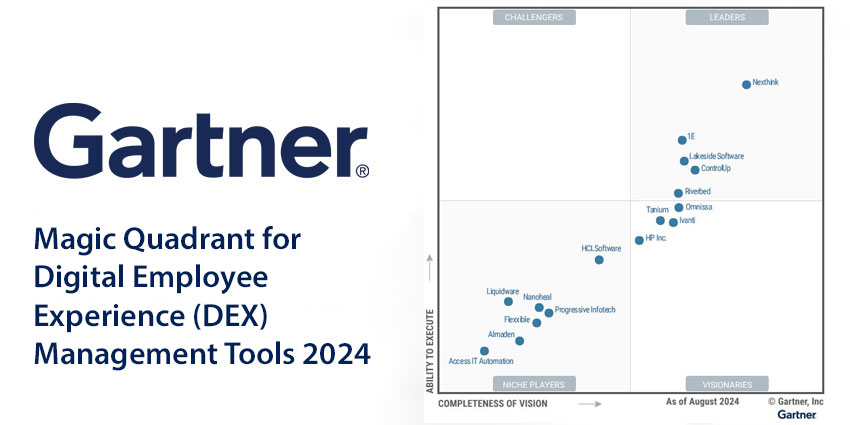

After sharing this and many other statistics, Gartner offers an in-depth overview of the DEX market, evaluating the offerings of 16 management tool providers and isolating five market leaders.

The Definition of Digital Employee Experience Management Tools

Digital Employee Experience (DEX) management tools monitor how employees engage with the technologies they leverage and their sentiment toward them.

These tools do so in real time, aggregating various data sources – including endpoints, applications, and employee surveys – to offer an overview of how multiple teams leverage their technologies.

In doing so, businesses can isolate unreported IT issues, inform automation projects, gauge new tech adoption, improve IT support, and so on.

Additionally, organizations can run several other initiatives with a DEX management tool. For example, they can remove unused licensed software to reduce costs and security risks by ensuring patching compliance.

Gartner notes that such a solution must offer these three mandatory features to enable such benefits and use cases.

- Data Collection – Features include an Agent for Windows, employee sentiment surveys, and custom integrations with HR, ITSM, and other APIs to import data from different sources.

- Analysis and Insights – Capabilities include a scoring mechanism, usage statistics, root cause analysis, and more.

- Taking Action – Functionalities include self-healing automations, scripts, and employee engagement via workstream UC platforms, like Microsoft Teams, Slack, or Zoom.

Other common features include compliance certifications and various integrations connecting the tool to adjacent technologies, like a business intelligence or data analytics platform.

In the busy DEX management market, many vendors can offer all this.

For its inaugural DEX Magic Quadrant, as shared below, Gartner split 16 providers into four categories: Leaders, Challengers, Visionaries, and Niche Players. Here’s how they performed.

The 2024 Digital Employee Experience Management Tools Magic Quadrant Leaders

Leaders in the Magic Quadrant couple a track record for execution with a forward-thinking vision for how the IT team can continually analyze and enhance the digital employee experience. They also offer a deep platform installed across “most” geographies and sectors. This year’s Leaders are:

- Nexthink

- 1E

- Lakeside Software

- ControlUp

- Riverbed

Nexthink

Nexthink offers DEX management for all “major” virtualization environments, applications, and UC platforms – including Microsoft Teams and Zoom. It also adds new capabilities, flow connectors, and library items with a monthly cadence. That rapid cycle, paired with its “highly extensible and scalable” platform, receives acclaim as Gartner ranks “product” as a core strength for Nexthink. Others include its market execution and understanding, evident in how the vendor has stayed at the market’s forefront since its inception.

1E

After only shifting into the DEX market in recent years, 1E has made up for lost time with its impressive market responsiveness. That is evident in its use-case-specific offerings, such as 1E for Microsoft Intune. Such packs cost less than ordinary bundles and help customers jump from endpoint management to a broad DEX management strategy. Gartner also commends 1E for its “elastic” SaaS architecture, which enables significant scalability, and its bundling sales strategy.

Lakeside Software

Despite its long history in the market, Lakeside Software has kept pace with its evolution, as evident in its SysTrack platform’s capacity for proactive problem resolution functionality. That functionality aligned to target buyers. Recognizing such capabilities, Gartner isolates its innovation cycle as a central strength alongside its ability to drive new growth and scale, extensive partner ecosystem, and sales strategy. The latter involves selling the platform at a price lower than most competitors.

ControlUp

ControlUp primarily differentiates through its product strategy. That includes native remote control for PCs, a low-code workflow orchestration engine for remediations, and data capture intervals of just three seconds. As such, it’s no surprise that Gartner notes “product strategy” as a big plus for ControlUp, alongside its market understanding and business model. With that model, it has accrued significant investment, raising $140MN from four investors during its latest funding round.

Riverbed

Riverbed has built a deep enterprise install base with large customers across APAC, Europe, and North America. Gartner recognizes this, alongside its ability to span other regions and serve the midmarket with a large partner base. In doing so, the analyst applauds Riverbed’s geographic strategy, in addition to its vertical strategy and innovation streak. As to the latter, Gartner singles out its Intel partnership, which provides hardware performance data and deep remediation functionality.

The 2024 Digital Employee Experience Management Tools Magic Quadrant Challenges

Challengers in the Magic Quadrant provide a “strong” tech stack coupled with slick sales and marketing operations. They may also demonstrate a history of positive deployments in specific sectors. However, their vision, roadmap, and/or innovation lags Leaders. This year’s Challengers are:

- Gartner didn’t place any Digital Employee Experience Management Tool provider in the Challenger quadrant.

The 2024 Digital Employee Experience Management Tools Magic Quadrant Visionaries

Visionaries in the Magic Quadrant showcase an acute understanding of the DEX space, evident in their vision, innovation cycle, and roadmap. Nevertheless, they may trail leaders in the breadth of their offerings, integrations, and/or market presence. This year’s Visionaries are:

- Omnissa

- Ivanti

- Tanium

- HP Inc.

Omnissa

Previously a unified endpoint management vendor, Omnissa extended into the DEX management market and has since developed several “advanced” features. Its use case for frontline workers and sustainability reporting are primary examples. Gartner references these while tagging “product” as a core strength for the vendor, alongside its product and geographic strategy. Yet, Omnissa lags on customer experience, which stuttered after its acquisition by private equity firm KKR, as per Gartner.

Ivanti

Ivanti has been quick to embed AI and machine learning across its platform to build on its capabilities in endpoint discovery, asset management, security, and beyond. But its innovation isn’t limited to that. The vendor has also closed the gap with adjacent technologies, like spend intelligence and risk management. As such, innovation is a significant strength, in addition to its global presence and ability to anticipate broad market trends. However, its sales execution has proven a challenge.

Tanium

Tanium DEX is a technology often found within administrative bodies, government, and events. That’s due to its keen vertical market focus, allowing the vendor to adapt quickly to emerging market regulations. Gartner highlights this as a central strength alongside its diverse marketing strategy market understanding, enabled by close customer relationships. Nevertheless, the analyst warns that Tanium DEX lacks breadth and maturity as a relatively new market entrant.

HP Inc.

As the successor to HP Proactive Insights, the HP Workforce Experience Platform stands out for its “overall viability”, according to Gartner. In noting this, the analyst cites its large-scale development – led by a 700-strong team – and large partner network of resellers, systems integrators, and hardware manufacturers. HP has also developed a “highly scalable” offering and maintained its large global footprint. Gartner recognizes all this but warns that HP lacks maturity in its overall features.

The 2024 Digital Employee Experience Management Tools Magic Quadrant Niche Players

Niche Players in the Magic Quadrant often force their way onto may shortlists via specialisms in specific use cases, geographies, or verticals. However, the depth of their offerings and ability to scale to become relevant to all DEX management tool buyers is a concern. This year’s Niche Players are:

- HCLSoftware

- Progressive Infotech

- Nanoheal

- Flexxible

- Liquidware

- Almaden

- Access IT Automation

HCLSoftware

As one of the more recognizable names in the Magic Quadrant, HCLSoftware has several strengths in DEX. For example, its bundle sales strategy means that DEX comes at no additional cost for customers with an HCL BigFix Workspace license. The vendor also has a global presence and a 900+ strong partner network of integrators, manufacturers, and resellers. But Gartner cautions of HCLSoftware’s market understanding, citing it being late to market with “basic” features.

Progressive Infotech

Progressive Infotech’s Workelevate platform – which will soon spin into its own company – offers many advanced AI and analytics features. Those include predictive, sentiment, and anomaly analysis. These underline its innovation prowess, with Gartner also labeling the vendor’s roadmap as “innovative”. Progressive Infotech also gains plaudits for its vertical industry strategy and ability to keep its finger on the market’s pulse. However, its marketing and sales execution are concerns.

Nanoheal

Nanoheal offers easy-to-comprehend packaging for its platform, with just one SKU and a handful of add-ons. Such simplicity and its below-market-average price have helped Nanoheal develop a slick sales strategy. Its consistent annual growth and roadmap that address common DEX customer pain points are also plusses that Gartner pinpoints. Nevertheless, the analyst questions the vendor’s marketing strategy and execution, underlining its limited market awareness.

Flexxible

Flexxible supports all customers with local support centers in each region it operates. That highlights a sophisticated geographic strategy, as does its ability to flex its solution capabilities and customer engagement approaches. There are also signs of a blossoming product strategy in its latest release wave, which included enhancements to its software asset management (SAM), compliance, and green IT reporting functionalities. Unfortunately, Gartner notes two significant CX-related issues.

Liquidware

Liquidware excels in sectors where it faces few rivals. Education, pharmaceuticals, and government are three excellent examples. That strategy has enabled the vendor to extend its global presence, as has its customer experience. Indeed, Gartner notes that Liquidware has received positive reviews for it high-touch, technical support services. Market understanding and product strategy are, however, two concerns. The vendor’s lack of turnkey ITSM integrations perhaps best exemplifies this.

Almaden

Almaden Collective IQ (CIQ) offers a value proposition that can deliver rapid ROI for IT service desks – according to Gartner – thanks to its focus on reducing tickets. The analyst notes this as a critical strength, along with its discounting, consistent growth, and customer-guided roadmap that prioritizes ease of use. Nevertheless, Gartner refers to Almaden’s customer support strategy as “ad hoc” and notes how the vendor doesn’t flex its solution to meet the needs of specific sectors.

Access IT Automation

Like Almaden, Access IT Automation can demonstrate consistent revenue growth, with the vendor now deploying seven million active DEX endpoints. Each implementation is customized to the customer’s unique environment, reporting requirements, and integrations, with an overarching focus on automated endpoint management. Gartner highlights these strengths but warns of a limited geographic footprint, low brand recognition, and a restrictive business model.

Deep dive into other CX-related Magic Quadrant reports by reading the following rundowns:

- Gartner Magic Quadrant for Digital Experience Platforms (DXPs) 2024

- Gartner Magic Quadrant for Analytics and Business Intelligence (ABI) Platforms 2024

- Gartner Magic Quadrant for Contact Center as a Service (CCaaS) 2023