Seat-based pricing has long been the standard for contact centers, and before the rise of AI, it worked well. Service teams had a fixed number of agents, and costs were simply tied to those seats.

Meanwhile, it suited vendors, too. After all, it’s neat, tidy, and predictable.

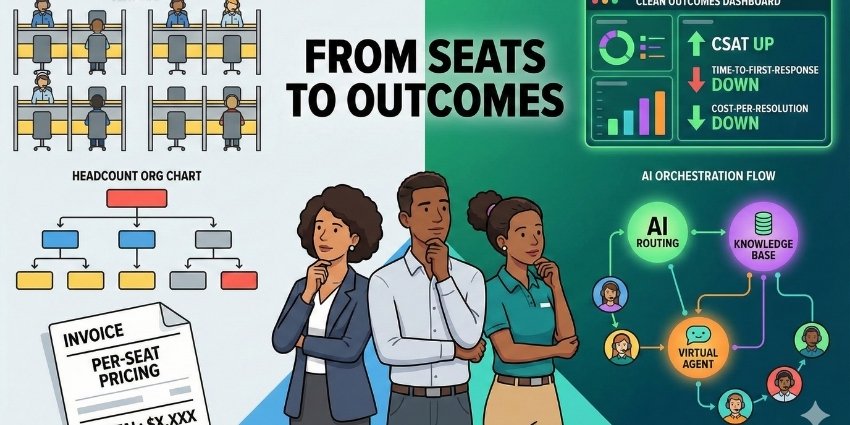

However, the traditional seat-based licensing model is fundamentally misaligned with the value proposition of AI.

Vendors promise efficiency and seat reduction, but their pricing model incentivizes the opposite. As a result, they must either increase the number of seats or replace the lost license revenue with more usage costs.

Against this backdrop, a wave of new pricing models is emerging. Here are four of the most common.

1. Consumption-Based Pricing

The most common alternative to seat-based pricing is consumption-based pricing, where contact centers only pay for what they use.

That approach has several advantages. For instance, contact centers have the flexibility to test AI without making large upfront payments. Moreover, operations with fluctuating demand can cut costs, as they don’t have to commit to year-round seats.

But, here’s the kicker: it’s prone to volatility, and CFOs hate volatility in their bills. Indeed, as AI starts to skew forecasts, unpredictable price spikes become a real risk.

2. Subscription-Based Pricing

Subscription-based pricing has come to the fore as a more predictable alternative to consumption-based pricing. If a contact center has steady traffic, it’s typically a more cost-effective option.

However, subscription models lack flexibility when service leaders wish to add new features. Additionally, their fixed nature can cause problems, as contact centers may end up paying for more than they use.

3. Outcome-Based Pricing

With its baseball cap on backwards, outcome-based pricing is the cool new kid on the block. It promises that contact centers only start paying for AI once it delivers on the “outcomes” that the seller and buyer agree on beforehand.

The big benefit here is that businesses don’t pay a dime if the AI doesn’t deliver, which means the provider is also likely to invest more in customer success.

Nevertheless, defining what the “outcomes” are exactly and tracking them often requires significant negotiation and legwork. Also, many leaders feel uneasy with an all-or-nothing gambit.

4. Tiered Pricing

Another emerging model is a tiered approach, where the provider bundles its features into specific “levels”. As the business moves up each tier and pays more, it unlocks new capabilities.

The bundle approach often appeals to midmarket contact centers that don’t require all the bells and whistles of a full-stack CCaaS platform.

Yet, the downside is that it ties contact centers to a rigid package rather than allowing them to tailor features to their specific needs.

The Perpetual Problem with the Pricing Model

Alongside all the pricing models listed above are hybrid options. For instance, consider a token-based model that allows contact centers to purchase and overlay new AI capabilities. This option blends the benefits of seat- and consumption-based pricing.

Yet, while some of these hybrid models have potential, there are again notable downsides. Take the token example, it bakes volatility into contact center bills and adds to costs with every AI innovation. It’s perhaps the most unpredictable approach to charging for AI usage.

Commenting on the status quo, Zeus Kerravala, Principal Analyst at ZK Research, said: “The real challenge for customers is that there’s no industry standard yet.

Vendors are experimenting with all these models, and I don’t think anyone is fully sure what the right answer is in the face of AI.

Enter Glia. The AI interactions provider for banks and credit unions, believes it has the definitive solution to the pricing challenge.

Is Glia’s “Priceless Pricing” Model the Solution?

“Priceless” pricing is Glia’s model to optimize CCaaS and AI expenditure.

No, it’s not free tech. Instead, Glia engages with prospects to establish a single price that never changes over the length of their contract.

It doesn’t matter if the business adds licenses, uses more minutes, leverages more AI, or expands its data storage; the price stays the same.

“If you ask us today what your cost will be in December of 2027, we can give you a definitive answer right now,” explained Patrick Russell, GTM Strategy Leader at Glia.

Ask the same question to CCaaS vendors, and they’ll have no idea. They’ll ask you a lot of questions, but they still won’t be able to tell you.

Other providers have avoided similar “flat-rate” approaches out of fear customers may pay for solutions they never use.

Yet, Glia takes a more consultative approach, which could save contact centers ready to innovate and scale big bucks. Indeed, it believes the “Priceless Pricing” model allows contact centers to scale their AI adoption and utilization without incurring additional charges that often penalize growth with other models.

“By giving our customers consistent, predictable pricing, they gain strategic flexibility to reallocate their skilled team members to higher-value roles and add seats in areas like sales or fraud prevention,” explained Russell. “It’s a pricing model built to empower organizations to expand AI into every frontline team.”

Learn More

The industry will keep debating over the single-best pricing model, but what matters most is a provider’s ability to demonstrate to contact centers how their approach delivers value and aligns with their specific needs.

Glia does this, and for banks and credit unions ready to move quickly, reimagine customer service, and scale, it’s a compelling option.

To find out more, visit: www.glia.com