CCaaS is the future for contact centers. It promises greater ease of innovation, agility, and scalability.

Yet, that doesn’t mean every CCaaS migration is a resounding success. They’re often not.

Many cloud transformations suffer from budget constraints, cumbersome workloads, and regulatory challenges.

However, there are several other pitfalls, some relating directly to the CCaaS provider. That is causing a wave of cloud contact centers to switch vendors, a trend that Zeus Kerravala, Principal Analyst at ZK Research, recently pegged on his YouTube channel.

“Historically, when looking at who’s buying CCaaS, it was primarily the small to mid-market segments moving away from on-premise systems,” he said. “But, we’re now seeing a lot of cloud-to-cloud migrations, which is intriguing.

With the conclusion of many three-or four-year COVID contracts, companies are reassessing their vendors.

As this trend continues and several CCaaS vendors struggle to secure renewals, it’s time to face the following five uncomfortable truths.

1. Sweetheart Deals Could Never Last

As Kerravala noted, many “COVID contracts” have recently come up for renewal. Many of those were “sweetheart deals”, designed to attract subscribers at a time when companies rushed to the cloud to simplify remote working.

But, now those deals have expired, vendors will look to bring customers onto their normal pricing plan or – at least – upsell many new features.

In many cases, that will evoke significant soul searching, especially amongst contact centers that accelerated their CCaaS switch out of necessity and didn’t commit to their usual due diligence.

Indeed, more contact center directors – and their CIOs – will ask themselves: are we getting the best possible value and ROI?

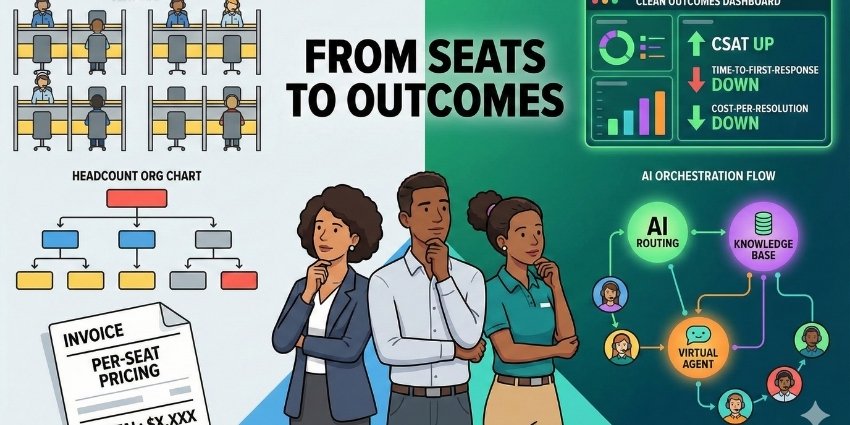

2. Inflexible Pricing Hikes Should Have Taken a Hike

In CCaaS, contact centers pay for a particular number of seats. That number of seats typically rises over time as deployments widen, with mandatory increases in seat numbers.

However, CCaaS migrations often stall, and contact centers don’t always hit those numbers.

Some vendors may offer more flexibility to meet customers where they are. But others will argue: “Sorry, it’s in the contract.”

Technically, they are well within their right to do so. But, when renewal time comes along, some customers may well hold a grudge.

3. Vendor Lock-Ins Broke Relationships

There are several ways that SaaS tech providers lock businesses into contracts, and – when they can finally wriggle free from these – customers rarely look back.

Perhaps the most common method in CCaaS is for the vendor to attach calling plans to their contracts, so the customer ends up giving their telephone numbers to them.

After, customers often realize they could have negotiated a better deal with the carrier, which may grind their gears.

Yet, more annoyingly, they lose the ability to port their numbers autonomously, restricting their ability to test new solutions. As such, they’re stuck with the CCaaS vendor until the calling contract ends.

While there are short-term gains for CCaaS providers, this is a surefire way to lose customers over time and trash their reputations.

4. Steady Expansion Unraveled without Shrewd Reporting

Many CCaaS platforms are simple to scale. As a result, customers can add an AI feature here and a new module there without realizing that costs have spiraled.

Then, one day, the CFO is standing in the doorway with a big frown on their face, asking: how much are we spending on the contact center?!

Many operations can justify that number. But, without shrewd reporting and cost analysis, those costs may eventually prove difficult to validate and cause customers to reconsider their contracts.

Of course, those “layer cake” pricing models can work well. Nevertheless, vendors that follow this approach should offer more prescriptive reporting tools and advice to avoid this common scenario.

5. Radio Silence Killed the CCaaS Vendor

The reasons for shifting CCaaS providers aren’t always so sinister. For instance, sometimes the vendor just hasn’t evolved with the customer, leaving notable feature and integration gaps.

For vendors, making these considerations is critical. After all, in the cloud technology world, customers want tech partners that will work with them over the long term, not just deploy something and disappear.

That’s especially the case in contact centers, where technology is never static. It requires constant improvement to optimize performance.

If customers aren’t receiving that ongoing support – and the roadmap doesn’t contain features, integrations, and updates that matter to them – they will seek new partners to provide it.

A Little Too Close to Home? Consider Zoom

Many customer experience and IT directors cite these issues as motivation to shift vendors.

However, as AI promises to bring seismic change to the industry, these stakeholders must get their CCaaS partnerships right this time around.

Many will consider Zoom, the provider that identified these shortcomings, before launching its new-wave CCaaS platform in 2022.

Without baggage, it’s helping contact centers migrate from older, monolithic CCaaS solutions to a cloud-native, AI-first offering.

Indeed, four of its top ten CCaaS deals last quarter saw the enterprise communications giant transition customers from competitor solutions instead of on-premise systems.

To learn more about why Zoom is proving an attractive CCaaS alternative, check out our webinar: The Contact Center Evolution

Alternatively, deep dive into the Zoom Contact Center by visiting Zoom.