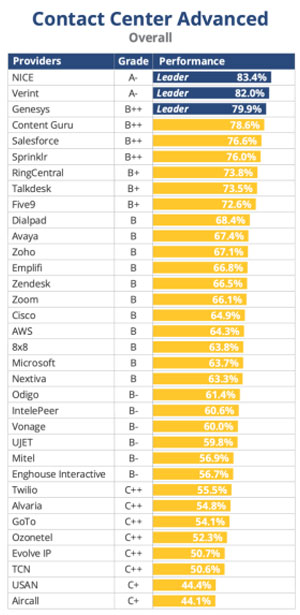

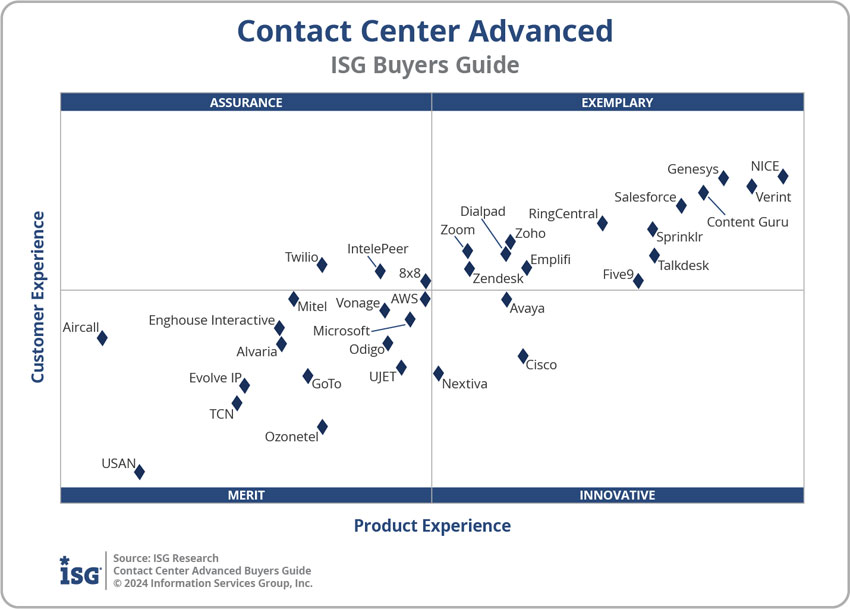

The Contact Center Advanced Buyers Guide 2024 from ISG Research evaluates the product and customer experiences provided by 34 tech vendors.

That’s a huge number of providers, reflecting two critical contact center trends.

First is the explosion of deployment options. Indeed, contact center provisioning was historically straightforward: a brand purchased on-premise equipment from a limited set of vendors.

However, now buyers can consider premise-based, cloud-based, or hybrid options. That has brought new entrants into the market while legacy vendors adapted.

The second significant trend is the diminished role of the Automatic Call Distributor (ACD).

After all, businesses can now provision a contact center starting from various points in the tech stack, whether that’s a CRM, a helpdesk system, a digital routing platform, or even unconventional tools like marketing technology (MarTech).

Hyperscalers like Amazon, Microsoft, and Zoom also play a role with their quasi-CPaaS platforms.

As such, contact center buyers have numerous options when considering a contact center partner. The ISG Buyers Guide recognizes this, putting forward an extensive evaluation.

ISG’s Contact Center Buyers Guides

ISG presents two Buyers Guides for the contact center space, a “basic” and “advanced” edition.

The basic edition reflects the traditional provisioning model where an ACD system remains the core, catering to the mid-to-lower end of the market where lightweight solutions dominate. These vendors typically focus on fundamental capabilities and straightforward implementations.

Then, there’s the advanced edition, which fixates on those helping to redefine the provisioning model by bringing systems to market without an ACD.

As such, it considers how brands can leverage CRM systems – like Salesforce, Zendesk, or Zoho – or case management systems – such as ServiceNow – to act as the operational hub. These solutions integrate routing engines from partners like Amazon Connect or Twilio.

In doing so, ISG brings in vendors traditionally outside the contact center space, enabling a focus on enterprise customer experience (CX) rather than just handling interactions.

ISG’s Inclusion Criteria and Methodology

ISG only analyzed contact center vendors that have operations in more than one country, over 50 customers, and have launched a major release over the past 18 months.

ISG only analyzed contact center vendors that have operations in more than one country, over 50 customers, and have launched a major release over the past 18 months.

The analyst also noted that participating providers must have a “good” financial and ethical standing – alongside at least $25MN in projected annual revenues.

In addition to all the core functionality, from multichannel routing to agent scheduling and forecasting solutions, ISG evaluated the following “advanced” aspects of the platforms:

- AI in quality measurement and self-service

- Native and integrated data management systems, like CDPs

- Knowledge management

- Advanced interaction analytics

- Customer feedback solutions

- Workflow automation

These capabilities helped inform ISG’s Value Index, alongside a questionnaire sent to each participating vendor.

That questionnaire includes seven categories. The first five considered “product experience”:

- Usability

- Manageability

- Reliability

- Capability

- Adaptability

The final two categories considered “customer experience”:

- Total Cost of Ownership (TCO) / Return on Investment (ROI)

- Validation of the Vendor

Finally, ISG gathers product verification via documentation and – where possible – demos.

In doing so, ISG ranked each vendor on its core contact center offering, scoring the 34 participants and spotlighting insights into their suites.

The matrix below showcases how each performed, while ISG also breaks down its rankings in the table to the right.

The Top 10 Takeaways from the Advanced Buyers Guide 2024

The ISG Contact Center Advanced Buyers Guide 2024 offers more than a vendor analysis. It also puts forward a process for selecting the best-placed provider, market commentary, and projections.

Below are ten top takeaways, alongside additional insight from report author Keith Dawson, Director of Research for Customer Experience at ISG.

1. CCaaS Is an “Increasingly Problematic” Term

Initially used to describe cloud-based contact centers, “CCaaS” is now a term that’s becoming “increasingly problematic” and outdated, according to Dawson.

“It excludes on-premise and hybrid models and fails to capture the expanded role of non-traditional vendors,” he told CX Today.

Contact center buyers today prioritize orchestration and data usage over traditional routing.

Indeed, modern contact centers integrate customer data into marketing, sales, and commerce, focusing increasingly on proactive CX strategies.

“Communication infrastructure, such as routing calls or chats, has become a commodity,” continued Dawson. “The real differentiators lie in areas like data management, enterprise integrations, and workflow automation.”

As such, the analyst concludes that vendors investing heavily in these areas are helping to drive innovation while those focusing solely on routing are falling behind.

2. Competitive Pressure Has Driven Significant AI Progress

Unsurprisingly, the report underscores the rapid advancement in AI applications.

Initially, vendors focused on building a platform approach to AI rather than honing in on specific use cases. As such, it took time to define relevant outcomes, ROIs, and realistic expectations.

However, as Dawson suggests: “Competitive pressure accelerates progress.

When one vendor introduces a new AI capability, others quickly catch up.

Yet, that doesn’t mean all AI is equal. Indeed, the model orchestration, engineering, and data management strategies behind AI use cases help providers differentiate.

Take data management. Contact center vendors employ different strategies to manage their customers’ data and power AI.

Some are taking a more data-centric approach, focusing on solidifying knowledge management back-ends, which are crucial for ensuring reliable outputs from GenAI-based solutions.

Meanwhile, others are working on creating controlled, contained data hubs, like customer data platforms (CDPs), to train their models effectively.

Yet, those leading the Buyers Guide are tackling multiple fronts simultaneously because that’s what the market now demands, as per Dawson.

3. AI Is Bringing IT Teams Into the Buying Conversation in a Much Bigger Way

The study highlights how the industry-wide significance of AI is shifting buying decisions back toward the IT team.

Such involvement from IT changes how organizations approach RFPs, governance, and the integration of contact center tools with broader CX applications. It’s become a more complex conversation, according to Dawson.

“I suspect traditional CCaaS vendors will face challenges in having these deeper, enterprise-wide conversations during purchasing periods compared to vendors with broader capabilities or legacy foundations,” he noted.

For example, if an IT team aligns with ServiceNow, they’ll likely prioritize integrating contact center tools with that ecosystem rather than the other way around.

“That said, there’s still a lot of outdated thinking in the market—what I’d call a “2005 mindset”—when it comes to provisioning and operating contact centers,” concluded Dawson. “This mindset clashes with the flexibility needed to address modern requirements.”

4. The Contact Center Functionality Gap Closes

ISG underscores how the functionality gap between top and middle-tier vendors is narrowing.

“Core contact center technologies have become standardized,” noted Dawson. “Differentiation now hinges on strategic priorities – whether that’s AI, data integration, or enterprise CX – rather than baseline features like routing.”

Given this, contact center vendors must demonstrate their vision for where the industry is moving to stay ahead, and many are rapidly expanding their portfolios.

However, Dawson suggests that adapting to the broader requirements of a modern call center toolkit is proving challenging for some.

“Many are addressing gaps through partnerships rather than in-house development because that’s often quicker,” he continued. “The result is a more widespread and comprehensive portfolio now required to compete for mid-market and larger contact centers.”

5. Smaller Vendors Are Over-Relying on Specific Ecosystems

Some vendors lagged in the study due to their dependence on platforms, like Microsoft Teams, with ISG noting how it increased their reliance on external systems and limited their innovation.

“These vendors also tend to underinvest in emerging technologies like AI or enterprise integrations,” added Dawson.

Such underinvestment underlines how some still struggle with fully realizing AI’s potential. While use cases are clearer now, there’s a lag in addressing costs and prerequisites.

Still, innovation is happening quickly, and – as Dawson previously noted – peer vendors don’t stay behind for long.

6. NICE & Genesys Lead the Way Again

Across each of the seven categories ISG explored, NICE ranked amongst the top three vendors.

Genesys gets amongst the top three in five of those categories, offering NICE its closest competition in that regard.

That’s no surprise. Buyers will be hard-pressed to find an industry report that doesn’t categorize these two CCaaS stalwarts as market leaders.

Typically, NICE stands ahead thanks to its AI & analyst expertise, deep workforce management (WEM) portfolio, and extensive support network.

For its part, Genesys has demonstrated its thought leadership by owning the convergence of contact center technologies, notably co-innovating with Salesforce and ServiceNow. It’s also highly regarded for providing global enterprises with trusty playbooks for legacy transformations.

However – for ISG – NICE and Genesys are not alone in leading the contact center market…

7. Verint Surges to the Market’s Forefront

Despite only announcing its Open CCaaS platform in May 2023, Verint places second within the study – even outranking Genesys.

The offering allows businesses to leverage Verint’s specialist workforce engagement, knowledge, and customer feedback management tools. Therefore, it has a leg-up on the “advanced features”.

However, more significantly, the concept of Open CCaaS devalues the core telephony platform.

Indeed, Verint doesn’t start with telephony and routing to retrofit workflows. Instead, it leads with workflows and then provides an open architecture so businesses can best compose them.

That vision aligns closely with what ISG puts forward for the future of the space. As such, it’s perhaps no surprise to see Verint surge.

“Verint’s inclusion in the advanced category underscores the shift away from viewing the ACD as indispensable,” concluded Dawson.

8. New Wave Contact Center Providers Overtake Stalwarts

Many vendors have sold CCaaS platforms for almost a decade yet failed to reach the “exemplary” group.

Meanwhile, the likes of Sprinklr, RingCentral, Zoom, and – of course – Verint only entered the market in the past one to three years. Still, they shot past many of their predecessors.

Again, this comes back to the weight ISG places on each vendor’s vision.

“Ultimately, what distinguishes successful vendors is their vision for where the industry is heading,” noted Dawson. “Whether that’s automation, workflow design, or data-driven CX, those investments shape the leaders in this space.”

Sprinklr is a particularly fascinating case, securing several massive CCaaS deals, including a 40,000+ seat contract with Deutsche Telekom.

9. AWS Underperforms, But Its Progress Is Positive

Despite Gartner and Forrester isolating AWS as a market leader in their respective market evaluations, the tech giant sits in the bottom-left quadrant in this report.

ISG has previously pointed to the lack of knowledge management solutions available on the platform and the lack of customizability as significant cautions.

However, Dawson believes that the platform is on an upward trajectory.

“Back when Amazon Connect launched, it was primarily an internal tool for Amazon, and it showed,” he said. “But, over the years, AWS improved it significantly.

“Now, Amazon Connect is both a platform for others to build on and a capable contact center solution in its own right.

“It’s a “Trojan horse” of sorts, competing directly with traditional CCaaS vendors while serving as a foundation for other solutions,” he concluded.

Dawson also highlights that AWS has greatly expanded its WEM toolkit to become a more viable vendor.

In addition, AWS – alongside its fellow hyperscalers like Microsoft – excels in its adaptability, scalability, and financial stability. Buyers view them as reliable long-term partners, which is crucial.

“Hyperscalers have shown they can meet the demands of a modern contact center, shifting the buying conversation entirely,” summarized Dawson.

10. Consider the ISG Buyers Guide Alongside Reports Like the Gartner Magic Quadrant

The ISG Buyers Guide lands shortly after the release of the Gartner Magic Quadrant for CCaaS.

While the Magic Quadrant holds weight, this year’s edition drew criticism from some quarters for “downplaying AI” and failing to address the convergence of CCaaS with the broader CX stack.

ISG doesn’t make that mistake. Yet, Dawson urges buyers to consider the various industry reports to gain a deeper market understanding. He stated:

Evaluations like ours and Gartner’s complement each other. They approach the market from different angles, providing a fuller picture.

Indeed, the Magic Quadrant is particularly good at spotting vendor cautions, leveraging feedback from Gartner Peer Insights, its verified review program.

Read CX Today’s coverage to catch up: Gartner Magic Quadrant for Contact Center as a Service (CCaaS) 2024: The Rundown

Meanwhile, for more insight from Dawson, read our article: Welcome to the AI-Fueled CCaaS Platform of Tomorrow