Every year, customer experience research firms present a CRM industry assessment, ranking major providers. This is not one of those evaluations.

Instead, this top ten rundown spotlights innovative brands differentiating in the CRM space.

Prominent industry experts Rebecca Wetteman, CEO & Principal Analyst at Valoir, and Martin Schneider, VP & Principal Analyst at Constellation Research, helped select the vendors.

In the following video, they dissect each, highlighting what sets them apart heading into 2025.

A written breakdown of their key points is also available below.

1. Zoho

Zoho impresses with the breadth of its platform capabilities, which go beyond CRM. From human capital management (HCM) and finance to supply chain management, Zoho touches so many areas.

For example, it recently launched payroll for the US, a complex offering that demonstrates its ability to provide end-to-end solutions.

Additionally, Zoho’s platform allows businesses to integrate insights across units – sales, supply chain, finance, and service – into a single ecosystem.

The company has built its own infrastructure to support this, raising some eyebrows but allowing it to scale globally with multi-million-seat deployments.

Crucially, this strategy breaks down the total cost of ownership (TCO) for customers while driving value.

Zoho’s AI strategy is unique, too, building it themselves, focusing on specific use cases. That gives it an edge with tailored, practical AI solutions rather than relying on off-the-shelf models like ChatGPT. It also allows Zoho to look further ahead and plan its roadmap without relying on partner releases.

2. HubSpot

HubSpot has expertly expanded beyond its core marketing automation roots, with its sales automation and customer service offerings showing solid growth.

The provider also bolstered its AI capabilities by acquiring Frame AI at the close of 2024.

Frame AI allows HubSpot to analyze unstructured data – like customer interactions – at scale. This positions HubSpot to deliver proactive and predictive insights across sales, marketing, and service.

It’s a smart move, especially since many competitors in the SMB and midmarket space lack a strong AI story.

HubSpot’s pricing model has also evolved, creating options like free read-only CRM access. That extends the visibility of customer data across entire organizations.

Finally, HubSpot has successfully transitioned from a freemium model to a suite player, and its next challenge is solidifying its position with AI-enhanced offerings.

3. Salesforce

Salesforce is the 800-pound gorilla in the CRM market, and its Agentforce platform proved a game-changer at the back end of 2024.

Leveraging its existing data, workflow, and trust layers, Salesforce has enabled customers to deploy AI Agents quickly and accurately.

However, results may be less straightforward for customers that lack tidy data or haven’t adopted Salesforce Knowledge. It’s the classic “garbage in, garbage out” scenario.

Of course, Salesforce has made great strides with Data Cloud, enabling better management of unstructured data, which will help here.

Elsewhere, Salesforce has been quietly innovating across its other clouds, too. For example, Sales Cloud now offers features like enhanced account planning and conversational intelligence, strengthening its pipeline-to-pay-check narrative.

Pricing may provide a challenge, though. Salesforce will need to address concerns around value-based pricing versus traditional per-seat models.

The CRM juggernaut is working on solutions, but seeing how their pricing evolves in response to the rise of AI-driven capabilities will be fascinating.

4. Gong

Gong isn’t a conventional CRM player. However, it excels at analyzing customer signals and automating insights that CRM systems often miss.

While traditional CRM tools are rigid and rely on structured data, Gong automatically captures interaction data and generates actionable insights.

For example, Gong can analyze what’s working – and what isn’t – in sales calls. Yet, the vendor is going beyond that, helping businesses build accurate pipelines and improve outcomes across the customer journey. It’s essentially the missing layer of intelligence in traditional CRM.

That’s critical, given the shift where real-time feedback and coaching become core CRM capabilities.

The question is whether Gong will remain a standalone player or become part of a larger ecosystem through acquisition.

Ultimately, Gong could be a game-changing acquisition for a company looking to leapfrog into AI-driven CRM. Its ability to inject intelligence into workflows is differentiative, making it a potential accelerant for any vendor looking to strengthen its position.

5. SugarCRM

SugarCRM always had a strong technical product. But with a new CEO, it’s at a critical juncture, shifting strategies.

The challenge is moving past the founder’s mindset of focusing on technical cleverness to better connect with their key targets – in manufacturing and distribution – where they have a strong value proposition. Communicating that effectively is its big hurdle.

Indeed, SugarCRM’s focus on manufacturing and related industries has been clear for a while, but the messaging isn’t breaking through.

Manufacturers don’t prioritize lead generation; they need tools to optimize revenue within their existing customer base.

SugarCRM’s acquisition of sales-i helps with that by showing what customers are buying, what they should buy, and how to optimize revenue relationships.

However, SugarCRM must emphasize this more, especially as other CRM providers push advanced AI stories.

With the new CEO and leadership changes, it’s an opportunity to sharpen their vertical focus and highlight their unique strengths.

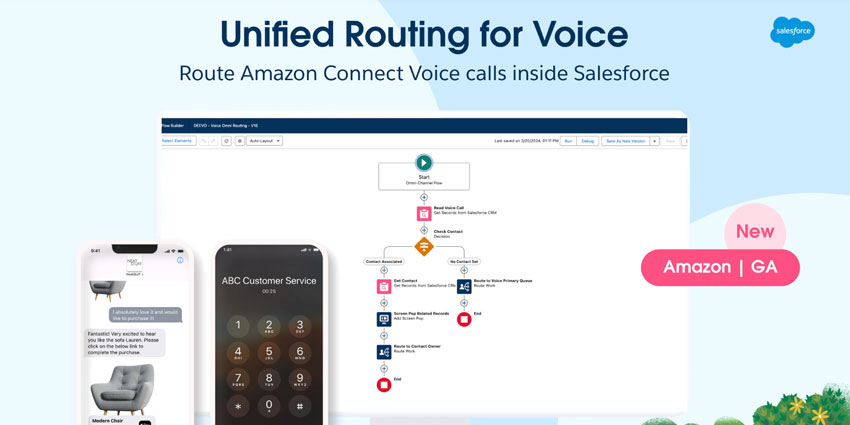

6. Amazon

Amazon is not a CRM platform provider. Yet, it makes this list because of the potential in its component parts: the data, AI, and communications infrastructure.

The cloud giant has assembled the building blocks for CRM and CX solutions as Microsoft did with its ecosystem. The question is whether Amazon wants to enter this space fully or continue supporting partners like Salesforce.

After all, Amazon already profits from Salesforce and other CRM providers on its platform, so it might prefer to remain a facilitator.

So, the numbers might suggest sticking to their current model while enhancing partnerships and becoming the go-to provider of white-labeled AI solutions for vendors without a robust AI story.

Of course, Amazon’s AI and unstructured data management capabilities give them immense potential, but it might stay opportunistic rather than fully committing to CRM.

7. ServiceNow

ServiceNow is targeting this market, with its customer service workflows increasingly resembling CRM functionality.

Meanwhile, ServiceNow can differentiate by positioning itself as a modernization layer for legacy systems, not a rip-and-replace CRM solution. That approach is unique.

By expanding from its service management background, ServiceNow also delivers a more data-enriched CRM from the start.

Additionally, it’s integrating AI with strong workflows, order management, and inventory systems.

As such, ServiceNow offers a powerful CRM-like capability, particularly for enterprises with specific and complex requirements.

The vendor’s challenge is communicating this value beyond IT champions to sales, marketing, and service leaders. Its marketing emphasizes business needs, but execution in the field still leans on those IT relationships.

Crucially, it has earned enterprise trust, which should make its transition easier than others who’ve taken the opposite path.

Ultimately, it’s reminiscent of Salesforce’s journey with Service Cloud. It took time, but now it’s a multi-billion-dollar business.

8. Totango

In 2024, Totango acquired Parative AI to create more customer intelligence, developing better behavioral and health scoring data.

In doing so, the vendor developed an overall account health score that not only helps customer success teams but also supports revenue teams and marketing teams with segmentation insights.

Does this mean Totango is becoming a CRM? Maybe not. But it’s an example of how customer success vendors are leveraging AI and data to reinvent their products, strategies, and market positioning.

In doing so, Totango has gone from being a one-product company to a three-product company. It now offers analytics, multimodal solutions, and off-the-shelf tools for quick insights like health scores.

AI is transforming how it builds products, structures pricing, and goes to market, with Totango now a company addressing the full customer journey, not just customer success.

Ultimately, it’s now enabling any member of the revenue team – RevOps, marketing, or product teams – to get strategic insights into customer health and focus efforts more effectively

9. Oracle

Oracle stands out because, unlike most vendors – except maybe SAP and Zoho – they have access to all the finance, HR, CRM, and supply chain data. That gives them a unique ability to do amazing things with AI and data.

Admittedly, Oracle has faced challenges in communicating the value of its CRM offerings. Still, its ability to combine data from different domains, like finance and service automation, sets the provider apart.

Indeed, Oracle can address complex customer issues beyond CRM, such as financing and product-related concerns.

Also, its Fusion applications are solid, and they’ve integrated AI in a way that adds real value without additional cost. It’s just built into their offerings.

Meanwhile, Oracle continues to modernize its customers’ infrastructures quietly but effectively.

Overall, Oracle’s strategy has largely focused on transformations within its existing customer base, modernizing and moving customers to the cloud with Fusion and OCI.

Now, it’ll be fascinating to see if they shift to a more aggressive market expansion strategy, aiming to win new customers.

So far, the vendor has enjoyed success within its install base and hasn’t had to do that yet. But, with its enterprise credibility and data capabilities, Oracle is in a strong position to compete for new business.

10. Creatio

Formerly BPM Online, Creatio excels at workflow automation. It has built robust mid-market CRM applications across marketing, sales, and service.

Moreover, with its late 2024 “Energy” release, Creatio improved its AI capabilities, integrating generative AI and copilots.

Yet, what’s particularly exciting about Creatio is its approach to pricing and composability.

The vendor has made its platform highly flexible, with modular applications that allow businesses to build tailored solutions.

Meanwhile, the entry cost is lower than that of many competitors, as Creatio makes AI capabilities accessible without extra charges.

However, perhaps most notably, Creatio has developed a deep partner ecosystem, cultivating a rare sense of enthusiasm and collaboration. That has helped it grow globally, surpassing the $1BN valuation this year.

In addition, the vendor has also attracted partners that previously worked with legacy products, giving them a new lease on life with a modern cloud solution. It’s a win-win.

To unpack more top ten provider lists from across the CX stack, sign up for the CX Today Newsletter.