During SAP’s Q2 earnings call, the enterprise tech giant shared an update on its ongoing “workforce transformation” program.

The update revealed that 2,000 positions had been scrapped last quarter, with the affected employees departing voluntarily, leaving non-voluntarily, or being reskilled.

Altogether, SAP plans to shut down 8,000 jobs before the year’s end.

However, most turnover was expected toward the end of 2024, so SAP could ramp up its reskilling and rehiring processes.

Indeed, SAP only planned to close 1,000 roles in Q2.

Nevertheless, in April, the company reportedly notified 75 percent of the 8,000 employees that the transformation would impact. That may have encouraged many to jump ship early.

Christian Klein, CEO of SAP, confirmed that this rise to 2,000 jobs stemmed from a spike in voluntary – and non-voluntary – departures, not necessarily reskilling.

During the Q2 earnings call, he acknowledged that it had been an “abnormal” quarter before noting:

We’ve seen a lot of reduction… especially in those countries where we had either fast voluntary measures, like in the U.S., but also non-voluntary measures, frankly.

Given this somewhat unexpected exodus, SAP’s teams may worry that they’ll be left temporarily short-staffed as the company’s reskilling efforts take shape.

Yet, Klein also pledged to speed up the business’s recruitment efforts. “You’ll see the hiring actually accelerate because these kinds of initiatives are a bit more back-end loaded,” he said.

Although, he caveated that by stating: “Even if we rehire, we do it in a more cost-effective way than what was the status before, and sometimes we don’t rehire at all.”

Such comments perhaps parrot the concerns of SAP’s European Workers Council, which panned the company’s “transformation” program in April as a guise for workforce reductions and cost-cutting.

However, Klein stressed shortly after: “Where our SAP colleagues are affected by restructuring, we are moving with care and empathy, always aware of our social responsibility.”

As to where many of the 2,000 jobs may have come from, reports at the start of the quarter highlighted wide-scale layoffs in Montreal and San Franciso.

In May, these spilled over to SAP Labs India, with 300 job losses in Bengaluru and Gurgaon.

Nevertheless, Europe is the primary target of these transformation efforts, with 4,100 of the 8,000 impacted jobs expected to come from the continent, with 2,600 based in Germany.

Thankfully, however, SAP has no plans to raise that 8,000 job target despite reports that it could rise to 10,000. “We are still keeping the target for the full year constant,” disclosed Klein.

Other Takeaways from SAP’s Q2 Earnings Call

Alongside its workforce transformation update, SAP shared that its overall revenues had risen ten percent to $9.02BN year-over-year (YoY) last quarter during the earnings call.

Even more positively, the ERP juggernaut announced that its Q2 cloud earnings rose 25 percent to $4.50BN YoY – helping SAP exceed analyst revenue estimates.

While its operating profit fell 11 percent, SAP attributed the drop to the $600MN it spent on restructuring expenses over the quarter.

Meanwhile, SAP revealed a new generative AI (GenAI) goal: to deliver more than 100 use cases across its portfolio by the end of the year.

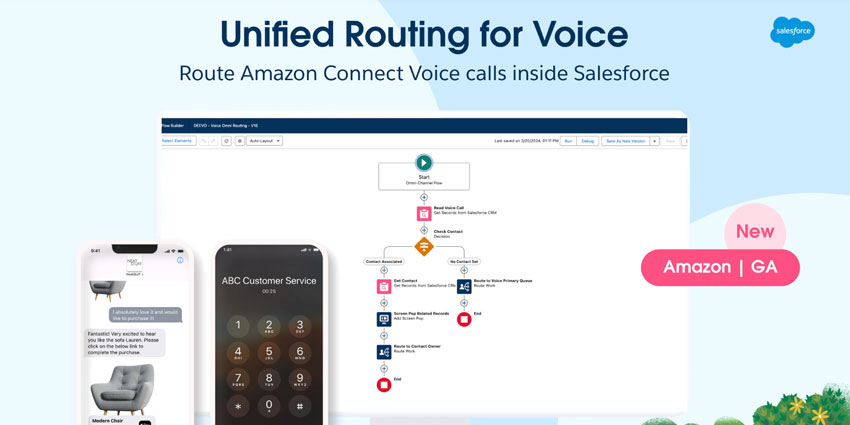

That may include additions to the CX AI toolkit it launched in June, which is available as a standalone app that funnels new AI – and GenAI – capabilities into its SAP Commerce, Service, and Sales Clouds.

Already, these are generating positive results for end-users. Klein said:

In Q2, customers selected our CX AI toolkit to boost the productivity of sales teams by up to 10 percent and e-commerce teams by up to 50 percent.

The concept of the AI toolkit aligns well with SAP’s customer experience strategy. Unlike Salesforce – which chases big dreams – it focuses on maximizing efficiencies between the CRM, ERP, and its broader CX solutions.

That has changed in recent years. After all, it previously chased the market, making moves like its Qualtrics acquisition to please big customers.

According to Liz Miller, VP & Principal Analyst at Constellation Research, that resulted in a scatter approach of trying to do everything.

“Now, it’s much more focused on what its customers are doing instead of what they’re saying,” she said on LinkedIn. That’s driving more nuanced innovation.

That intense customer focus is driving its efforts to build a broader CX ecosystem – via innovations like its CX AI toolkit – instead of chasing trends.

Again, that’s evident in why its new Sales Cloud is available on SAP Grow to highlight that it’s just a part of something much bigger.

After all, customer experience is not a tool, individual function, or software that a business deploys and hopes it works. CX is an enterprise-wide strategy.

Recognizing this, SAP – and some of its CRM rivals – now focus more on toolkits and suites than singular platforms that promise to be the silver bullet of CX. After all, many of those bells and whistles are unnecessary.

Indeed, no enterprise will require all 100 of SAP’s upcoming GenAI use cases, but three or four targeted applications could transform its customer, employee, and broader business outcomes.