Shopify has claimed that it has taken “hundreds” of Salesforce’s customers.

The eCommerce giant has long been associated with providing smaller, mom-and-pop businesses with an easy-to-use online shopping platform … until now.

Recently, the company has been making a concerted effort to target large-scale businesses and is now boasting about poaching the likes of Toys R Us and Casper (mattress seller) from Salesforce.

As part of what Shopify is calling “the mass migration” the company is attempting to lure businesses away from its more established enterprise rivals through its lower prices.

Indeed, during an interview with Bloomberg, Shopify’s Chief Operating Officer, Kaz Nejatian, took a shot at Salesforce’s costly business practices:

The reason most enterprise software is so expensive is because it takes so many steak dinners to put it in your hand.

Aside from the first-hand brags and digs at Salesforce’s expense, others have jumped to support Shopify’s claims.

Speaking to BNN Bloomberg, Scott Lux, EVP of Global Commerce and Technology at Esprit, suggested that Shopify’s lower fees mean that customers could save up to 50 percent over three years by making the switch from Salesforce.

Another way in which the e-commerce specialist is appealing to businesses is through its flexible pricing model, which was key to Mattel Inc.’s recent decision to become a Shopify customer.

Subramanian Kovilmadam, Mattel’s VP of Technology, explained that Shopify’s traffic-based fees model allowed the toymaker to handle demand spikes for new products, without paying for constant high capacity.

“Shopify has been extremely responsive to the complexities of Mattel’s needs,” he noted.

“By moving from a large, annual licensing fee model to a more flexible and transactional cost model, transitioning to Shopify has also resulted in cost savings for us.”

Unsurprisingly, Salesforce had something to say about Shopify’s claims.

Salesforce Claps Back

While e-commerce is far from Salesforce’s primary offering, the company was still quick to clap back at Shopify, with Luke Ball, Salesforce’s Senior VP of Product Management, stating:

Anything’s cheaper if you narrow the use case to one thing and say, ‘Oh, we’re cheaper for this one thing.’

“We’re still the incumbent reigning champion in the space other companies are trying to break into.”

The CRM specialist also claimed that it had taken hundreds of customers from Shopify, including brands like Black Rifle Coffee Co., ReserveBar, and Hasbro Inc – a point that Shopify refuted.

Ball did, however, concede that Shopify was “a noticeable competitor in the space,” commenting that one would have to have their “head in the sand to not see it.”

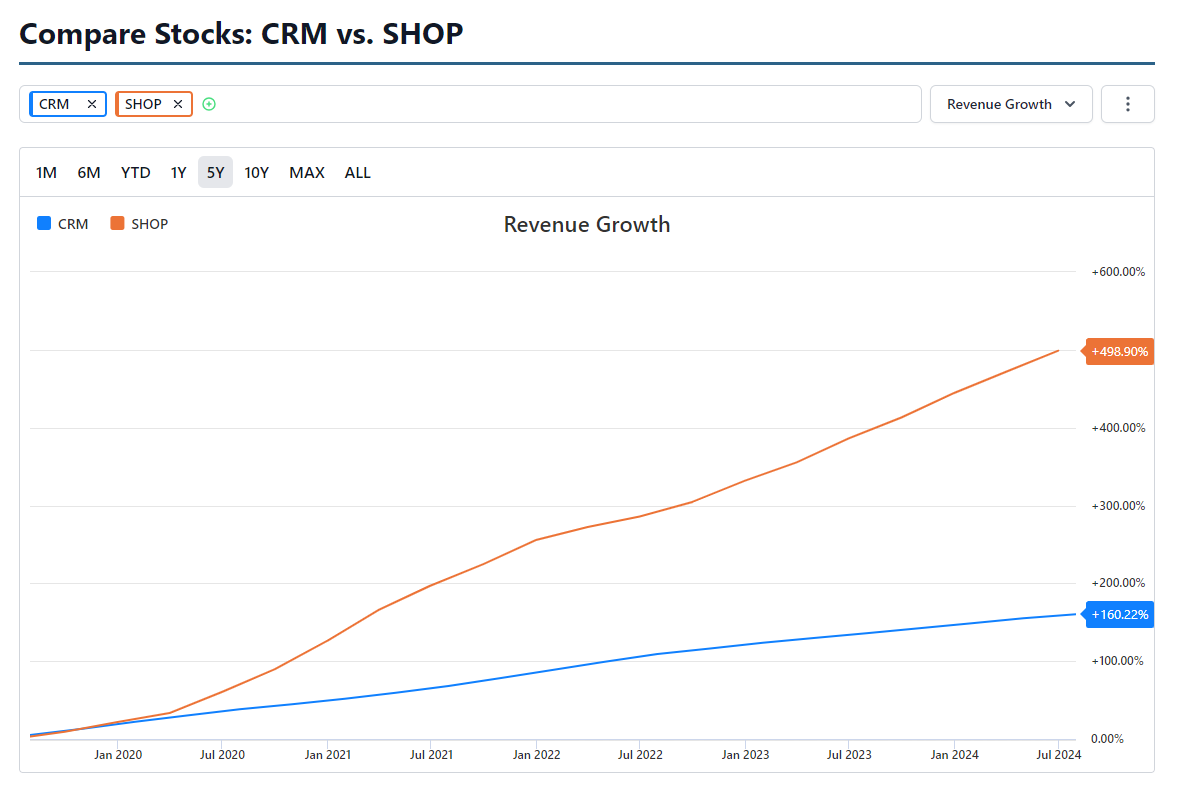

Ball’s concession is also supported by the figures.

While, as expected, Salesforce’s most recently reported overall revenue of $36.47BN far eclipses Shopify’s $7.76BN, the latter is experiencing surging revenue growth.

As seen in the graph below, Shopify has increased by almost 500 percent.

Please note that in the graph, ‘CRM’ refers to Salesforce, and ‘SHOP’ refers to Shopify.

Moreover, Salesforce’s commerce and marketing business is currently its slowest growing segment, making it an opportune time for Shopify to attempt to poach more of its customers.

This point was discussed by D.A. Davidson Analyst Gil Luria, who commented:

“Shopify has added enough capabilities over the last few years that have made it a viable option for even the biggest e-commerce merchants.

At the same time, Salesforce is deemphasizing its Marketing Cloud and focusing more on the Data Cloud, which leaves them vulnerable to losing e-commerce customers.

A Taste of its Own Medicine

Ironically, Shopify’s remarks are right out of Salesforce’s playbook.

In recent months, the company’s CEO, Marc Benioff, has taken a number of shots at Microsoft, with his most recent X attack describing Microsoft’s Copilot as “Clippy 2.0,” referring to the company’s 1990s Office assistant, which was often seen as more distracting than helpful.

Prior to this, Benioff claimed that “many customers” felt “disappointed” with Microsoft Copilot.

While the CEO is the only person who knows precisely why he has been so critical of Microsoft Copilot, it likely stems from Salesforce’s recent launch of Agentforce, its autonomous AI Agent platform.

Elsewhere, Benioff swiped at ServiceNow earlier this year, comparing its CRM rivalry with the vendor to McDonald’s vs. Weinerschnitzel.