Customer service, sales, and marketing teams are catching on: they’re part of a bigger front office.

As they begin to collaborate, they’re recognizing overlap in their toolkits.

Indeed, while traditional service, sales, and marketing tech suites may have different core strengths, they are converging at the center.

ISG has grasped this trend and believes a new market is forming at that center: the customer experience management (CXM) market.

How Does ISG Define Customer Experience Management?

Across contact center, sales, and marketing toolkits, ISG spotted five areas of functional overlap.

The tech providers that perform best across these areas, as denoted by their place in the Buyer’s Guide quadrant, appear well-positioned for the age of customer experience technology convergence.

1. Interaction Handling

Think channels, routing, screen sharing… any feature facilitating conversations between employees and company reps.

2. Resource Management

Resource management includes scheduling and supporting people. Yet, equally critically, it’s about managing knowledge, data, and digital content.

3. Process Orchestration and Automation

AI and machine learning have gravitated in this direction, automating various workflows, including those that spread information from one team to another.

4. Insights and Analytics

There’s significant overlap here as teams transition from function-specific KPIs to enterprise-wide analytics focused on revenue growth, loyalty, and other desired results.

5. Customer Journey Management

At first, journey management solutions focused on the contact center experience. However, their use is expanding to offer a more holistic view of the customer experience.

ISG’s Inclusion Criteria and Methodology

ISG only included tech providers that sell products and provide support in at least two continents. They must also have 25+ customers and at least $50 million in annual or projected revenue.

ISG only included tech providers that sell products and provide support in at least two continents. They must also have 25+ customers and at least $50 million in annual or projected revenue.

While ISG factored out “interaction handling”, as it has a separate piece of research coming soon, it stipulated that participating providers must have capabilities in at least three of the four other areas highlighted above.

The research firm then evaluated those capabilities using the ISG Value Index, scoring vendors across seven categories. The first five relate to “product”:

- Usability

- Manageability

- Reliability

- Capability

- Adaptability

Meanwhile, the final two categories relate to “customer experience”:

- Total Cost of Ownership (TCO) / Return on Investment (ROI)

- Validation of the Vendor

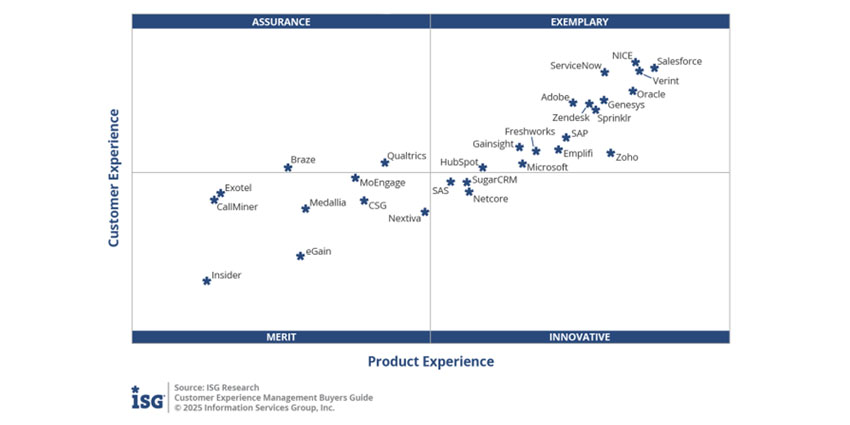

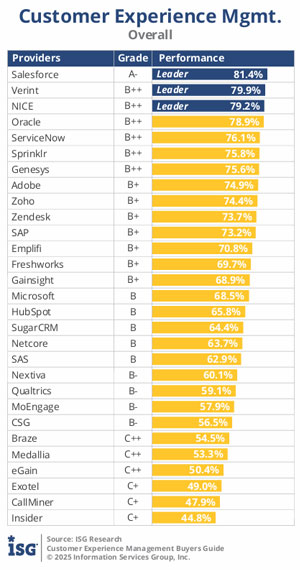

During its evaluation, ISG scored 29 vendors and placed them on the following matrix to highlight how well each performed. The table on the right offers another view of these rankings.

Top Takeaways from the ISG Buyers Guide 2025

The ISG Customer Experience Management Advanced Buyers Guide dissects each vendor’s performance. However, it also spotlights key industry trends, shares advice for selecting the best-placed provider, and offers more market commentary.

The seven top takeaways below touch on all this and include additional insight from the study’s author, Keith Dawson, Director of Research for Customer Experience at ISG.

1. CX Teams Need to Think Further Beyond Their Functional Domain

“What I would encourage readers to take away from this report and similar ones is the urgency of thinking beyond their own functional domain,” said Dawson.

Look left and right at what’s happening in other parts of the customer journey or lifecycle. Try to understand how other departments’ actions impact you and vice versa. Look for ways to smooth the bumps between silos. Increasingly, that’s both possible and necessary.

As function leaders do so, they’ll naturally consider adjacent technologies and tools. That expands the vendor set beyond the traditional comfort zone for many people. Yet, it provides an exciting opportunity for co-innovation that considers the customer journey’s full scope.

Contact center leaders should be particularly watchful of this trend. After all, they have long operated in isolation as part of a purpose-built domain that does its job well, but doesn’t always get the enterprise-wide attention it merits. As such, these leaders aren’t always fluent in enterprise language. Expect that to soon change.

2. Contact Center Providers Are Struggling to Connect with CIOs

As noted, contact centers still often operate in isolation. Part of this is because they deal with voice, phone numbers, and other tricky components that CIOs just don’t want to get bogged down in.

Sure, they excel in interaction handling and measuring those interactions. Yet, as Dawson noted: “Contact centers haven’t fully convinced other parts of the enterprise that their solutions are a suitable foundation for broader enterprise CX.

Enterprise CX is about thinking through the outcomes you want and then executing the steps to achieve them. There’s a tension: contact centers are reactive by nature, while the rest of the enterprise needs to be proactive.

Dawson emphasized that this tension isn’t the contact centers’ or their vendors’ fault. Contact centers were designed for high-volume, repetitive, cost-effective interactions and do that well. Now, they’re being asked to shift their role.

3. AI Needs to Deliver Beyond Beginner Contact Center Use Cases

AI has helped pull many contact centers out of their siloes, as business leaders have encouraged the implementation of various AI technologies: transcription, summarization, quality management, agent assist, and guidance.

While service teams haven’t adopted agent assist as widely as Dawson expected, he believes contact centers are the first front-office function to show genuine ROI from AI.

“The challenge now is expanding AI usage and value,” said the analyst.

The most interesting AI examples now involve analytics and orchestration beyond the contact center, helping adjacent teams analyze customer data that’s better formatted and more accessible than ever.

“It’s still tough to extract insights, but AI tools are helping non-data specialists ask meaningful questions,” he concluded.

These emerging AI applications aren’t flashy or “shiny objects”, like in 2023 or 2024. Instead, as Dawson alludes, they’re analytics tools that are easier to access and work with, producing more profound insights by revealing things they weren’t necessarily looking for.

This helps isolated teams think differently, ask questions, look at new data, and coordinate enterprise-wide customer approaches instead of just team-by-team.

4. Customer Journey Management Is Becoming Better Understood

Journey management is evolving quickly. For some in the contact center, a “journey” starts when a contact comes in and ends when the agent wraps up. Meanwhile, other front-office teams see the journey through the lens of the parts they control.

However, thankfully, there’s increasing recognition that the customer journey is an interconnected, longer process.

The Buyers Guide recognizes this evolution and how CXM providers are now funneling insights across these broader journeys. Dawson also noted:

Interestingly, there’s now an industry institute being formed by some vendors in this space, similar to what happened with CDPs about ten years ago. This group aims to establish common terminology and frameworks around journeys.

That example underscores the growing understanding of distinctions between journey mapping, management, and orchestration. While such distinctions might seem obvious to some, they take time for practitioners to grasp them fully.

5. Brands Like Adobe & Sprinklr Performed Well for One Specific Reason…

While Dawson avoided commenting on specific brands, he spotlighted Sprinklr and Adobe as strong performers for one key reason: they’re actively driving increased alignment between CX teams.

Sprinklr is best known for its social media monitoring tech, but it has spent three years building contact center and workforce engagement management (WEM) solutions.

Why? As Dawson noted: “It’s not about build vs. buy, but they perceived a need. They saw the market direction shifting from MarTech toward broader service solutions.

Adobe is another example. They won’t be a contact center company, but they provide services and tools that can be leveraged within contact center environments.

For example, the tech giant launched its Adobe Brand Concierge during its Adobe Summit 2025 to ensure a unified approach to self-service across ALL customer-facing teams.

While alignment between departments is a key advantage here, the cost benefits of sharing CX solutions and converging the CX ecosystem are also notable.

6. Contact Center Stalwarts Need to Isolate Where They Fit in the CXM Market

Front-office buyers often restrict themselves to the vendors they’re most used to. For example, marketers might start with companies they know from web analytics or digital asset management. Meanwhile, salespeople might look at sales enablement or CRM tools.

However, as Dawson stated:

Thanks to cloud technologies, ecosystems, partnership programs, and APIs, you can basically start anywhere and build out your CX tech stack in any direction and still arrive roughly at the same point.

That’s a dramatic shift for the contact center world. The idea that customer service needs an ACD as its foundational tech purchase no longer holds in this era of hyper-scaled platforms.

Instead, businesses can build a contact center without a traditional contact center vendor in the mix, most likely leveraging a CRM system. While traditional service vendors will have advantages in their expertise and resources, it gives them a lot to think about.

7. Don’t Put Too Much Emphasis on the Quadrant Graphic

Despite authoring the Buyers Guide, Dawson warned: “The quadrant format can cause people to write off companies just because they’re in the ‘wrong’ part of the graph. That’s ill-advised because you can’t pick vendors without considering your unique needs.”

To that point, most buyers need only subsets of the full CXM toolkit or already have incumbents for parts of it. As such, focusing only on the large platform providers that performed best can be a mistake.

Smaller, more focused CXM solutions are also relevant for many use cases. Businesses should definitely consider these, scouring the vibrant startup and experimental landscape that’s filled with new brands doing interesting things.

As Dawson summarized: “Mark my words, the big vendors are watching these smaller companies closely, for partnerships, ecosystems, and acquisitions.”

Interested in learning more from Dawson and the ISG team? If so, check out CX Today’s coverage of The Contact Center Advanced Buyers Guide 2024