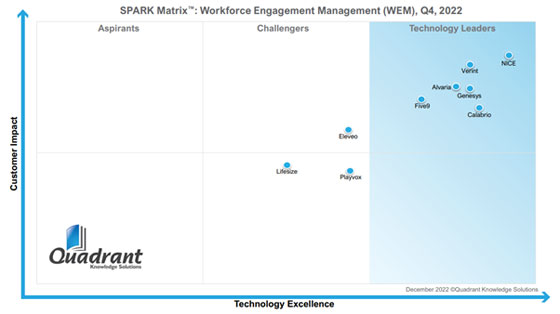

Global consulting firm Quadrant Knowledge Solutions (QKS) has released the results of its SPARK Matrix: Workforce Engagement Management (WEM), 2022 report.

First distributed to paying clients in December last year, the study details rising WEM trends, introduces the vendor landscape, and offers competitive positioning.

Now, QKS has made much of this insight publicly available, including the Matrix graphic, which splits vendors into three groups: technology leaders, challengers, and aspirants.

Read on to discover the providers that have gained this leader status, alongside the pros and cons that QKS spots within each of their offerings.

The Definition of Workforce Engagement Management (WEM) Platforms

WEM platforms provide a solutions suite that aims to engage and empower contact center teams and – in doing so – help businesses meet their customer service objectives.

As this definition suggests, there is an overlap with workforce optimization (WFO) platforms, and many use the terms interchangeably.

Yet, QKS suggests that the rise of “WEM” underlines the technology’s evolution.

Vendors no longer mold their platforms around priming team productivity to meet business goals quickly. They are now more employee-exerience-centric.

That said, they still contain many conventional contact center solutions. These include workforce management (WFM), quality assurance (QA), and recording software.

However, many now also include conversational analytics, voice of the employee (VOE), gamification, and several other solutions.

Often these overlap. For instance, many vendors can automate call scoring by combining QA, recording, and speech analytics software.

Yet, this is only one example of many, and some providers are pushing the boundaries further.

QKS aims to single these vendors out by evaluating nine leading WEM against two central benchmarks: customer impact and technology excellence.

The analyst gauges customer impact against market presence, product strategy, and track record criteria.

Meanwhile, it evaluates tech excellence on factors such as competitive differentiation, technology sophistication, and application diversity.

In doing so, it places WEM providers on a matrix, segmenting them into leaders and challengers – with no aspirants positioned on the graphic below.

Delving deeper into this, consider the following analysis of the nine WEM providers, which draws from high-level insight from the QKS study.

WEM Technology Leaders

- NICE

- Verint

- Genesys

- Calabrio

- Alvaria

- Five9

NICE

The WEM suite native to CXone – NICE’s CCaaS platform – offers complete visibility for managers and agents into individual performance. It also provides real-time guidance based on these insights.

QKS spotlights these capabilities while noting NICE’s Enhanced Strategic Planner (ESP) as a considerable differentiator. The tool allows WFM teams to develop more accurate long-term workforce planning strategies and manage outlays.

The consultancy also pinpoints the native robotic process automation (RPA) bots, gamification, and schedule flexibility as significant strengths within the platform.

“Their innovation is advanced compared to other vendors,” notes the analyst.

Moreover, despite warning of the increasing tech advancements touching the WEM space – which NICE must stay wary of – QKS states that the vendor is well-placed to maintain its growth trajectory.

Verint

Verint has experience deploying large-scale enterprise solutions across many locations, on-premise and in the cloud, leveraging longstanding partnerships with many contact center providers.

In doing so, Verint delivers a unified suite, which benefits from high interoperability between the solutions within its WEM platform.

Indeed, QKS notes that cross-domain workflows are a significant differentiator.

Other notable plusses include analytics-enhanced agent-assist capabilities, automated quality management, and centralized staff management features.

Yet, QKS also cautions that its portfolio is the result of many acquisitions and that there are opportunities for further integration that will make for a more seamless user experience.

Genesys

Sitting within Genesys Cloud CX, this WEM benefits from a microservice-based architecture, allowing for a composable design. As such, contact centers can configure the suite to best meet their needs.

QKS lauds this approach while admiring how the vendor combines WEM, analytics, reporting, UC, and collaboration tools into a single user interface.

Additional differentiators include the API-first approach, pre-built integrations, and support services that Genesys offers.

Nevertheless, QKS warns that Genesys must keep pace with the diverse product sets that various WEM disruptors are building.

Calabrio

Following its 2019 acquisition of Teleopti, Calabrio rose to the forefront of the WEM space. Now, it boasts market-leading WFM tooling paired with advanced QA, agent engagement, and business intelligence solutions.

Soon, Calabrio became the vendor contact centers often call upon when the native WEM solutions offered by their CCaaS providers miss the mark.

It battles with Verint, Eleveo, and Playvox for these customers but often gets the nod thanks to its deep integrations with CCaaS leaders, Calabrio often gets the nod.

Meanwhile, its virtual staffing solution “Grant”, embedded AI, and data management are all critical differentiators for the vendor.

In terms of cautions, QKS notes that Calabrio may need to develop new APIs to integrate with homegrown tools, which contact centers often cling to.

Alvaria

When Aspect Software and Noble Systems merged in 2021, they developed the Alvaria WEM Suite.

The offering excels in its dynamic scheduling capabilities, cross-location shift management, and various other WFM capabilities – as per QKS.

The analyst also highlighted the combination of screen and voice recordings with QA as a significant strength – alongside Alvaria Motivate, an engagement tool for sales teams.

However, as is the case with several other vendors, Alvaria’s primary challenge will be in keeping up with the market’s accelerating tech advancements, according to QKS.

Five9

Five9 works with WEM specialists to combine native and third-party solutions to deliver unique offerings for the user’s organization.

QKS seemingly admires such an approach and Five9’s support for customers in installing, configuring, and maintaining the specialized end-solution.

The analyst also pinpoints the speech & text analytics features, CRM integrations, and planning tools embedded into the platform.

Nonetheless, the intraday management, schedule optimization, and coaching automation features “need improvements” – according to the report.

WEM Challengers

- Eleveo

- Playvox

- Lifesize

Eleveo

Eleveo fuses its QA and coaching tools to excellent effect, allowing contact centers to create a connected learning strategy to bolster agent performance. Interaction analytics runs between them to take this plan to the next level.

That approach is a crucial differentiator for Eleveo – as per QKS – while its “affordable” price options allow the vendor to remain adaptable and competitive.

However, the analyst cautions Eleveo is still evolving from a QA player to a WEM leader, lacking agent onboarding and task assistance features.

Playvox

Unfortunately, Playvox is the only WEM provider within the report without extensive analyst commentary.

Nevertheless, QKS notes that it offers a feature rich platform with a plethora of features.

The analyst also reveals that Playvox has invested heavily in R&D, developing a roadmap to enhance its predictive AI capabilities.

Lifesize

Lifesize’s WEM platform, CXEngage, provides users with all the capabilities they require to drive up productivity and save the time of agents, supervisors, and resource planners.

This is according to QKS, which also notes that the pre-built Salesforce and Zendesk integrations enable users to extract additional value from the platform.

Although, the analyst underlines the need for further integrations with various enterprise solutions. Meanwhile, it also questions Lifesize’s suitability for enterprise deployments. Indeed, the mid-market seems to be the vendor’s sweet spot.

Gain insights from half the WEM market leaders by checking out our roundtable: Top Trends In Workforce Optimization (WFO)