For years, automation in the contact center promised transformation but delivered frustration. Callers had to navigate rigid decision trees, robotic voices, and a single overriding goal: deflection. But as Joe Havlik, Vice President of Global Revenue at Synthflow, told CX Today in an interview, something fundamental has changed.

“There’s been an evolution where I can now have a conversation with an AI agent that is enjoyable, and I feel like my problem can be solved. I don’t think that that’s been the case for the last 10 years, even the last five years.”

What came before was not conversation at all. But customers were yearning for a system that could solve their problems effectively.

“I’d love nothing more than the first thing that an AI agent says to me is, how can I help you?” The difference today is not marketing language or interface polish. “The technology is finally getting there where that’s what we’ll be able to do.”

Leaving Containment Behind

The contact center industry has spent more than a decade framing automation around efficiency metrics. Havlik, who was previously Vice President of North America at Cognigy, believes that framing is now outdated.

“This is not about containment. This is not about… features and functions. This is about ROI and problem solving.”

That shift also changes how vendors should demonstrate value. “Nobody wants to go to a demo where I give you a harbor tour of the inside guts of my system,” Havlik said. Instead, the moments that immediately resonate with enterprise users center on outcomes. “If I show you that first notification of loss, then the wheels start turning.”

At its core, the work is about customers, not technology, Havlik said.

“This is about creating an experience for the end users… I’m not selling software. I’m selling an outcome that is enjoyable.”

A major driver of this shift is architectural.

LLMs Change the Economics

Havlik contrasted earlier generations of conversational AI based on natural language understanding (NLU) with what large language models (LLMs) enable today.

“Think about… the LLMs being a foundation and then building the NLU around the edges versus the other way.” With an LLM as a foundation, enterprise developers can build working AI agent prototypes within hours, compressing timelines in a way enterprises understand.

“That drives an ROI timeframe that’s very different than what we’ve seen… we can see a real ROI in weeks, not months… That’s a different conversation. People are much more willing to try that out.”

Start Small, Then Scale, While Keeping the Human Element

Despite the new capabilities, Havlik warned against sweeping replacements.

“I see customers all the time almost getting to the point of analysis paralysis, [asking] ‘do I make this wholesale change?’ No, don’t make this wholesale change.”

Instead, he advocated for narrow, well-defined entry points. “Pick a part of your business. Pick a phone number.”

Havlik pointed to a customer who did exactly that and scaled up successfully. The customer “started out with a single phone number to a single contact center” and the payoff came through iteration. “They grew that to out and out,” Havlik said. “And within less than two years, they grew that over a thousand percent because they started small.”

Even with better reasoning, customer acceptance hinges on something more visceral. “We are still creatures that want to feel like we’re talking to something that is like us,” Havlik said.

The older interfaces failed that test. “The robotic voices of yesterday didn’t make you feel that way.” Today, the response is different. “Now the voices have gotten so good that they really make it where we’re willing to have this conversation.”

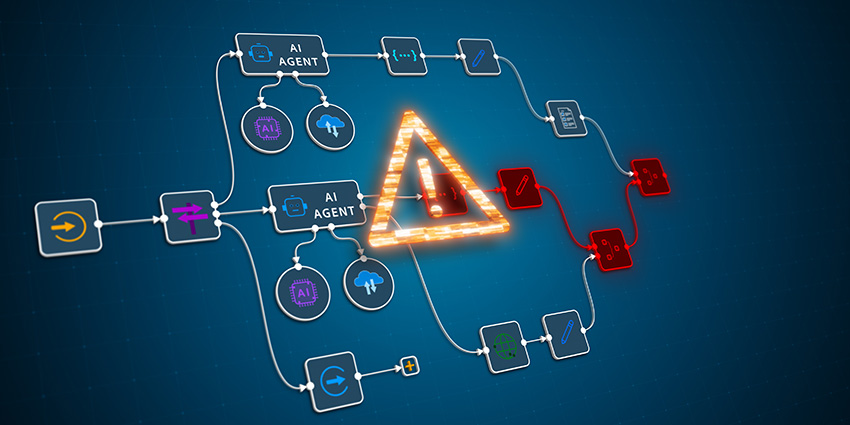

Guardrails, Not Guesswork

As systems become more capable, safety becomes more complex. Havlik describes security as layered by design.

“You don’t just leave it as purely an LLM and good luck. You do need some guardrails.”

Those guardrails include third-party validation as well as internal testing. “Having a third party do that is incredibly important,” Havlik said. “Because now it’s not just me and my people saying we built it, and we tested it ourselves.”

Equally important is real-world feedback. “Our customers will always find something else,” he noted. “So getting that feedback loop from all three pieces… creates a very good approach to it.”

One of Havlik’s strongest assertions challenges internal skepticism around customer attitudes towards AI.

“Our customers… are more ready for it than we in the industry have naturally been willing to give them [credit for].”

Havlik pointed to a double standard when it comes to implementing AI agents:

“We expect 100% from our AI agents, but we don’t expect 100% from our contact center. Why?”

The answer lies in mindset, not capability. “Sometimes when you reset that people go, ‘Oh, yeah, you’re right. I don’t expect 100% there.’”

The possibilities for AI enhancements in the contact center are clear in crisis scenarios. In the insurance industry, for instance, hurricane season can cause a spike in customer claims. “But you can’t possibly staff up a contact center for a thousand people suddenly like that,” Havlik noted.

Yet AI enables scalability and the potential to design a claims experience around empathy and immediacy. Automated contact centers could collect information from customers for follow-up by human agents in a more efficient way that encourages loyalty, Havlik explained.

“If instead of me waiting on hold after I’ve just had this happen, when I have 20 other things [to deal with]… I could call in and have an AI agent that can scale as much as I need that to scale, as an end user, I feel like my immediate need has been solved.”

“[A]n AI agent has the ability to know that I’m calling from Texas because I’ve got a 214 number, and ask ‘did this happen to you? I’m so sorry for your loss’—because it can give that concept of emotion—and collect the information for upload to the CRM.”

“Now, 48 hours later, a human picks it up from the CRM. They call them back… That’s a completely different experience than having to wait on a call for 48 hours.”

That is the real promise of conversational AI, Havlik said. “Those are the kind of experiences that we can create in the insurance industry.”

Not containment or deflection.

What Comes Next

Looking ahead, Havlik sees the interface itself evolving. “Now voice has gotten so good. You add an avatar. Now I’m having a video call,” he said. “That’s where we are going.”

Havlik also pointed to contextual memory as a defining element of successful customer interactions.

“The concept of long-term versus short-term memory is incredibly important.”

When a customer repeatedly interacts with a brand, there is information that they want the brand to know and store to inform ongoing interaction, and information they don’t want the company to hold.

“There’s going to be a segmentation… and it’ll be more granular.”

Taken together, these shifts point to a future where automation no longer feels like a barrier. As Havlik puts it, the goal is simple and long overdue: “I want my problem solved.”