Alongside its Magic Quadrant series, Gartner sometimes releases a Critical Capabilities study.

In 2022, it did precisely that for CCaaS and is set to do so once again next month.

Yet, as the leading vendors wait in anticipation for the latest edition, it is perhaps an ideal moment to look back at last year’s report.

Indeed, it conceals many golden nuggets of information that remain relevant to contact centers that wish to weigh up particular aspects of prospective CCaaS solutions.

After all, Gartner claims: “Application leaders should use this report to help shortlist providers for further evaluation.”

So, without further ado, let’s dissect some of the essential learnings.

How the Critical Capabilities Report Works

Within its Critical Capabilities reports, Gartner isolates features of a particular platform that it deems vital to differentiated offers within the respective market.

After introducing these capabilities, the analyst dissects the ability of market stalwarts to deliver these across various use cases.

For CCaaS, these use cases include a high-volume call center, digital customer service center, and global contact center – amongst others.

The entry conditions also differ across reports. In this CCaaS study, a vendor must have earned a minimum of $50MN in total revenue as of December 31, 2021.

Yet, there are many other requirements. For instance, a provider must demonstrate a sales, marketing, and operational presence in three of the following five regions: North America, South America, Asia/Pacific, Europe, and/or the Middle East and Africa.

The 13 Critical Capabilities for CCaaS

Gartner has identified 13 critical capabilities for CCaaS. Here is a brief summary of each:

- Data Center Design – Scaling the solution infrastructure up and down to meet peaky service demands is critical in CCaaS. As such, businesses should consider the resilience of a platform’s computing power, which hinges on a robust data center architecture.

- Telephony-Centric Offer – Telecom connectivity is an essential part of CCaaS services. Yet, for businesses with complex needs, “bring your own telco” is also a trend vendors should facilitate, and many do. Buyers must recognize this, consider the rates across these models, and ponder over a vendor’s track record of supporting similar high-volume environments.

- Digital-Centric Offer – CCaaS vendors must keep up with the explosion of digital channels and offer the tools to orchestrate journeys across them, keeping customer context. Yet, channel support is just half the story. Vendors should also offer flexible licensing, which makes it simple to shift from a telephony-first to a digital-first approach.

- Marketplace – Providers must integrate their CCaaS solution with prominent third-party systems readily available in a marketplace. That should include the most widely utilized apps across parallel markets, such as CRM, UCaaS, CPaaS, ERP, and marketing automation. Moreover, buyers should ensure other solutions they leverage are there and seek out trial and buy options within prospective integrations.

- Developer Environment – Businesses often seek out a test environment, which allows them to trial integrations and customizations in a safe space. That may include helpful features like test migration, rollback, and versioning tools. Active community engagement, where customer developers may support each other, can also be a significant plus.

- Workforce Engagement Management – The CCaaS market is converging with the workforce engagement management (WEM) space. Given this trend, many expect vendors to offer core workforce management (WFM) and quality assurance (QA) solutions. In addition, they should provide integrations with WEM specialist solutions, such as those served up by Calabrio or Verint.

- Virtual Customer Assistant – Alongside WEM, conversational AI is now touching the CCaaS market, with many vendors offering in-house conversational interfaces. Those that can handle non-scripted, more complex dialogs will stand out – alongside those that play the orchestrator role to specialist third-party platforms.

- Customer Administration Portal – Contact centers now look beyond the ability to manage the operational parameters of their CCaaS solutions. Moreover, they want more intelligent reporting that goes beyond insight generation into queuing, routing, and admin, with an intuitive UX design. Buyers often seek independent reviews to asses this capability.

- Agent Experience – The contact center agent role is demanding, and boosting their experience to preserve retention rates is critical. As such, seeking out high configurability, increased visibility across channels, and robust workflow management capabilities is a significant priority for many buyers.

- Pricing & Contract Elasticity – The ability to add and revise agent licenses flexibly is critical to help service leaders manage costs. Moreover, it allows them to scale up and down more efficiently to meet expected and unexpected demand. As such, businesses should seek monthly contract elasticity and ensure they never receive penalties for overconsumption.

- SLAs and Trust Center – When migrating to CCaaS, businesses must be confident that the provider can manage their contact center better than they can. A 99.99 percent availability as a standard is an excellent indicator of this, backed up by high ratings from verified review sites such as Gartner Peer Insights and G2.

- Customer Experience – Perceptions of how a contact center team interacts with a vendor’s team, systems, and services are the cornerstone to robust relationships with a CCaaS platform provider. Proactive support alongside fast, helpful support is also essential here.

- Channel Partner Program – When migrating to CCaaS, businesses must be confident that the provider can manage their contact center better than they can. A 99.99 percent availability as a standard is an excellent indicator of this, backed up by high ratings from verified review sites such as Gartner Peer Insights and G2.

Gartner has evaluated the capacity of nine market stalwarts to deliver on these capabilities – drawing many vendor-specific insights, including those highlighted below.

How Did Each Vendor Perform?

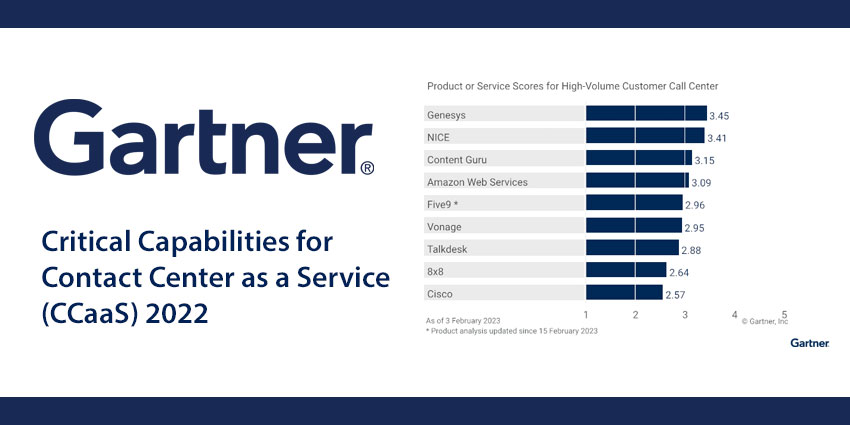

Within the study, Gartner scores each provider’s performance across these 13 critical capabilities. In doing so, the analyst ranks them across five use cases.

While additional vendor-specific insights are available within the report, here is a sneak peek of how the vendors ranked and their scores. These scale from one to five.

Use Case 1: High-Volume Customer Call Center

- Genesys – 3.45

- NICE – 3.41

- Content Guru – 3.15

- AWS – 3.09

- Five9 – 2.96

- Vonage – 2.95

- Talkdesk – 2.88

- 8×8 – 2.64

- Cisco – 2.57

Use Case 2: Customer Engagement Center

- Genesys – 3.75

- NICE – 3.53

- AWS – 3.36

- Talkdesk – 3.24

- Five9 – 3.06

- Content Guru – 2.72

- 8×8 – 2.54

- Vonage – 2.38

- Cisco – 2.09

Use Case 3: Digital Customer Service Center

- NICE – 3.41

- Genesys – 3.37

- Talkdesk – 2.90

- AWS – 2.89

- Content Guru – 2.64

- Five9 – 2.63

- Vonage – 2.25

- 8×8 – 2.23

- Cisco – 2.13

Use Case 4: Agile Contact Center

- AWS – 3.41

- Genesys – 3.37

- NICE – 2.90

- Talkdesk – 2.89

- Five9 – 2.64

- 8×8 – 2.63

- Content Guru – 2.25

- Vonage – 2.23

- Cisco – 2.13

Use Case 5: Global Contact Center

- Genesys – 3.41

- AWS – 3.37

- NICE – 2.90

- Five9 – 2.89

- Cisco – 2.64

- Talkdesk – 2.63

- 8×8 – 2.25

- Vonage – 2.23

- Content Guru – 2.13

What to Expect In 2023

As generative AI hype swirls the CCaaS industry, Gartner may consider placing more emphasis on AI and automation as a critical capability for CCaaS vendors.

Indeed, as Ben Rigby, SVP, Global Head of Product & Engineering: AI, Automation & Workforce at Talkdesk, told CX Today:

In one fell swoop, it will wipe out much of what has come before it. It’s just a matter of time.

Yet, another fascinating trend is the de-emphasis on core telephony – as evident in Verint’s release of its Open CCaaS platform. Gartner may also factor this into its evaluation.

Thankfully, followers won’t have to wait long to find out, with August likely to bring the next edition of the report – alongside a new CCaaS Magic Quadrant.

For the time being, gain more insights from Gartner analysts into the state of the CCaaS market by checking out our rundowns of the following reports:

- Gartner Magic Quadrant for Contact Center as a Service (CCaaS) 2022

- Gartner Peer Insights “Voice of the Customer” for CCaaS 2023