Gartner Peer Insights is a review platform for enterprise technology decision-makers.

After an 18-month period – ending in November 2022 – the platform published 1,099 reviews of various CCaaS vendors.

Using this insight, Gartner created a “voice of the customer” report to compare and contrast the top 11 most reviewed providers.

Reviews involve customers answering a series of questions on a scale from one to five, which Gartner has averaged to surface insight into the software and services of each vendor.

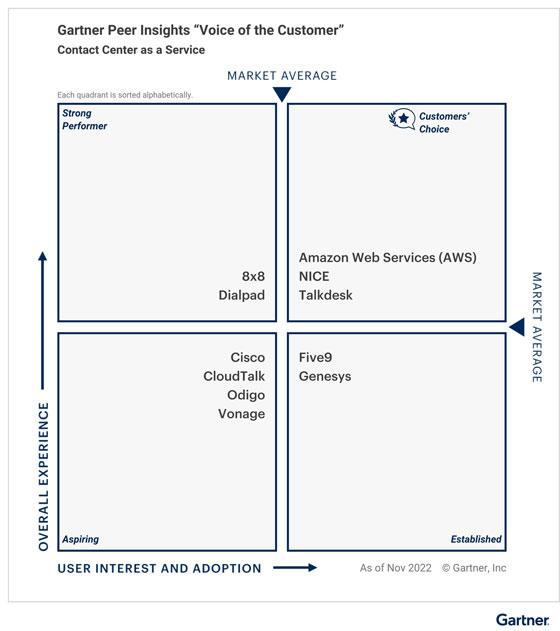

Most notably, it has created the voice of the customer graphic below, grouping vendors into various cohorts. These include: Customers’ Choice, Established, Strong Performer, and Aspiring.

Yet, within the report, there are also a host of other insights into each vendor. So, let’s consider them individually after running through the headline takeaways.

Headline Takeaways

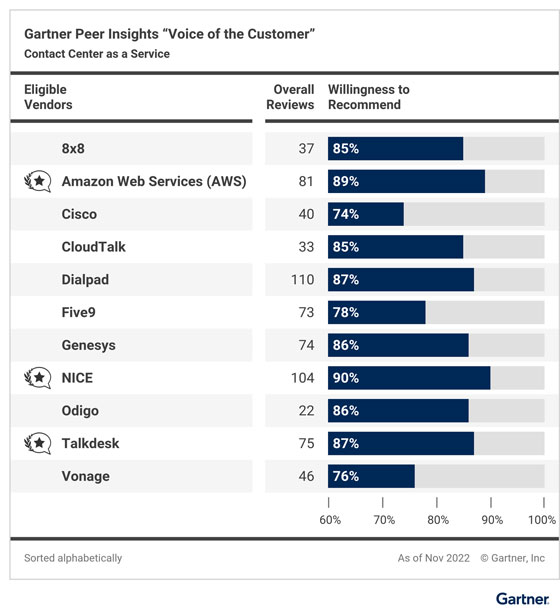

NICE, AWS, and Talkdesk received a customers’ choice vendor accolade while also scoring highest in their customers’ willingness to recommend them.

Indeed, 90 percent of NICE customers would recommend the CCaaS provider. Meanwhile, for AWS and Talkdesk, the figure drops slightly to 89 and 87 percent, respectively.

Dialpad also achieved an 87 percent score. Meanwhile, Genesys and Odigo performed well too, enjoying an 86 percent recommendation rating.

At the other end of the spectrum, Cisco and Vonage lag on willingness to recommend, scoring 74 and 76 percent, respectively.

NICE, AWS, and Talkdesk again took home the mantle as customers’ choice vendors when Gartner investigated the midsize enterprise (50M – 1B USD) segment specifically.

Yet, NICE proved the standalone leader in North America, with Gartner pinpointing the CCaaS provider as the only customers’ choice vendor in the region.

Insights Into Each of the 11 Vendors

Delve deeper into the results from Gartner Peer Insights “Voice of the Customer” report with some vendor-specific insights.

8×8

59 percent of 8×8 customers have given the vendor a five-star for CCaaS. Many particularly enjoyed the sales experience, which – on average – scored a 4.6 out of five.

8×8 thrives in the mid-market space, as 95 percent of its business seemingly comes from enterprises with a market valuation of between $50MN and $1BN.

However, the provider appears to trail its rivals in its market presence outside of North America and EMEA, with no reviews coming from APAC or LATAM.

AWS

AWS is one of the three customers’ choice vendors, with 95 percent of those customers giving it a four- or five-star rating.

Moreover, AWS had no two- or one-star ratings despite aligning itself with many large enterprises that often have complex contact center needs.

Indeed, 12 percent of its CCaaS customers are valued at 10BN+, while the provider serves many industries and geographies.

Cisco

Cisco has an extensive legacy base to leverage for CCaaS migrations. As such, it handles global deployments across many industries.

The vendor also caters to businesses of all shapes and sizes. Indeed, it has many enterprise customers migrating from on-premise, while it also works with SMBs that wish to extend their Webex UC platform.

Unfortunately, with a willingness to recommend score of 74 percent, it scored the lowest of all 11 vendors, as it did for “deployment experience”.

CloudTalk

None of the CloudTalk CCaaS reviews in the study gave the vendor a one- or two-star rating. Instead, most (58 percent) gave it a four-star score.

Despite being based in central Europe, much of CloudTalk’s business stems from APAC – alongside North America and EMEA. Yet, it seemingly lacks a robust presence in LATAM.

Finally, CloudTalk received respectable scores for its product capabilities, sales experience, and support experience. However, like Cisco, the vendor fell back in its deployment experience.

Dialpad

Dialpad, which differentiates itself by doing contact center AI differently, performed particularly well in ratings for its sales and deployment experiences.

Moreover, 87 percent of its customers are willing to recommend the business.

Nevertheless, Dialpad’s business seems very much pegged to North America, with 90 percent of its reviews coming from customers in the region.

Also, the businesses it works with tend to be smaller, with less than one percent of customer reviews coming from companies with a market value of over $10BN.

Five9

Five9 markets itself to enterprise customers with complex deployment needs. This is evident in the industries that it typically works with.

Indeed, 22 percent of its reviews came from healthcare, 16 percent from finance, and another 16 percent from manufacturing.

Such a strategy has proven successful, with almost a fifth of its reviewing customers being enterprises valued at more than $10BN.

Despite this, 71 percent come from North America. While it is growing in other regions – thanks to its ongoing international expansion – its presence in EMEA trails its CCaaS rivals.

Genesys

Half of Genesys’s customers gave the vendor an overall five-star rating. Meanwhile, 86 percent are willing to recommend its software and services. These stats highlight its high customer loyalty.

Moreover, the vendor seems to be finding success in working with financial institutions, perhaps thanks to its advanced cloud security offerings.

However, Genesys received the lowest score for its support experience across all 11 vendors. Perhaps this is symptomatic of its expansive geographical footprint. Nevertheless, this is likely a cause for concern.

NICE

61 percent of NICE customers gave the vendor a five-star rating. That is the highest percentage of all vendors in the report.

In addition, it scored the highest percentage in terms of customers willing to recommend.

As such, it is no surprise that Gartner named NICE one of three customers’ choice CCaaS providers worldwide and the only vendor of choice in North America.

65 percent of its reviews came from this region. Yet, only two percent came from LATAM, where NICE seemingly lacks the presence it has in other parts of the world.

Odigo

Remarkably, Odigo only scored four or five-star reviews – the only CCaaS vendor in the report that can boast such a feat.

It also works with many large enterprises. Indeed, 36 percent of its reviewing customers have a market valuation of over $1BN.

Much of this success likely comes down to Odigo delivering solutions across private and public clouds. Whereas many of its rivals – including NICE, Genesys, and Talkdesk – only offer the latter.

Unfortunately, its presence across North America and LATAM significantly trails most other vendors in the list – despite being a stalwart CCaaS provider across much of Europe.

Talkdesk

Talkdesk is one of the three customers’ choice vendors, benefitting from a significant geographical reach across all major regions.

The vendor also scores above the market average across all categories in Gartner’s report – performing particularly well in its product capabilities, sales experience, and support experience.

Interestingly, the vendor also seems to attract many businesses in the transportation, education, and retail sectors.

Vonage

Vonage is a prominent global CCaaS vendor, and its acquisition by Ericsson may only serve to increase its worldwide presence.

Given its size, it’s impressive that none of Vonage’s customers gave it a one or two-star review in the report, and it scored well for its support experience.

However, more troublingly, Vonage placed tenth out of the 11 CCaaS vendors in the percentage of its customers that would recommend its software and services.

Eager to gain more insights from Gartner into the cloud contact center market? If so, read our rundown of its 2022 Magic Quadrant for CCaaS