According to Aragon Research, the intelligent contact center (ICC) market is in flux.

There are several catalysts. One example is in how more virtual agents are coming online, not only assisting customers but agents, supervisors, and managers, too.

As such trends surge, more enterprises recognize the need to transform, understanding the risk of being left behind.

Unfortunately, those leveraging traditional platforms that prioritize telephony and routing may struggle to keep up with new customer expectations for consistent, digitized, personalized journeys.

Meanwhile, those harnessing cloud-native ICC offerings – which embed AI to automate more processes, accelerate conversations, and derive new insight – are much better placed.

Yet, it’s not all about AI. ICCs also prioritize data management and developing unified customer profiles. Indeed, Aragon Research forecasts:

“By YE (year-end) 2024, 55 percent of contact center providers will enable the development of an enhanced customer profile that will enable a more personalized customer experience.”

While this underscores the overall advancement of contact center technology, some ICC providers are ahead in their product, AI, and data capabilities.

Thankfully, the Aragon Research Globe for the Intelligent Contact Center 2025 isolates those that are surging ahead, honoring them as “market leaders”.

Read on to discover how the analyst deciphers these leaders and its most striking findings.

Determining the 2025 “Intelligent Contact Center” Leaders

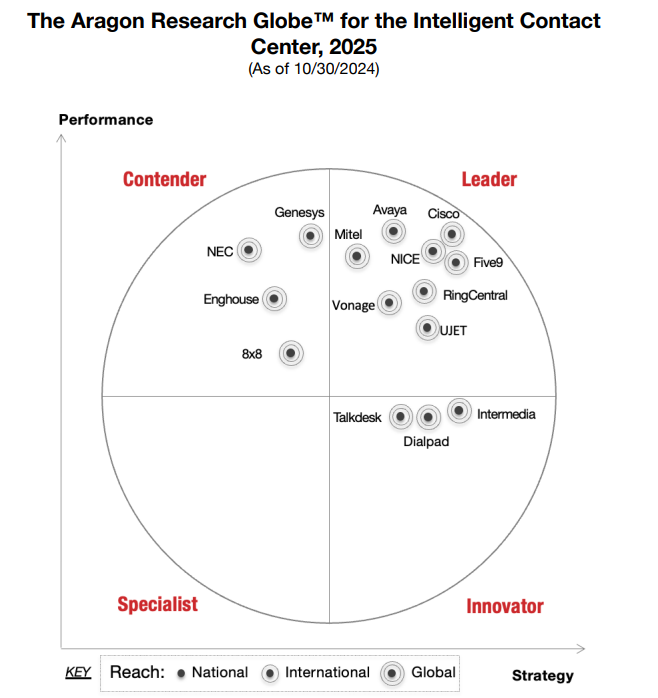

In its report, Aragon Research evaluated 15 of the “major” contact center vendors, deeming eight worthy of the “leader” tag.

As part of that evaluation, the analyst conducted a “rigorous” analysis that went beyond size and market share, factors that often dictate competitor reports.

Of course, global reach is critical when assessing a provider’s support services, and Aragon Research recognizes this. However, its central focus leans into each vendor’s core product features.

That’s evident in the three dimensions of Aragon Research’s assessment criteria:

-

Strategy

- Product

- Product strategy

- Market understanding and product roadmap

- Marketing

- Management team

-

Performance

- Market awareness

- Customer experience and feedback

- Financial viability

- Pricing and packaging

- Product feature mix and frequency/quality of releases

- Investment in R&D

-

Global Reach

- Worldwide sales and support offices

- Locations and time zones of support sentences

- Language support

- References across regions

- Data center locations

After dissecting the performance of analysts against this criteria, Aragon Research developed the matrix below, which features all 15 ICC providers.

Unpacking the analysis, Jim Lundy, Founder, CEO, & Lead Analyst at Aragon Research, said: “The contact center market is undergoing rapid change, driven by new use cases and the increasing need to automate knowledge delivery with virtual agents.

“Enterprises are under pressure to deliver exceptional customer experiences, and AI-powered virtual agents are key to achieving this.”

As such, it’s no surprise to see many of the familiar names – including Five9, NICE, and Vonage – in the leader group. After all, they aren’t shy of beating the AI drum.

Yet, another leader with a more differentiated AI strategy is UJET, which benefits from a special relationship with Google, empowering it with early access to leading AI models.

Leveraging those models, UJET empowers customers to orchestrate best-fit customer journeys by blending various forms of AI, humans, and channels. Here’s a closer look.

UJET Reaffirms Its Place Amongst the Elite Contact Center Providers

Aragon Research spotlights UJET’s modern architecture as a differentiator, offering customers two considerable benefits.

First, it enables a bidirectional data flow between the UJET Cloud Contact Center and any CRM, unlike competitive integrations that require data duplication and synchronization. That’s big for brands looking to build a unified CX environment and complete data sets.

Second, it facilitates smartphone-first customer experiences, allowing contact centers to design live and virtual agent-driven service experiences that leverage the capabilities of a modern phone.

For instance, consider a simple retail order return for an item that was damaged in shipment:

With UJET, the agent (whether live or virtual) can easily request a picture of the damaged item which the consumer can quickly snap and share with the camera on their smartphone.

That image can be automatically verified and appended to the ticket, so that a refund or replacement can be issued instantly without any additional follow up or interactions required

That’s just one example of how UJET can help brands reimagine service experiences by blending modalities, different forms of AI, and those complete data sets.

After referencing these strengths in the report, Lundy and fellow author Adam Pease, Analyst, Editor, & Video Producer at Aragon Research, noted:

“UJET’s commitment to innovation, strategic partnerships (including its collaboration with Google Cloud), and robust AI capabilities position it for growth in the ICC market.”

The vendor recently completed a $76MN Series D funding round to accelerate that growth, which is particularly strong in the mid-market.

There, UJET further differentiates, priming its offering for a 50-1,500-seat contact center with widespread customer approval across verified review sites, like G2.

Indeed, on G2, UJET has amassed an 18-quarter streak as the leading product in user satisfaction for contact centers.

Selecting an Intelligent Contact Center Vendor

The contact center market is crowded, and assessing all the available options can seem exhaustive. That’s why reports like the Aragon Research Globe are an excellent starting point.

However, when selecting an ICC, contact centers must complement these studies with their own research to evaluate providers against specific requirements.

There are several crucial considerations here. These include integrations with adjacent technologies, regional in-language support, configurability, financial viability, scalability, channel mix, etc.

Yet, as the market evolves, new considerations come to the fore. For instance, more contact centers now ask to speak directly to reference customers to learn “warts and all” stories.

Meanwhile, more wish to learn about their provider’s approach to building AI as platforms pop up utilizing third-party, white-labeled AI solutions. Understanding this background is critical to unpack potential ethical and legal concerns.

As a final example, contact centers should establish a commitment to regular reviews with their provider before signing on the dotted line. That ensures they can align the costs of an ICC with speed of innovation.

All this is just a fraction of what there is to think about. However, downloading the Aragon Research Globe – and similar industry reports – offers an excellent baseline, as it introduces the most prominent vendors and what sets them apart.

One with plenty of differentiators is UJET. To discover if it fits your ICC shortlist, visit: ujet.cx