A recent Gartner study highlighting a downturn in CCaaS growth has sparked debate across the customer experience space.

Indeed, the research firm found that growth has halved over the past two years, dropping almost every quarter and leading some analysts to predict increased market consolidation.

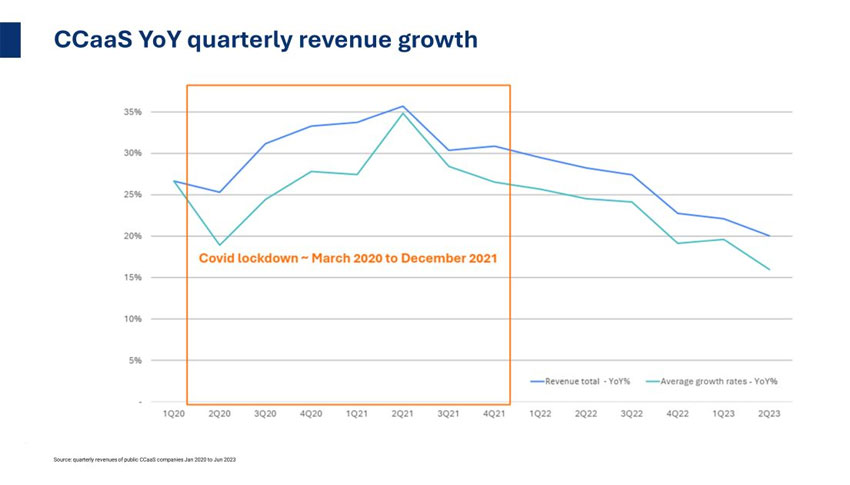

Nicolas de Kouchkovsky suggested this trend when sharing the following graphic from the report.

Liz Miller, VP & Principal Analyst at Constellation Research, followed suit when sharing her thoughts on an upcoming episode of CX Today’s Big News Update.

In doing so, she drew a comparison with the UCaaS market.

“UCaaS is starting to consolidate because many [vendors] turned themselves into a commodity,” said Miller. “And when you turn yourself into a commodity but want to be considered an “innovator”, you go and buy someone really fast. You try and make some new moves in the marketplace.

“That same pattern is about to hit CCaaS – and you’re going to see vendors start to look everywhere else for growth.”

Some of the moves that follow may add value to CCaaS suites. Yet, Miller worries that many will veer in the wrong direction.

“We Mustn’t Panic!”

Sharing an example of one such “wrong direction”, Miller said:

Where I start to see this going is [vendors thinking] we have multichannel and journey orchestration, maybe we can be the next marketing automation tool?

“I want to say: Slow down! No one is going to let the contact center run marketing operations.

“We mustn’t panic about the decline. It was expected, and it will start to level out.”

As it levels out, Miller asserts that businesses must keep their innovations customer-focused, not only to inspire new business but to keep what they already have.

After all, many COVID contracts from the pandemic-induced peak in CCaaS are in the renewal process, and some providers may struggle with retention.

Miller notes this and suggests that several poor practices may cost them business.

“You can’t sell a solution that claims to be customer-first and then do nasty things – like long-term vendor lock-ins and arbitrary increases to fees,” she said. “This must be a market that keeps its eye on customer satisfaction – and how their customers treat their customers.”

CCaaS Vendors Must Lead By Example

Miller suggests that there is a certain irony in particular CCaaS providers banging the CX drum and not doing what’s best for their own customers.

As such, they must close the gap between what end-users want and what they deliver. Noting this, Rebecca Wetteman, CEO & Principal Analyst at Valoir, added:

“It can’t just be about delivering capabilities in the software, particularly for the contact center managers not used to getting something new every quarter.

Managers need to understand: what am I getting out of the software, and where can I get more value?

Wetteman suggests that new telemetry must happen to meet this need, and Genesys is one example of a vendor breaking the boundaries in this regard.

Indeed, its new Genesys Experience Index aims to offer “new levels of visibility” for clients into how they can bolster agent engagement and specific customer outcomes.

Meanwhile, Salesforce recently released a novel Customer Success Score to help customers drive more value from their investments.

Yet, Wetteman advocates for further customer hand-holding.

“You don’t build it, and they come in the contact center,” she concludes. “You’ve got to bring them on a journey, from the manager to the agent level – and that’s not about pushing new capabilities out the door every quarter.”

Get a Grip on Licensing Models and AI Pricing

As CCaaS growth slows, vendors may bolster their margins by encouraging existing customers to augment their operations with more AI.

Yet, that raises a significant question: how much should we charge for AI?

Zeus Kerravala, Principal Analyst at ZK Research, believes that many CCaaS vendors are struggling to answer this.

Making this point, he introduces a recent conversation with an organization that migrated to CCaaS and leveraged their vendor’s native conversational AI.

Kerravala asked how the implementation of virtual agents had impacted costs. The response he received went something like:

“For us, it has been awesome. The vendor still uses per-seat pricing, so they charge for a virtual agent, but you can spin off as many conversations as you want. It’s the best deal ever.”

Kerravala questions the economics of this approach, which may come back to bite providers as their CCaaS growth and addressable market shrink. He said:

Trying to apply a per-user, per-seat model to virtual agents doesn’t work or scale. They’ve got to go consumption-based somewhere along the line.

According to Kerravala, AWS is the only prominent CCaaS provider that raced to consumption-based pricing, and – when others introduce such a model – it may cause quite a shock, especially after peak traffic seasons.

Nonetheless, he suggests vendors can take a leaf out of the utilities playbook.

After all, a utility company will say: “We understand that you have spikes in the summer for AC,” and they’ll try and smooth it out across the year for you.

“The industry could do that; we just haven’t,” said Kerravala. “Some innovation around pricing – and visualizations of that – has to be done.”

Enter AI again. Indeed, Michael Fauscette, Founder, CEO & Chief Analyst at Arion Research, notes the possibility of building a forecasting model for virtual agent usage to help customers stay on top of their costs.

Beware of the CFO’s Wrath

Contact center AI pricing will grow as a topic, with CCaaS increasingly coming under the scrutiny of CFOs – according to Miller.

In years gone by, the contact center was once something many left in the hands of the COO – as a relatively predictable cost.

Now, service teams are spending more time talking to customers, using more AI, and bringing in more IT resources.

All that is raising the visibility of the contact center in places it doesn’t necessarily want visibility, suggests Miller, as service leaders struggle to budget for next year.

Miller added: “I spoke with a Head of Technology, and he asked: Should I lower my budget now because we’re just going to shift agents over to AI?

I responded: That’s not the question to ask. You need to think further ahead because if you ask fewer people to answer more complex things and don’t give them extra space, guess what? The Calm app built into the agent desktop won’t cut it.

Cisco is one vendor getting ahead of that curve. During its latest contact center innovation spree, the vendor announced new CCaaS packages, allowing contact centers to more easily leverage external expertise and support.

Such packages emphasize how Cisco has kept its ear to the contact center floor – supporting service operations as they expand beyond their traditional confines.

Hopefully, the vendor – and its market rivals – will stay on this path, manage customer expectations closely, and offer more guidance throughout their journeys. That appears most crucial to retention and long-term CCaaS success.

Listen to more insights from Liz, Rebecca, Zeus, and Michael into the state of CCaaS and other big CX news as they join myself on an upcoming episode of our CX BIG News Show.

Make sure you don’t miss it! Subscribe to the CX Today Newsletter.