G2 is a prominent, verified review platform for tech decision-makers.

The comparison site harnesses those reviews to generate reports across 630+ software categories.

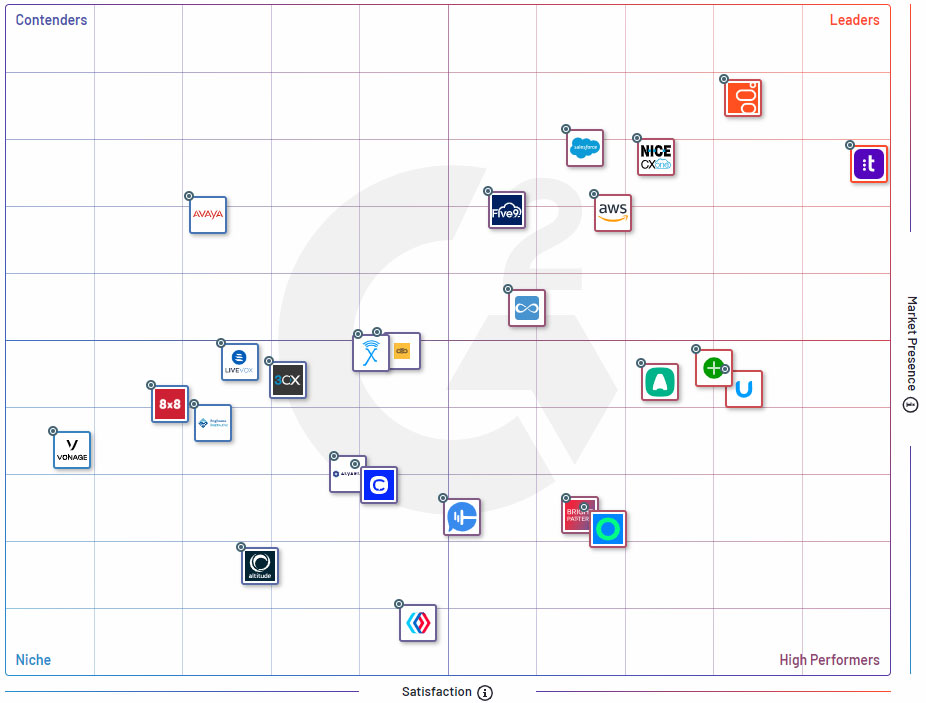

Perhaps the most popular of those reports are its quarterly Grid studies – and the firm has now released its Summer 2023 Enterprise Grid for Cloud Contact Center platforms.

To feature, each CCaaS vendor must have at least ten reviews – submitted by May 2023.

G2 then uses an algorithm to place vendors on the Grid. This factors in the recency of each review, the amount of feedback, the reviewer’s role, community engagement, and more.

In addition, it considers data from the web and social networks.

In doing so, G2 creates cumulative customer satisfaction and market presence ratings for each vendor. It then divides them into four categories: Leaders, Contenders, High Performers, and Niche Products – as highlighted below.

Yet, the supporting study also hosts many insights into each vendor and its offerings.

So, let’s consider the leaders individually after whittling through some top takeaways.

Headline Takeaways

Talkdesk, Genesys, and NICE placed best, as the vendors did in the most recent Gartner Magic Quadrant for CCaaS.

Through the lens of customer satisfaction alone, Talkdesk leads by some distance, scoring 98 out of 100. To put that in perspective, its closest rival – UJET – scored 84.

Meanwhile, Genesys recorded the best market presence ratings, ahead of NICE and Salesforce.

While many consider Salesforce’s Service Cloud a CRM platform, its convergence with CCaaS represents a larger market trend.

With that platform, Salesforce crept into the leader segment alongside AWS, Five9, and Ameyo.

While Ameyo’s score fell behind its fellow leaders, securing a place in the top-right quadrant – amongst these industry stalwarts – is a significant coup.

Elsewhere, UJET may feel somewhat aggrieved not to make the leader quadrant. Delve deeper into the satisfaction ratings, and it boasts the highest NPS score across all vendors, with its customers the most like to recommend the brand.

Yet, while its market presence is not quite there – as per the G2 report – its tight-nit partnership with Google is starting to change that.

One day it may even match Avaya, which performed particularly well in terms of market presence. Once again, this highlights the fierce loyalty of its customers despite the vendor’s financial woes.

Finally, it’s critical to note that the scores of 3CX, CloudTalk, and Vonage are somewhat hampered by G2’s failure to gain a complete set of data points.

Insights Into the Market Leaders

Delve deeper into the results from the G2 Enterprise Grid Report for Contact Center by scouring the following insights into the market leaders.

Talkdesk

Talkdesk achieved a 90+ percent score across each of the six core elements G2 measures as part of its customer satisfaction rating. These elements include:

- Quality of Support

- Ease of Use

- Meets Requirements

- Ease of Admin

- Ease of Doing Business With

- Ease of Setup

In doing so, Talkdesk surpassed the industry average across each of these criteria and achieved the highest CSAT score across all providers.

2,128 reviews contributed to these findings, which also reveal that the vendor’s highest-rated features include its auto-dialler, agent scheduling capabilities, and voice platform.

Live chat proved its lowest-rated feature, scoring 92 percent. Nevertheless, that is still higher than the industry average for the solution, which is 89 percent.

Genesys

According to G2, Genesys has the biggest market presence of all CCaaS providers worldwide.

The vendor also scored highly in customer satisfaction, with 94 percent of users giving the vendor an overall rating of four or five stars.

Digging deeper into the six core elements of CSAT (as highlighted above), Genesys scores best for “ease of use” – recording an 89 percent rating.

However, it trails the market average of 87 percent in “quality of support” – scoring 78 percent.

The vendor’s highest-rated features include its IVR, voice, and concurrent calling features.

Meanwhile, its reporting and dashboarding capabilities are its lowest ranked capability. Reviewers gave Genesys a 75 percent score for this, 11 percentage points behind the industry average.

NICE

NICE ranks third in both customer satisfaction and market presence amongst the leader quadrant in the G2 report.

Much of this satisfaction stems from its “ease of use” and ability to meet its client’s requirements – achieving a 90 percent CSAT score in both areas.

Its WFO suite also received a warm reception from reviewers. Indeed, its scheduling solution is its highest-rated feature, followed by its auto-dialer and session recording solutions.

Two of its three lowest-rated features – SMS and email – still score above average. Meanwhile, the third – social – only trails the benchmark by two percentage points.

Salesforce

According to the report, Salesforce trails only Genesys in its market presence and achieves above-average ratings across G2’s six core elements of CSAT.

The vendor also achieved an impressive 94 percent CSAT rating for inbound screen pop, which is perhaps not much of a surprise given its roots as a CRM platform. Its IVR and SMS features drew praise from end-users.

However, Service Cloud’s native speech analytics, dialing, and live chat features languish behind the industry benchmark.

Also, the vendor records the second-lowest NPS rating across each of the seven market leaders, achieving a score of 50. Meanwhile, Talkdesk achieved 78.

Five9

Five9 is a top five CCaaS vendor in terms of market presence, having secured a reputation for its platform’s ease of use after it underwent a large-scale rearchitecture.

The G2 report also revealed that Five9 receives the highest scores of all leaders in regard to its IVR, session queuing, and scheduling capabilities.

Interestingly, the capability for which Five9 scored lowest was its “Session Summary Notes”. However, the vendor has recently released a GPT-powered solution for this purpose, which should lead to a better score in future editions.

More worryingly perhaps is its NPS score of 28, which lags its fellow leading vendors.

AWS

AWS achieved several honors within the report. For instance, all its customers scored the vendor either four or five stars for CCaaS.

100 percent of its participating customers also believe the product is going in the right direction. The only leader to achieve this score.

Moreover, Amazon Connect recorded the highest score for “ease of admin” across each of the 25 vendors that the report investigated.

As such, it’s difficult to spot where AWS fell behind. Perhaps this is due to the vendor accruing only 56 reviews on G2 – making the data less reliable. For comparison, Talkdesk has 2,000+.

Ameyo

With 91 percent of users rating Ameyo four or five stars and the same percentage believing the provider is heading in the right direction – the vendor has reached leader status.

The vendor also scores a 90 percent CSAT rating for ease of use, ease of admin, and its ability to meet end-user requirements.

Such expertise is fuelling its expansion from APAC, alongside its specialties in voice, post-call processing, and scheduling tools – as per G2.

However, Ameyo does trail its fellow market leaders in not only its geographical footprint but also its screen pop, live chat, and SMS features.

High Performers, Contenders, & Niche Products

Alongside the market leader, G2 also presented the results of 18 other CCaaS providers.

The filtered into the following three groups:

- Contenders: Sinch, Exotel, Avaya, & LiveVox.

- High Performers: UJET, Gladly, Aircall, Ozonetel & Bright Pattern

- Niche Products: CallRail, CloudTalk, Alvaria, CONQUER, 3CX, Enghouse Interactive, 8×8, Altitude, & Vonage.

For much more detail into how these vendors performed, download the original report, which is available on the G2 website.

To compare and contrast this Grid to those served up by other CCaaS analysts, check out the following report summaries:

- Gartner Peer Insights “Voice of the Customer” for CCaaS 2023

- The Forrester Wave for CCaaS 2023: Top Takeaways

- The ISG Provider Lens CCaaS 2022