55 percent of IT and CX leaders think CRM will replace contact center platforms within five years.

This surprising statistic comes from Metrigy’s recent Technology Spending Forecast.

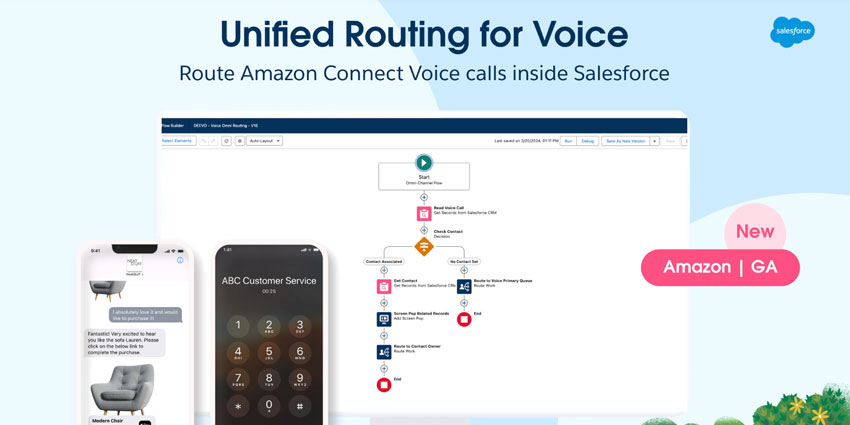

As if on queue, Salesforce went all in on CCaaS just days after its release.

The CCaaS Incentive for CRM Vendors

The move into CCaaS is an obvious adjacent play for Salesforce, as almost every contact center vendor integrates with its technology.

Yet, Robin Gareiss, CEO of Metrigy, highlights numerous benefits for businesses if CRM vendors can close the gap with CCaaS. On LinkedIn, she writes:

The main driver is general access to customer data records, followed by the ability to consolidate platforms, and automate communications from customer data records.

“As more customers conversations start in channels other than voice (35% as of April 2022), CX leaders see promise in using their CRM providers for those types of interactions.”

Vendors like Salesforce will undoubtedly wish to deliver these benefits to customers. Yet, the contact center also offers an opportunity for increased client spending.

Indeed, AI innovation – including agent-assist – is high in contact centers. With this innovation comes the opportunity to increase cost per seat.

Moreover, the number of people using contact center technology is also growing as marketing, sales, field service, and many more departments access CCaaS tools.

The opportunity to do so through a technology they are more familiar with, like a CRM (or possibly a UCaaS platform), is likely an attractive option for many.

Can CRMs Compete In the Mid-Market and Enterprise Space?

While they have a strong incentive, it seems unlikely that CRM will take over CCaaS in the coming years, as many CX leaders predict.

Of course, a significant acquisition could change the status quo – perhaps if Salesforce made a play for a well-established CCaaS vendor, like Genesys, Talkdesk, or Five9. Indeed, it has the resources to roll them up.

Yet, it seems more likely that Salesforce will first focus on SMBs. Why? Because mid-market and enterprise CCaaS deployments are often complex, with lots of application integrations that require technology and considerable expertise.

Moreover, while its solution does offer basic functionality with advanced CRM features, Salesforce lacks nuanced CCaaS capabilities, like predictive routing, which are mission-critical for larger deployments.

Gareiss also highlights voice as a critical frontier many CRM providers may struggle with. She notes: “Voice will never go away as a customer interaction channel – and voice is really hard to do well.”

Though CRM providers have started offering voice on their own or through partnerships, they simply aren’t as reliable or advanced as contact center providers. And, many large contact centers are complex and rooted in the technology from their contact center platform providers.

However, CRM vendors will likely have some success in the market, especially as the definition of “contact centers” expands.

For instance, many now refer to voice of the customer vendors like Qualtrics and helpdesk providers such as Zendesk as CCaaS players – despite it not being their core market.

Yet, there is a danger of vendors stepping on one another’s toes…

Salesforce Must Tread Lightly Into CCaaS

During a recent conversation with CX Today, Zeus Kerravala, Principal Analyst at ZK Research, said:

From a go-to-market perspective, Salesforce has to tread lightly. Every contact center vendor is their partner, and what they don’t want to do is create a scenario where all those partners flea, support other CRM tools, and create partnerships that end up damaging Salesforce.

So, while the move is likely fruitful, Salesforce perhaps needs to pick its spots carefully as it ramps up its CCaaS plans. Initially targeting the SMB market is an example of how it may do so.

After all, success for companies in the space may hinge on their willingness to build friendly relationships with competitors. The recent Cisco and Microsoft partnership is perhaps an excellent example of this.

Gareiss seemingly agrees with this, noting that the best possible outcome for end-users is the increasing interoperability of the CX stack.

“What does need to happen is incredibly tight integration between contact center, CRM, CPaaS, AI, marketing automation, ERP, and other platforms,” she concludes.