From multi-device experiences to integrating Internet of Things (IoT) services, many trends are transforming the ERP space.

Compossibility, collaboration, and hyper-automation… these are just some of the others touching the market and twisting its direction.

Then, there is AI, which is not only moving the ERP innovation needle but also driving the demand for an ERP-suite approach to improve data management.

Indeed, the space is experiencing several waves of disruption, which leading vendors must surf to stay at its forefront.

Some manage this better than others, pushing the market forward while ensuring the expected outcomes for customers.

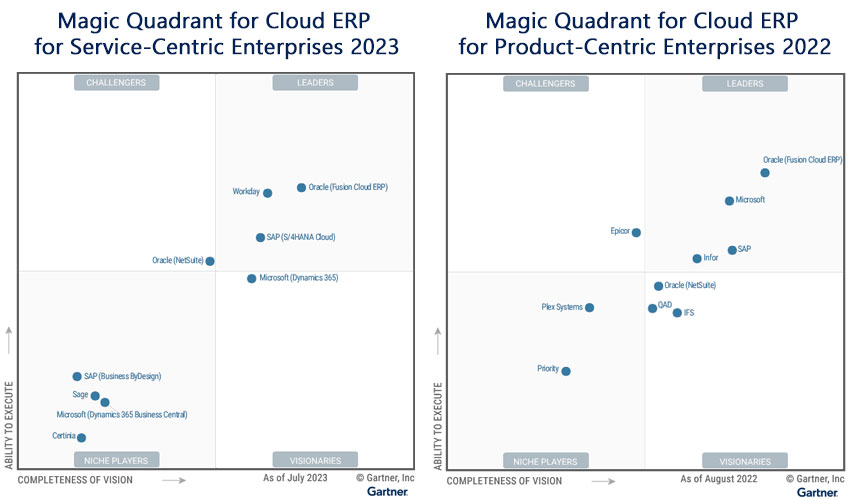

The Gartner Magic Quadrant for Cloud ERP for Service-Centric Enterprises 2023 has evaluated the nine propositions that promise to do so – uncovering four leading offerings in the process.

→ THE 2024 Edition: Check out CX Today’s coverage of the latest Magic Quadrant for Cloud ERP for Service-Centric Enterprises.

The Definition of Cloud ERP for Service-Centric Enterprises

According to Gartner, a service-centric cloud ERP platform provides an integrated solutions suite that includes at least three of the following functionalities:

- A Financial Management System – Such a system includes accounts payable, accounts receivable, general ledger, and more financial planning tools.

- Order-to-Cash – These capabilities range from cash collection functionality to configure, price, and quote (CPQ).

- Source-to-Pay – This category features contract life cycle management, e-purchasing, e-sourcing, and many similar capabilities.

- Human Capital Management – Think of HR tools such as position management, employee lifecycle, and core data management features.

- Other Administrative ERP functionality – Such capabilities cover areas like planning and analysis, service procurement, and project management.

Industries where businesses are likely to choose a service-centric cloud ERP over a more product-centric cloud ERP include healthcare, financial services, and telecommunications, amongst others.

These typically place more emphasis on service than companies in sectors such as manufacturing, deliveries, and servicing of goods.

As such, Gartner placed more emphasis on these particular verticals when conducting its study and pulling together the report.

In doing so, the analyst split the nine cloud ERP offerings into four camps: Leaders, Challengers, Visionaries, and Niche Players.

Gartner Magic Quadrant for Cloud ERP for Service-Centric Enterprises 2023

Gartner Magic Quadrant Leaders

Leaders in the Gartner Magic Quadrant demonstrate a “market-defining” vision coupled with a track record of executing that vision through solutions, services, and strategy. In doing so, they’ve established a broad global presence, a proven ability to secure enterprise deals, and trust amongst systems integrators in supporting financial transformation programs. This year’s leaders include:

- Oracle (Fusion Cloud ERP)

- Workday

- SAP (S/4HANA Cloud)

Oracle (Fusion Cloud ERP)

Oracle gains plaudits for the “mature” cloud financial, people, and project management capabilities inside its Fusion Cloud ERP. Alongside its procurement, financial planning, and analysis (xP&A), and order-to-cash features, these prove particularly valuable to the midsize, large, and global enterprises that derive value from the platform. Gartner also highlights robust application and data integration, development analytics, and support for specific industries as significant plus points. Those industries include healthcare, financial services, and government.

Workday

Workday embeds sophisticated xP&A into its ERP to provide planning models for workforce management, budgeting, third-party resources, and project-based planning from one space. Gartner notes this a significant strength, alongside its financial management and “advanced” HR capabilities. The latter includes innovative features for extended workforce management, skills management, and employee sentiment – with mature machine learning powering these.

SAP (S/4HANA Cloud)

SAP (S/4HANA Cloud) helps to consolidate many non-SAP systems from across the globe, including treasury and cash management solutions. In pulling these together, SAP offers a native tie-in with its Analytics Cloud xP&A platform for advanced analytics. Gartner commends this financial management product vision alongside the vendor’s support services and indirect procurement strategy. Also, the analyst notes “enablement of continuous improvement” as a core strength, as SAP’s portfolio paves the way for establishing and observing progressive internal benchmarks.

Gartner Magic Quadrant Challengers

Challengers in the Gartner Magic Quadrant have developed a deep market presence, typically appealing to a specific segment of the addressable market. Moreover, they often report excellent results when working with that faction. Nevertheless, they seemingly lack the broader vision to challenge leaders and compete with them for contracts that cross all shape and size of enterprise. This year’s challenger is:

- Oracle (NetSuite)

Oracle (NetSuite)

Oracle NetSuite covers CRM, HCM, commerce, and many more business software platforms. As such, it has a significant global presence, which the ERP solution exploits with embedded localization features. These cross various languages, regulation conformities, currencies, and more. Gartner underlines this geographic flex as a critical strength, in addition to NetSuite’s professional services automation and preconfigured implementation. Yet, despite the platform’s expansion, the analyst notes that it still misses xP&A capabilities, such as planning models for projects that include third-party workers.

Gartner Magic Quadrant Visionaries

Challengers in the Gartner Magic Quadrant have developed a deep market presence, typically appealing to a specific segment of the addressable market. Moreover, they often report excellent results when working with that faction. Nevertheless, they seemingly lack the broader vision to challenge leaders and compete with them for contracts that cross all shapes and sizes of enterprise. This year’s challenger is:

- Microsoft (Dynamics 365)

Microsoft (Dynamics 365)

Gartner recognizes the large-enterprise financial management system (FMS) capabilities within Dynamics 365 as a chief asset – despite many users being midmarket businesses. These closely integrate with the customer engagement applications inside the Dynamics 365 suite, Microsoft 365, and the Power Platform. The solution also draws value from the Azure platform and includes next-gen procurement capabilities – including new spend analytics features made available after Microsoft’s Suplari acquisition. Unfortunately, there are still gaps in its HR functionalities, crossing payroll, recruiting, and career management.

Gartner Magic Quadrant Niche Players

Niche players in the Gartner Magic Quadrant often meet client requirements and deliver ROI. Nevertheless, their platform capabilities are usually narrower, their vision for large-scale transformations weaker, and – in many cases – they lack a sector-specific focus. As a result, they are most frequently implemented by midsize or project-centric enterprises. This year’s niche player is:

- SAP (Business ByDesign)

- Microsoft (Dynamics 365 Business Central)

- Sage

- Certinia

SAP (Business ByDesign)

Aimed primarily at midmarket businesses, SAP (Business ByDesign) allows users to build custom capabilities required for their region or sector. Gartner highlights that as a plus, alongside SAP’s professional services and administrative ERP for SMEs. Smaller businesses wishing to benefit from such capabilities often build it into a two-tier ERP solution, with S/4HANA Cloud the likely adjacent technology. Yet, Gartner signals the evolution of S/4HANA to fit more midmarket requirements – in line with SAP’s GROW initiative – may threaten such use cases and Business ByDesign in itself.

Microsoft (Dynamics 365 Business Central)

Gartner refers to Microsoft Dynamics 365 Business Central as a “viable choice” for brands that wish to implement a “robust” solution that meets basic accounting requirements. The analyst also highlights Microsoft’s global partner base, market momentum, and the solution’s integration within the business’s stack as significant strengths. However, the native HR and operational capabilities within Business Central seem limited, with many customers relying “heavily” on partner solutions available on the Microsoft Dynamics 365 Business Central.

Sage

Lower-midmarket businesses in North America and parts of Europe often implement Sage Intacct. Many choose Sage for its finance features. For instance, its continuous auditing capabilities that detect anomalies are a particularly fascinating functionality. Gartner notes such innovation as a strength – alongside its native financial planning and analysis and solution. Yet, the analyst notes its global reach, limited native HR capabilities, and lack of P2P solution as cautions.

Certinia

Previously known as “FinancialForce”, Certinia chiefly serves project-based service organizations with “core financial components” that strengthen its offering. Gartner backs up this point by adding that Certinia integrates closely with Salesforce, with joint customers able to tie its platform with Einstein analytics for greater business intelligence. Yet, the solution does rely heavily on partnerships – with Gartner highlighting that these are particularly crucial for closing gaps in its native HR capabilities.

How Does This Magic Quadrant Differ from the Product-Centric Edition?

As in the Gartner Magic Quadrant for Cloud ERP for Product-Centric Enterprises 2022, the Oracle Fusion Cloud ERP and SAP S/4HANA platforms achieved leader status.

Yet, that is about where the similarities end, as the comparison below underlines.

Indeed, other than Microsoft and the two aforementioned vendors, there are no other overlapping cloud ERP vendors.

That is somewhat surprising, given the capability of brands such as Infor, Epicor, and Workday to cross all sectors.

Yet, Gartner has strict inclusion criteria. Moreover, the analyst highlights other critical differences between the ERP subsets.

For instance, it suggests that service-centric organizations have proven much more enthusiastic about migrating to the cloud.

According to Gartner, this is due to the reduced complexity of O2C and supply chains for service-centric businesses.

Moreover, the analyst suggests that these organizations have a heightened focus on improving the flexibility and mobile accessibility of ERP implementations.

Customers must understand such trends as they evaluate prospective cloud ERP platforms.

Uncover more of our Magic Quadrant rundowns below:

- Gartner Magic Quadrant for Contact Center as a Service (CCaaS) 2023

- Gartner Magic Quadrant for Analytics and Business Intelligence Platforms 2023

- Gartner Magic Quadrant for Enterprise Conversational AI Platforms 2023