Prominent research firm Gartner has released its much-anticipated 2023 Gartner Magic Quadrant for Analytics and Business Intelligence Platforms.

With enterprises pulling together, sharing insights, and aspiring to become increasingly customer-centric, demand for these platforms is rising.

Indeed, analytics and business intelligence solutions uncover emerging business trends and create a unified view of the customer experience.

As a result, each business unit may sing from the same hymn sheet.

Nevertheless, there are many more components within such solutions. To understand each of these, consider how Gartner defines analytics and business intelligence platforms.

The Definition of Analytics and Business Intelligence Platforms

Analytics and business intelligence (ABI) platforms make it much easier to “model, analyze, explore, share, and manage data” for CX teams – according to Gartner.

As a result, less technical users can uncover and visualize insights, laying the foundations for cross-function collaboration.

AI is playing an increasingly critical role here, spotting trends in data, pulling them together, and automating insight delivery.

Such insights are relevant to the user’s objectives, actions, and workflows.

Yet, this only scratches the surface of an ABI platform’s functionality. The following 12 critical capabilities – as put forward by Gartner – underline this.

- Automated insights

- Analytics catalog

- Data preparation

- Data source connectivity

- Data storytelling

- Data visualization

- Governance

- Natural language query

- Reporting

- Data science integration

- Metrics store

- Collaboration

These features are fundamental differentiators for many of the 20 ABI providers below.

After evaluating each, Gartner separated them into four categories: leaders, challengers, visionaries, and niche players.

The 2023 Analytics and Business Intelligence Platforms Magic Quadrant Leaders

With superior know-how of those core ABI capabilities and a vision to drive client success, leaders deliver a compelling pricing model that “supports proof of value.” Alongside this, they pave the way for phased purchases and increased scalability to meet the unique requirements of businesses across numerous industries. This year’s leaders are:

- Microsoft

- Salesforce

- Qlik

Microsoft

In its user adoption, Microsoft “dominates the market.” The growth of its Microsoft Power BI cloud service enabled this, with the tech pioneer bundling the solution with other products in its deep portfolio. These include Office 365 and Teams – with the latter allowing enhanced knowledge sharing. Gartner applauds its alignment with these offerings – alongside Azure Synapse – and the value proposition they deliver. The analyst also noted “product ambition” as a core strength – again noting the integration with its broader portfolio – notably Power Apps and Power Automate – as exciting innovation enablers.

Salesforce

With Tableau, Salesforce remains Microsoft’s closest competitor at the forefront of the market. The vendor has built a community of developers around this, which help to ramp up the solution’s adoption. Tagging this approach as “Tableau as a skill”, Gartner notes this a significant plus point – in addition to the visual analytics experience incorporated into the system, making it easier to extract meaningful insight. Finally, researchers admired that Tableau had remained cloud-, data source- and application-agnostic despite its Salesforce acquisition, enabling greater composability.

Qlik

Qlik Sense Enterprise SaaS is an ABI platform that includes its Qlik Sense, AutoML, and Application Automation solutions. The latter enables deeper analytics into businesses process with a visual no-code approach. That makes its analytics much more composable than its competitors and is an inherent strength. Gartner notes this, alongside Qlik’s cloud-agnostic approach and comprehensive data & analytics capabilities. Put together after many acquisitions and a laser internal R&D focus, these capabilities support several business personas in gathering and evaluating relevant insights.

The 2023 Analytics and Business Intelligence Platforms Magic Quadrant Challengers

Grabbing the ABI market bull by its horns, challengers provide specific applications proven to continually deliver business value. Nonetheless, some providers seem to trail leaders in the native integrations that bind features within their portfolio. Instead, they may lag in their industry-specific innovation, geographical footprint, and sales channels. This year’s challengers are:

- Domo

- Amazon Web Services (AWS)

- MicroStrategy

- Alibaba Cloud

Google has made significant strides in unifying its BI tools in the past 12 months. Now, it has pieced together the Looker Platform – combining Looker, Data Studio (now known as Looker Studio), and a LookML semantic layer. This layer receives acclaim in the report for allowing businesses to leverage the power of Google Sheets, Microsoft Power BI, and Tableau in coordination with other tools in the Looker platform. Gartner also notes its decision support, workflow features, and further integrations with solutions in the Google Cloud Platform – including Dataproc, Dataprep, and Composer – as cornerstone strengths. Nevertheless, some avoid the platform due to its prevailing developer/data engineer focus.

Domo

Often a platform that businesses with a robust data warehouse foundation select, Domo offers more than 1,000 data and application connectors – all of which are native. To support this, the vendor introduced the “Domo App Framework” to connect these, embed BI into business workflows, and enable what-if analysis in a low-code environment. The example is one example of Domo driving innovation. Gartner praises the vendor for this, alongside its platform’s scalability and multipersona support. Unfortunately, the analyst suggests that its third-party ecosystem is somewhat limited.

Amazon Web Services (AWS)

As it did in the CCaaS magic quadrant, AWS wins praise for the pricing model of its ABI platform Amazon QuickSight, allowing clients to pay-per-use. Moreover, its mature software development kits (SDKs) and APIs enable customers to develop sophisticated embedded analytics use cases. AWS expanded the potential of these further by increasing its investment in its serverless cloud BI service last year to enable complex applications that are less of a burden on the cloud infrastructure. Where AWS lags, however, is in its support services – which include end-user training.

MicroStrategy

MicroStrategy builds organically instead of acquiring code bases. This strategy has given its platform stability and “less buggy code.” That platform is also incredibly open, with an emphasis on interoperability that spans multiple clouds and business application stacks. Gartner notes these two elements as significant strengths, alongside MicroStrategy’s reputation for robust reporting and governance – which drives much of its enterprise business. Nevertheless, the analysts believe the vendor trails leaders in its augmented analytics and lack of product differentiation.

Alibaba Cloud

Alibaba impresses with its composable analytics approach. While its Quick BI platform is available as a standalone offering, it fits within the Alibaba LYDaaS portfolio, which provides modular and reusable data and analytics (D&A) capabilities. Gartner admires this approach alongside Alibaba’s digital workplace-oriented analytics and data literacy support programs. Nonetheless, the vendor is very much pegged to the Asia/Pacific region, where competition is growing. The analyst also noted its low market momentum and investment focus as areas of concern.

The 2023 Analytics and Business Intelligence Platforms Magic Quadrant Visionaries

With a differentiated, meticulous vision for the ABI platforms of the future, visionaries can provide deep functionality in specific arenas. Unfortunately, despite their expertise in the space, they often lack the broader portfolio or global presence to deliver a well-rounded ABI platform steadily and at scale. This year’s visionaries are:

- Oracle

- ThoughtSpot

- SAP

- TIBCO Software

- Pyramid Analytics

- Sisense

- IBM

- SAS

- Tellius

Oracle

Within 12 months, Oracle has released composability features, action frameworks, and even human-like avatars to present analytics news. These innovations showcase its pioneering vision for the Oracle Analytics Cloud platform. Combining this with its end-to-end cloud offering, augmented capabilities, and comprehensive data management, some may question why Oracle does not place in the leader quadrant. Yet, Gartner suggests the vendor has lost momentum because its benefits are less clear when users invest little in its broad applications ecosystem.

ThoughtSpot

According to Gartner, clients often cite a streamlined user experience, an ability to conduct tricky analysis, and scalability to handle expansive datasets as reasons for working with ThoughtSpot. Thanks partially to these strengths, ThoughtSpot has achieved “extensive recognition as an augmented analytics platform,” – as per the market analyst. Such recognition is a significant plus for the provider, alongside its embedded product offering strategy. Nevertheless, Gartner notes its narrowing functional differentiations and the absence of a full D&A stack solution as concerns.

SAP

Gartner reveals that SAP has “significantly increased its market momentum” in the last 12 months. Its user experience optimization initiatives – which aim to improve reporting, data storytelling, and developer support – may have played a role here. Yet, the analyst also implies that the impressive data integration and connectivity within the SAP portfolio, augmented analytics, and analytics accelerators for SAP business apps may have facilitated this growth. Unfortunately, further market penetration may prove difficult, with limited adoption amongst customers outside the SAP sphere.

TIBCO Software

TIBCO Spotfire has recently enjoyed the addition of a new “actions” tool. The provider developed this to allow no-code BI functionality in workflows across cloud and legacy applications. Such functionality helps overcome the steep learning curve often associated with the platform. Gartner still pinpoints this as a chief caution for potential buyers. Nonetheless, the analyst also highlighted numerous strengths. These include its support for data scientists and citizen data scientists, prebuilt domain applications, as well as deployment flexibility and autoscaling.

Pyramid Analytics

With new spreadsheet functionalities, business modeling capabilities, and a decision modeling plug-in, 2022 proved a big year for Pyramid Analytics. It kept all these within its browser-based, no-code environment, which allows the provider to ensure accessibility for non-technical users. Gartner indicates that this is one of Pyramid Analytics’ core strengths, in addition to its foundational augmented analytics and community-building initiatives. Yet, the vendor lags in its market presence, catalog interoperability, and “user enrichment” features.

Sisense

Sisense BI platform has three pillars: Fusion Analytics, Fusion Embed, and Infusion Apps. Innovations across each come thick and fast, even with third-party services such as Alexa and NLG. Moreover, it was very quick to pounce on the ChatGPT bandwagon. Gartner commends such speed, which has enabled Sisense to quickly develop a “strong embedded offering.” The analyst also shines a positive light on its DevOps-first principles. Although, the integration of its metrics store, limited application ecosystem, and community does draw criticism.

IBM

IBM Cognos Analytics with Watson has many deployment options across private, hybrid, and public clouds, alongside multi-cloud and on-premise implementations. As such, IBM can differentiate through flexible deployment options. On top of that, its platform is comprehensive, with enterprise reporting, governed and self-service visuals, data management tooling, augmented analytics, and more embedded into a single platform. Gartner applauds this, as well as its roadmap for “applying analytics everywhere.” Although, the analyst warns its market awareness is “diminishing.”

SAS

SAS Visual Analytics is central to the vendor’s vision for a unified, comprehensive data & analytics platform. This will prepare and analyze data to inform AI models that augment the business process design experience. Gartner admires such a vision, noting that SAS is one of the few vendors to build text analytics into its core offering. The report also lists “market-leading” data visualization, automated insights, and global reach as core strengths. Yet, despite this reach, limited adoption is a caution the analyst raises – alongside its somewhat confusing pricing model.

Tellius

Tellius takes an inventive approach to business intelligence, developing “What?”, “Why?”, and “How?” interfaces to deliver insights. Users can source these through a natural language query (NLQ) search function. Such Q&A capabilities draw praise from Gartner, giving clients a simpler method of sourcing contextualized insights. The analyst also lauds the scalability and multipersona support that Tellius delivers. Although, it does highlight product gaps, especially in its storytelling capacity, with supporting infographics and connected slideshows not available on the platform.

The 2023 Analytics and Business Intelligence Platforms Magic Quadrant Niche Players

A niche player often delivers the outcomes clients anticipate across particular sectors and applications. Moreover, they sometimes fit nicely into an enterprise’s tech stack. Nevertheless, Gartner notes that they have a “limited ability” to compete with many prominent market rivals in regard to innovation and performance. This year’s niche players are:

- Zoho

- GoodData

- Incorta

Zoho

Zoho built out its ABI platform by launching a pluggable microservices architecture last year. The move enhanced the composability of the Zoho Analytics solution – and Gartner appreciates the vision behind this approach. In tandem with its broader portfolio, Zoho can also offer unified business analytics. Moreover, Gartner believes the vendor is “well-positioned” to help its clients transition from reporting to true decision intelligence. The catch is that Zoho lacks the BI-specific capabilities of rival vendors. Although, it launched 70+ product updates in 2022, which is a sign that it’s catching up.

GoodData

GoodData has gained momentum by developing an analytical architecture that decouples the analytical backend from its metric store. With this “headless vision”, its clients can consume metrics via open APIs and SDKs. Gartner commends this approach, its composability mantra, and the availability of third-party resources its clients enjoy. Nevertheless, GoodData is yet to engage a plethora of mature buyers, perhaps because – in the words of Gartner – “traditional ABI deployments are limited.” Constrained core capabilities are a significant factor here.

Incorta

Incorta prides itself on supporting clients in quickly modeling data from enterprise applications, including Oracle, Salesforce, and SAP. In doing so, it offers agile operational reporting and appeals to many low-maturity businesses. Gartner notes this while highlighting security and scalability as significant strengths, primarily because its model allows Incorta to inherit data access privileges from source applications. Yet, the analyst isolates several cautions. These include: a lack of functionality for “the augmented consumer”, competition from market leaders with similar packaging models, and low market awareness.

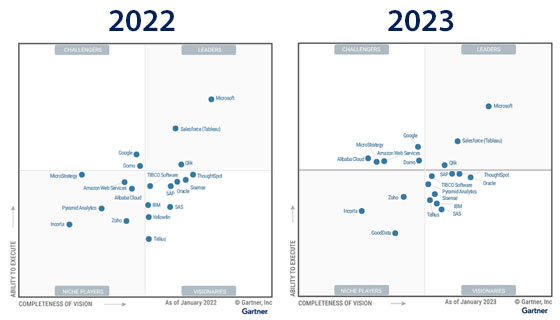

How Do the Results Compare to 2022?

Compared to the Magic Quadrant reports for other CX solutions, the 2023 analytics and business intelligence platform report has shown little change from the 2022 edition.

Microsoft has cemented its position at the market’s forefront. Meanwhile, Salesforce has solidified its status as its nearest competitor.

Qlik advanced slightly in “completeness of vision” to further compound its status as a market leader.

Meanwhile, AWS, MicroStrategy, and Alibaba Cloud advanced from niche players to challengers.

Yet, Pyramid Analytics wins the prize for the biggest gain. Last year, it sat firmly in the niche player quadrant. Now, it has raced across to the right, securing visionary status.

In good news, no vendor seemed to drop back. Nevertheless, competition for that leader quadrant is heating up, and in 2024, another name may break through.

To gain more insight from Gartner regarding analytics service providers, read our rundown of the Gartner Magic Quadrant for Data and Analytics Service Providers 2022