Data problems “plague” customer service, sales, and marketing teams – alongside other CX functions – according to Gartner.

As such, businesses aim to centralize data collection from various sources – and that’s where customer data platforms (CDPs) enter the fray.

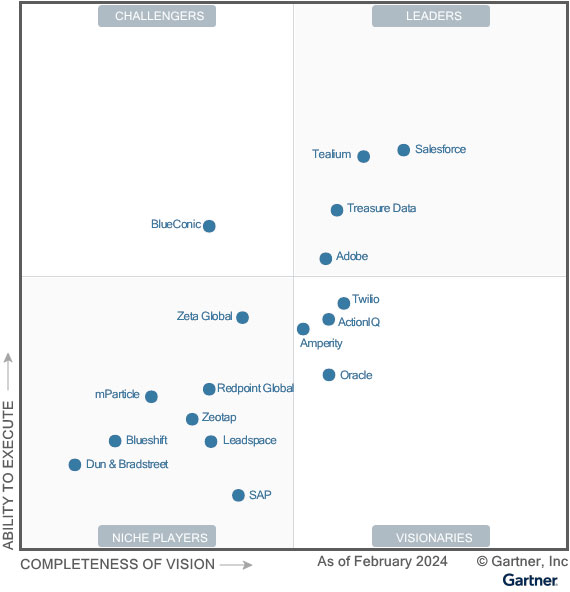

Increasingly, brands are turning to these platforms, and – as a result – Gartner has launched its first-ever CDP Magic Quadrant.

To do so, the research firm has evaluated 17 prominent CDP providers, isolating four market leaders.

The Definition of Customer Data Platforms

Customer data platforms connect with other systems to establish a unified customer database.

Such other systems include CRM, CCaaS, social media, conversational intelligence, the company website, and third-party databases – to name just a few possibilities.

Yet, beyond that, a CDP must consolidate profiles at the individual customer level and activate the data within those profiles. These are core capabilities.

Then, there are other features that Gartner notes CDPs “should” provide. Those include customer segmentation, integrations, data model management, privacy, and analytics reporting.

However, those at the forefront of the market go further. For instance, leaders may release other features from consent and preference management to data science workbenches and clean rooms.

While assessing all these capabilities, Gartner evaluated each of the 17 vendors in the Magic Quadrant on their deployment histories and vision.

In doing so, the analyst segmented each CDP provider into four groupings: Leaders, Challengers, Visionaries, and Niche Players.

Gartner Magic Quadrant Leaders

Leaders in the Magic Quadrant showcase a track record for satisfying enterprise requirements across critical CDP use cases and industries. Yet, they also go beyond the “table stakes” capabilities, embracing a longer-term view of the market demonstrated via potentially disruptive roadmaps. This year’s leaders are:

- Salesforce

- Tealium

- Treasure Data

- Adobe

Salesforce

The Salesforce Data Cloud connects the vendor’s CRM apps, including its Sales, Service, and Marketing Clouds, analyzing and activating data across the Salesforce ecosystem. Its partner network helps to pull data from many third-party solutions into that ecosystem, catering to the needs of businesses of all shapes and sizes. Gartner recognizes these strengths alongside Salesforce’s innovation cycle, citing its predictive and generative AI extensibility for engagement and activation.

Tealium

Tealium first brought a verticalized offering for Pharma to the CDP market. Since then, it has built a cross-sector, leading CDP. However, Tealium has maintained its nous in handling complex data and regulatory systems. Gartner recognizes this, lauding the vendor for identifying “specific regulatory and vertical combinations” that would benefit from a sector-specific innovation. Moreover, the analyst tips its cap to Tealium’s partner ecosystem of global collaborators and market neutrality, with 1,300 out-of-the-box connectors.

Treasure Data

While it may appear a marketing CDP, its add-ons for sales, service, and B2B demand-gen have helped Treasure Data deliver a fully-fledged, leading platform. In addition, the vendor enables cross-CRM customer profiles that connect the customer experience, allowing businesses to action various data sources for nonmarketing use cases. Gartner highlights this as a plus point, alongside its capability to track open web advertising and AI framework that enables predictive segmentation, next-best-offer, and channel recommendations.

Adobe

The Adobe Experience Platform (AEP) offers a CDP in its UI, making it easy to navigate and interoperable with other Adobe solutions – such as Adobe Target, which allows businesses to run A/B tests. There are also plenty of helpful resources and tutorials to help enterprises leverage these capabilities. That cohesive interface is a notable strength, in addition to its “multipronged” partnership strategy and full-funnel vision that combines first-, second-, and third-party data within customer profiles.

Gartner Magic Quadrant Challengers

Challengers in the Magic Quadrant have a reputation for “strong” product functionality and execution. Moreover, they stay focused on meeting client expectations. However, they may lag behind leaders in their “visionary pace” and exposure to large enterprises. This year’s challengers are:

- BlueConic

BlueConic

BlueConic prioritizes privacy, with “granular” functionality and control to determine a “customer’s legislation zone.” That supports its effort to simplify how marketing teams manage consent and preferences. Moreover, such innovation highlights the marketer-first nature of the platform – as do its predictive models, GenAI capabilities, and website personalization module. Gartner isolates these as strengths – alongside its second-party data sharing. Yet, it warns that BlueConic may not fit organizations with “more complex data infrastructure”

Gartner Magic Quadrant Visionaries

Visionaries in the Magic Quadrant embrace disruptive innovation within their recent product releases and product roadmaps – whether in identity-matching rules, highly configurable identity resolution, or something else. Nevertheless, their ability to execute trails market leaders. This year’s visionaries are:

- Twilio

- ActionIQ

- Amperity

- Oracle

Twilio

Twilio entered the CDP market with its 2020 acquisition of Segment, and while that move has come under activist investor scrutiny, Gartner lauds its roadmap vision. That includes its continued development of composable CDP capabilities and its real-time, zero-copy architecture enhancements. The analyst also commends its large partner network and use-case-based sales process. However, cautions come from its complex packaging and corporate turnover, with CEO Jeff Lawson recently falling victim to the latter.

ActionIQ

ActionIQ offers “enterprise-ready technology”, according to Gartner. Its investment in mature data warehouses and the development of modularized CDP exemplifies this. The analyst also highlights this warehouse prowess as another strength, isolating its support of real-time integrations with platforms such as Snowflake, Amazon RedShift, and Google BigQuery. Yet, despite these plus points and differentiated generative AI development, ActionIQ may prove too costly for smaller businesses and lack vertical-specific innovation.

Amperity

Amperity uses an AI and machine learning (ML) led approach to match probabilistic and deterministic data to unify customer data at scale, with a quality control layer running over the top. That is one example of its innovation, alongside its proof-of-concept approach – which gives prospective clients first-hand experience with the platform with a subset of their own data – and its advanced segmentation creation and testing tools. Nevertheless, Gartner cautions that its pricing scales may risk costs and noted that it’s unsuitable” for B2B.

Oracle

Behind the Oracle Unity Customer Data Platform is an extensible AI/ML framework within which lies 27 oven-ready customer behavior intelligence models. In addition, clients can even bring their own models to meet their unique requirements. Gartner pinpoints this as a differentiator alongside its vertical market enablement and onboarding experience. That experience includes multi-format education resources for various stakeholders. Nevertheless, the analyst cautions over its technical user dependencies and limited data warehouse integrations.

Gartner Magic Quadrant Niche Players

Niche Players in the Magic Quadrant fulfill all of the CDP’s “basic” requirements but often embrace a narrow market view. That often makes them a good fit for particular verticals or business models. Yet, few could demonstrate broader, long-term disruptive innovation. This year’s niche players are:

- Zeta Global

- Redpoint Global

- Zeotap

- mParticle

- Leadspace

- Blueshift

- SAP

- Dun & Bradstreet

Zeta Global

Zeta Global offers a solution often preferred by marketing and advertising agencies alongside multi-brand businesses. Reasons for this include the ability for agencies to set up a CDP instance for clients in addition to their own, streamlining campaign creation and management. Its unique calendaring and workflow capabilities that pave the way for greater media management are also attractive to this customer segment. However, Gartner warns its broader product strategy is “unclear” and that its presence is very much pegged to North America.

Redpoint Global

Redpoint Global’d rg3 offering combines a CDP with journey orchestration and real-time interactions in one platform. By combining these capabilities, the vendor has crafted various vertical toolkits, including templates, processes, and reports designed for the specific sector. Gartner highlights these toolkits as a strength, alongside the provider’s speed to value, data ingestion, and data unification capabilities. Yet, the analyst cautions that the solution may exert high demands on internal resources, and several features are inconsistent around the globe.

Zeotap

Zeotap puts forward a CDP that businesses can enhance with add-on modules, which range from data ingestion and unification to journey orchestration. Companies can utilize the former via an “intuitive” UI, which allows non-technical users to import, transform, and action data. Gartner recognizes this as a core strength of the platform – in addition to its flexible customer profile unification and European focus. However, the analyst warns of cost increases and a narrow go-to-market strategy, which centers on its integrations with Snowflake and the Google Cloud Platform.

mParticle

mParticle often catches the eye of technical users, with developers enjoying its quality assurance and data monitoring features, amplifying the value of IT support. Alerts for data formatting and implementation errors are an excellent example. Its journey analytics component also has significant potential, following mParticle’s 2022 acquisition of Cortex, as do its predictive capabilities. However, Gartner suggests its new consumption-based pricing model may make it difficult for buyers to monitor costs. Non-technical users may also worry that many features require developer expertise.

Leadspace

Leadspace provides 80 out-of-the-box target personas to support B2B sales-driven use cases. It also offers capabilities that allow teams to define and target buyers to bolster their revenue pipeline – which helps the vendor attract sales-focused buyers. Gartner highlights this as a strength alongside its opportunity-based segments and account-to-lead verification. Yet, the analyst isolates its services-dependent model and customer onboarding programs, which end-users have indicated their dissatisfaction with.

Blueshift

According to Gartner, Blueshift delivers “strong” features for retail and media marketers. The analyst cites its Recommendation Studio, which personalizes recommendations based on a product catalog, as an example. Other plus points for the Blueshift platform include its marketing channel focus and ease of use, with the vendor pumping funds into simplifying the user experience and offering a self-guided demo experience. Unfortunately, Gartner labels its product strategy as “unclear” and calls the depth of its product roadmap into question.

SAP

SAP is a recent market entrant and puts forward a CDP that integrates tightly with its ERP applications to drive “incremental value.” The solution also connects with Gigya, the customer identity and access management (CIAM) that SAP acquired in 2017. A robust partner network supports the platform, and Gartner recognizes that the vendor has one of the deepest certification programs in the industry. Nonetheless, SAP “remains behind” other vendors in its innovation, as per the report, due to its limited time in the space.

Dun & Bradstreet

Dun & Bradstreet wins a lot of business in the B2B space, largely thanks to features like its account-level aggregation, which totals more than 500 million unique account records. Its account scoring and activation features also work well for the B2B market, and Gartner notes it has the shortest implementation time of all vendors included in the research. Yet, the analyst acknowledges Dun & Bradstreet’s low market momentum and visibility, alongside its dependency on add-ons for marketing activation.

Unpack our other CX-related Magic Quadrant report coverage by reading the rundowns below:

- Gartner Magic Quadrant for the CRM Customer Engagement Center 2023

- Gartner Magic Quadrant for Contact Center as a Service (CCaaS) 2023

- Gartner Magic Quadrant for Voice of the Customer (VoC) Platforms 2024