CX has become a defining factor in business success, yet implementing effective CX solutions remains slow, expensive, and complex for many organizations.

Traditional approaches to CX delivery often require extensive customization, long proof-of-concept (PoC) phases, and heavy IT involvement, all of which create roadblocks for companies aiming to provide seamless customer engagement.

Enter the ‘SequenceShift Experience’ shorthand for the SequenceShift customer-first delivery model.

What Is the SequenceShift Experience?

This ‘SequenceShift Experience’ represents a fundamental shift in how businesses approach PCI compliance within Amazon Connect, combining “self-service efficiency, responsive support, and frictionless integration.” explained Dmitri Muntean, Managing Director, at SequenceShift.

Designed for organizations that need fast, secure payment processing without the traditional hurdles of lengthy onboarding and costly proof-of-concept trials, SequenceShift delivers an “experience that is streamlined, scalable, and built for rapid adoption.”

At its core, SequenceShift stands for simplicity, speed, and autonomy, allowing customers to set up and manage their own PCI-compliant payment solutions without requiring extensive interaction with sales or technical support teams.

Unlike many competitors in the payment security industry, which rely on complex presales consultations, engineering calls, and expensive onboarding processes.

“SequenceShift enables businesses to self-serve through the AWS Marketplace, where they can create an account, configure their solution, and deploy it without a single phone call or email exchange,” added Muntean.

The ability to run proof-of-concept tests quickly and at no cost means organizations can assess “functionality, fit, and security compliance without financial risk.”

Free PoC Acts as a Key Differentiator

Muntean picked up on this, explaining “Having a free proof of concept is just unheard of in this market and specifically across all of our competitors, there’s no such thing as free proof of concept.”

“Traditionally, you talk to pre-sales you agree what you’d like and then you pay, wait six weeks – with us it’s just 32 minutes.”

Prospective customers can instead access the service through Marketplace, sign up, create account, organise the PoC, and explore if the solution meets requirements.

This coupled with the pay-as-you-go feature, equally as rare in the market, gives customers a different solution that meets growing and changing dynamics within its own operations.

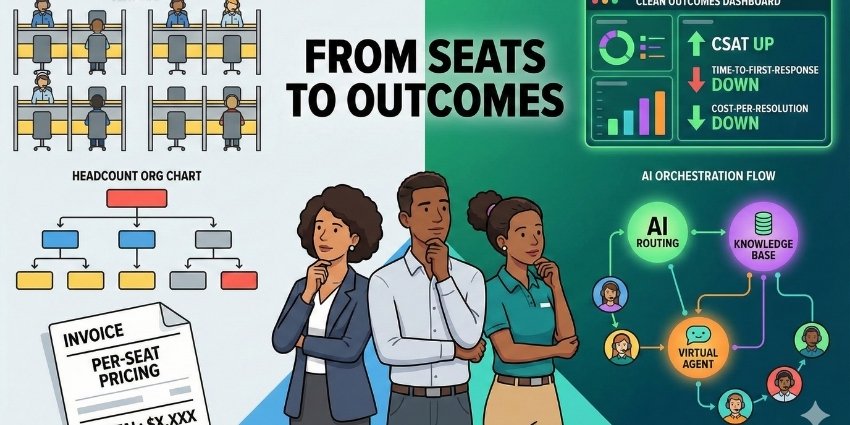

Tangible Outcomes at the Core of SequenceShift’s Direction

While policy decisions can act as a differentiator, there are tangible outcomes for customers.

SequenceShift delivers multiple benefits that enhance operational efficiency and customer satisfaction, but three are worth particular note.

Reduced Time-to-Value

One of the biggest advantages of SequenceShift’s approach is its ability to dramatically cut implementation timelines.

With self-managed setup, customers can configure their solution without waiting weeks for pre-sales consultations, engineering reviews, or custom integrations.

This swift activation ensures businesses achieve compliance and operational functionality almost immediately, allowing them to process secure payments faster and with minimal disruption.

Lower Setup Costs

As mentioned, the free proof-of-concept phase ensures companies can evaluate the platform before committing financially, while the self-serve setup eliminates costly professional services and complex onboarding.

As a result, organizations can maintain financial flexibility while meeting security standards without excessive investment.

Seamless User Adoption

SequenceShift’s “intuitive, self-service model ensures users can onboard without friction.”

Describing anecdotally, whether it’s an engineering team configuring compliance settings, a contact center processing transaction, or a finance team reviewing payment security policies, “the system is designed for effortless adoption,” added Muntean.

Chef Works Needed PCI Compliant Payment Solution

Take Chef Works for example, part of their contact center transformation project required the need to find a PCI Compliant payment solution with operational improvements and global scalability.

Key challenges included previous licensing model limitations.

The limited number of customer service reps who could process payments slowed efficiency.

Chef Works selected SequenceShift’s cost-efficient payment solution to meet their needs during the migration to Amazon Connect.

CX Today heard, the quick PoC enabled an “efficient evaluation,” and SequenceShift collaborated closely with Chef Works to integrate the system into their ERP and new phone platforms, streamlining payment processing in U.S. and Canadian contact centers while laying the foundation for future scalability.

The result – the elimination of per-agent licensing cost modal, a quick PoC and seamless integration with Amazon Connect.

This approach change to CX helps builds to the larger narrative that CX success does not start with tech alone – it starts with how it is delivered.

Subsequently, it highlights how the SequenceShift model offers a new benchmark for the industry, and particular attention will be paid to see how other vendors react and adapt to this approach.

The ‘SequenceShift Experience’ is not a buzzword – it’s a fundamental reason customers choose to partner and stay with SequenceShift.

You can find out more about the ‘SequenceShift Experience’ and the company’s full suite of customer service and experience products by visiting the website today.