Decision-makers often leverage the Gartner Peer Insights platform to scour verified reviews of enterprise technology.

Across an 18-month period, ending in November 2023, the platform published 1,444 reviews of CCaaS solution providers.

Those reviews contain answers to a standard set of questions, which customers score on a scale from one to five.

Hoisting this insight, Gartner developed a “voice of the customer” study, highlighting how the top 11 most reviewed vendors match up.

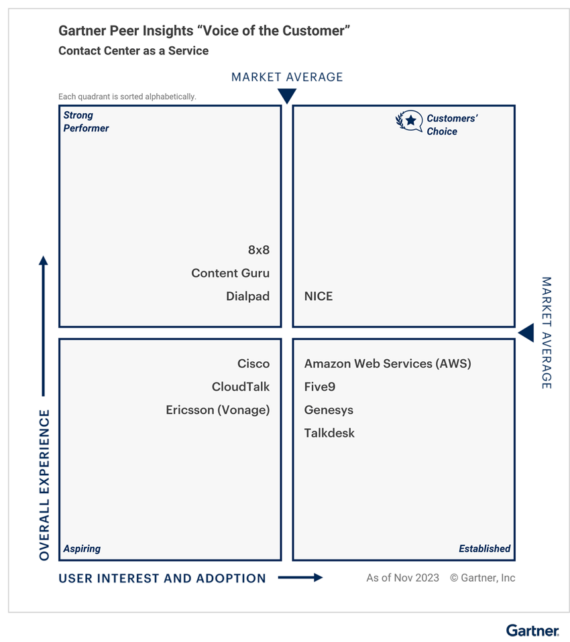

Most notably, the research firm presents the following matrix, which groups vendors into four cohorts: Customers’ Choice, Strong Performer, Established, and Aspiring.

Yet, the report also offers many more insights into each vendor. Here is an overview of some of those insights – alongside a direct comparison with last year’s report.

Headline Takeaways

NICE is this year’s only global “Customers’ Choice” CCaaS vendor.

Last year, Gartner also included AWS and Talkdesk as Customer Choice Vendors. However, they dropped into the “Established” Category this time around.

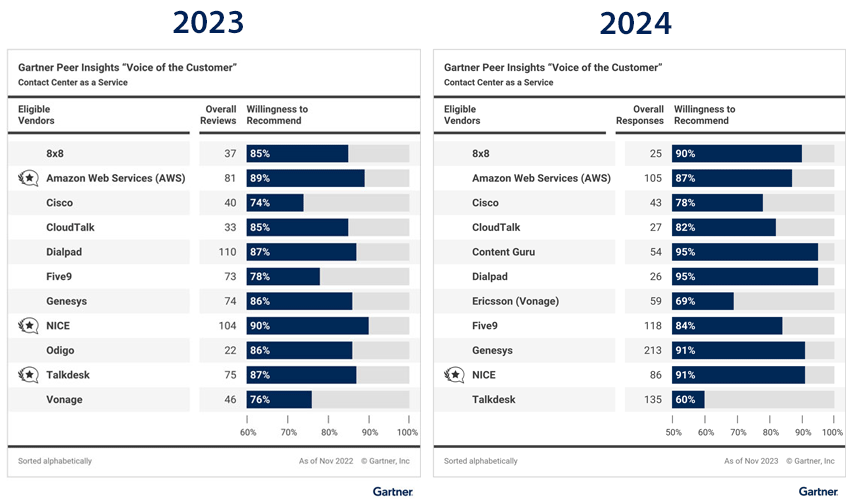

That fall comes as the percentage of customers willing to recommend both providers slipped – as evident in the 2023 vs. 2024 comparison below.

In the case of AWS, it fell by two percent. Yet, much more worryingly, Talkdesk plummeted by 27 percent – with only three in every five customers willing to recommend the vendor.

On a more positive note, 8×8, Five9, and Genesys enjoyed a big jump in this metric.

Yet, Dialpad achieved the biggest uplift, with 95 percent of customers now willing to recommend the provider. That places them at the top of the chart, alongside Content Guru.

As that statistic also suggests, Content Guru made a big impact on its first appearance in the report, replacing Odigo on the top 11 most reviewed CCaaS providers list.

In addition, the vendor impressed in the other pockets of the study, which share how the CCaaS providers performed across various market segments and geographies.

For example, it joined NICE in the Customers’ Choice quadrant for the midsize enterprise (50M – 1B USD) specific section of the study.

The matrix for this particular segment – alongside several others – is available within Gartner’s report.

Insights Into Each of the 11 Vendors

The vendor-specific section below spotlights additional, thought-provoking insights from the Gartner Peer Insights “Voice of the Customer” study.

8×8

68 percent of customers give 8×8 a five-star overall review for CCaaS. They also spoke highly of the sales and deployment experiences, which – on average – scored a 4.8 out of five.

The report also underlines 8×8’s prowess in the midmarket space, with 88 percent of reviews coming from businesses with a market valuation of between $50MN and $1BN.

8×8 seems to have bolstered its presence in APAC, too. Yet, with no reviews from LATAM, service leaders within that geography should read these findings with caution.

Amazon Web Services (AWS)

AWS performs well within the report despite losing its Customers’ Choice status. Indeed, 94 percent of its customers give the vendor a four- or five-star review.

AWS also demonstrates a broad base of customers across various industries, geographies, and business sizes, with 16 percent of reviews coming from large enterprises worth more than $10BN.

Such large enterprises have more complex requirements. Yet, AWS still scores 4.5 out of five for its support experience and 4.4 for its deployment experience.

Cisco

The report reflects the significant strides Cisco has taken within the CCaaS space over the past 12 months, with 95 percent of customers giving the Webex Contact Center a four- or five-star review.

Moreover, 78 percent now say they would recommend the vendor, four percent more than the figure from the previous report.

The vendor has also achieved an uptick in its ratings across categories, including product capabilities, sales experience, and deployment experience. Although, the latter is below the report’s mean figure.

CloudTalk

CloudTalk has developed a robust enterprise presence in APAC, with 22 percent of its reviewing customers coming from enterprises worth more than $10BN.

The vendor likely attracts these clients with its product capabilities and sales experience, for which it scores 4.5 out of five. Yet, it ranks joint last, with Ericsson and Talkdesk, for deployment experience.

Alongside APAC, it has a limited presence in North America and EMEA. However, like 8×8, none of its reviews come from LATAM.

Content Guru

80 percent of Content Guru customers give the vendor a five-star rating, the highest percentage of all the vendors in Gartner’s report. It also tops the table – alongside Dialpad – in its customers’ willingness to recommend.

Meanwhile, Content Guru earns the “Customers’ Choice” status for midmarket CCaaS and across the EMEA region segment.

Last year, Content Guru did not qualify for the report. Yet, this year, it received more reviews than Cisco, CloudTalk, Dialpad, and Ericsson, underlining its market momentum.

Dialpad

95 percent of Dialpad customers would recommend the business, and 73 percent gave the vendor a five-star review.

Moreover, with 35 percent of reviewing customers in transportation and 23 percent in healthcare, the vendor appears to be enjoying success in targeting significant market segments.

However, Dialpad received a quarter of the reviews it did 18 months ago, which may present a cause for concern and somewhat skew any comparisons with its performance in previous reports.

Ericsson (Vonage)

Over half of Vonage customers give the vendor a four-star rating, receiving 4.3 out of 5 scores for its support and sales experience.

Moreover, three-quarters of those customers are EMEA-based, while 25 percent are in North America. That reflects its more limited APAC and LATAM CCaaS customer base.

Yet, maybe more worryingly, Vonage ranked second-bottom in its customers’ willingness to recommend the vendor’s software and services.

Five9

53 percent of Five9 customers give the vendor a five-star rating, with a blend of large enterprise and midmarket clients across all geographies.

They also spread across many industries, with numerous reviews from healthcare, finance, manufacturing, and other sectors.

Five9 rates particularly well across the product capabilities and support experience categories, with scores of 4.5 and 4.6, respectively.

Genesys

91 percent of customers are willing to recommend Genesys, while 96 percent would give the vendor a four- or five-star rating.

Also, while Gartner did not give Genesys “Customers’ Choice” status overall, it did receive the accolade in the APAC and EMEA regions.

Lastly, the provider performed well in the product capabilities and deployment experience categories, scoring 4.5 and 4.6, respectively.

NICE

70 percent of customers give NICE a five-star rating. In addition, 91 percent are willing to recommend the vendor.

NICE also rates highly its for product capabilities, sales experience, and deployment experience – receiving scores of 4.8, 4.7, and 4.7, respectively.

Thanks to these scores and its global presence, NICE is the only overall “Customers’ Choice” CCaaS provider within the report.

Talkdesk

Talkdesk demonstrates a broad global reach across all major regions and maintains a deep customer base across various sectors.

Last year, the vendor earned Customers’ Choice status in the report. Yet, its performance – across the board – has dropped significantly within the report.

Most worryingly, its customers’ willingness to recommend the vendor has fallen from 87 to 60 percent. As such, it ranks last for this metric – while it placed joint third just 12 months ago.

To gather further insights from Gartner into the cloud contact center space, check out our rundown of its Magic Quadrant for CCaaS 2023.