CPaaS solutions have surged in recent years, increasing the ease of integrating digital channels and customer-facing systems.

In doing so, CPaaS providers strive to democratize customer communication channels – including voice, video, and messaging apps – via programmable APIs and pay-as-you-go pricing.

Such ease of implementation and use initially made CPaaS more attractive to agile disruptors than traditional market stalwarts.

However, tech ecosystems are evolving and attracting many larger businesses looking to pivot quickly and embrace digital channels at speed.

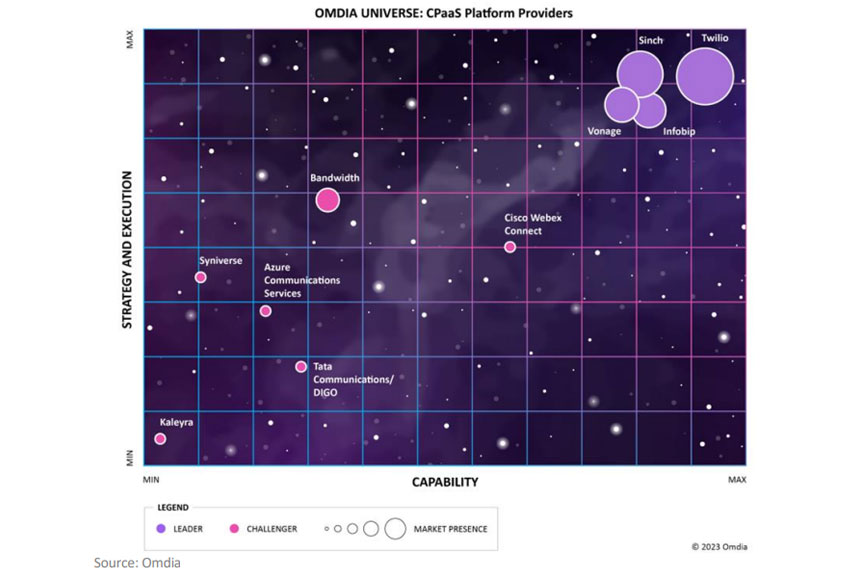

Recognizing this growing trend, Omdia – an enterprise technology research and advisory group – decided to assess ten leading CPaaS vendors. Here is what they found.

The Market Definition of CPaaS

CPaaS is a technology and services suite of APIs, SDKs, and cloud solutions that allows companies to insert communication tools within customer-facing applications.

Diving deeper, Omdia stresses that vendors must also offer phone numbers, cloud-based access to communications networks, and pay-as-you-go contract-free pricing to qualify as a CPaaS vendor.

That said, each of the four leading providers within the study offers additional capabilities, including security and authentication features, in addition to pre-packed enterprise communications and data platforms. Examples include CCaaS, UCaaS, and/or CDP systems.

By assessing and breaking down these core and advanced capabilities – alongside each vendor’s go-to-market, pricing, and execution strategy – the Omdia Universe report separates ten CPaaS providers into leaders and challengers.

Leaders

Leaders in the Omdia CPaaS Universe demonstrate a transparent vision for how their solutions can support forward-thinking customer experience strategies across various applications and verticals. They also back their strategies up with all the necessary elements that support a “fully-realized CPaaS offering.” This year’s leaders are:

- Twilio

- Sinch

- Infobip

- Vonage

Twilio

Twilio continually pushes the boundaries of what it means to be a CPaaS player, according to Omdia. Moreover, it significantly democratized and enhanced enterprise access to SMS and voice service. From there, it has built a comprehensive CPaaS stack, laying the foundations for its customer engagement, CCaaS platforms, and a rich developer ecosystem. Now, it’s “forging ahead” with generative AI (GenAI) integration across its portfolio, helping customer experience teams transition from customization to AI-enabled hyper-personalization strategies.

Sinch

From its beginnings as a global SMS aggregator, Sinch has developed its Customer Communications Cloud – a deep CPaaS stack built via lots of M&A activity and internal development. The Cloud comprises three core products: a Super Network for voice, a Developer API platform, and Sinch Applications for customer engagement. These Sinch Applications have swollen in recent years to include CCaaS, UCaaS, conversational AI, and digital channels. That depth and structure allow Sinch to meet diverse customer requirements across developer- to solution-orientated businesses.

Infobip

Like Sinch, Infobip started as an SMS aggregator and connectivity services provider, growing its global data centers and direct operator connections at a rapid pace. Yet, 17 years later, the vendor can offer a complete CPaaS stack, with AI built into many use cases. With high-profile customers – including Vodaphone, Uber, and UNICEF – continuously innovates to improve its platform, API, and SDK capabilities before propagating them across its portfolio. In doing so, it has built a solutions-orientated go-to-market that often appeals to businesses light on developers.

Vonage

Vonage is a prominent CCaaS, UCaaS, and conversational commerce provider, and it leverages CPaaS to support the development of customer engagement capabilities across each platform. The vendor supports these activities with widespread developer and partner ecosystems – which feature over 700 ISVs and systems integrators. Like Twilio, it is also ahead of the game in augmenting GenAI across its CPaaS stack. Meanwhile, Vonage also benefits from its verticalization strategy, AI studio, and how it links APIs with Ericsson’s 5G network.

Challengers

Challengers in the Omdia CPaaS Universe offer all of the fundamental capabilities expected of a CPaaS provider and can demonstrate a track record of successful implementations for specific use cases. However, they may fall behind leaders in terms of the depth of their portfolios, professional services, or technical support. This year’s challengers are:

- Cisco

- Bandwidth

- Microsoft Azure Communications Services

- Tata Communications

- Syniverse

- Kaleyra

Cisco

Cisco moved into the CPaaS space with its 2021 acquisition of IMImobile, renaming the platform as “Webex Connect”. It now sits beside the Webex CCaaS and UCaaS platforms as part of a customer engagement and collaborations suite. Omdia notes that the “comprehensive” suite offers AI, experience management and orchestration, omnichannel, and customization features. A customer favorite is its visual builder that allows businesses to define new conversation, eCommerce, and campaign marketing use cases.

Bandwidth

Bandwidth offers less depth than its CPaaS competitors. However, this is a strategic decision, as it prioritizes interoperability and integrations with prominent UCaaS, CCaaS, and AI platforms. In doing so, Bandwidth allows developers to build unique customer engagement capabilities that cross their cornerstone communications platforms. Alongside this, Omdia labels Bandwidth’s core communications network as “robust” – which includes voice, messaging, 911-access, and additional communication-focused APIs.

Microsoft Azure Communications Services (ACS)

Microsoft ACS provides many APIs and SDKs for multichannel customer communication across websites, mobile platforms, and customer applications. These range from voice, video, and chat to call recording and screen sharing. ACS powers Microsoft Teams, Dynamics 365 for Customer Service, and Skype. Yet, developers can also leverage the platform to build enterprise-grade applications that communicate via Azure APIs – including Graph, Microsoft’s RESTful web API.

Tata Communications

Tata Communications’ DIGO platform encompasses customer communication solutions with device-agnostic modules. These solutions include omnichannel engagement tools, a no-code visual design solution, a chatbot, a CCaaS platform, and a video commerce offering. Omdia hones in on its AI and engagement capabilities, labeling them “impressive”. Other standout tools include its number masking, pre-built CRM connectors, and multistep voice/SMS marketing programs.

Syniverse

Syniverse has established itself by delivering SMS, voice, and mobile data connectivity services to enterprises and telcos. Yet, its CPaaS journey began with the 2021 release of the Syniverse Concierge Platform, which houses its communications network, voice, and messaging APIs. That’s alongside its analytics, reporting, integrations, and “premium” support services. The platform targets large enterprises with several Fortune 2000 companies leveraging Syniverse for CPaaS.

Kaleyra

Since Omdia conducted its research, Tata Communications has acquired Kaleyra. In doing so, Tata will roll up numerous digital channel capabilities, including instant messaging, push notifications, and RCS – alongside chatbots. Yet, its primary offering is a multichannel programmable communications platform that connects customer-facing applications with mobile network operators via a no-code visual interface and APIs.

The Future of the CPaaS Space

Reports like the Omdia Universe present a beneficial overview of the CPaaS space, yet the study has a few significant absentees, including AWS, Tanla Platforms, and MessageBird.

Indeed, the latter has even been linked with a move for Twilio.

Nonetheless, if these vendors participate in future editions, it will paint a clearer picture of a market increasingly coming to the fore as companies transition from siloed communication systems.

As time passes, expect these CPaaS stacks to swell and include many more APIs for 5G-enabled communications APIs, E-SIMs, and IoT-packaged offerings.

Alongside all this, additional connectivity services, enterprise platform integrations, and service orchestration capabilities may also come.

Eager for more insights into the CPaaS market? If so, check out our rundown of the Gartner Magic Quadrant for CPaaS 2023