Bird has announced an “AI-first” CRM for “marketing, sales, service, and payments”.

The move signals an overhaul of its core platform, which dropped off the latest Gartner Magic Quadrant for CPaaS due to this strategy shift.

That news foreshadowed this launch, which Robert Vis, CEO of Bird (formerly MessageBird), revealed is the culmination of 3.5 years of strategizing.

“This is more than a redesign; it’s a complete re-architecture,” he wrote on LinkedIn.

“[The CRM is] built from the ground up with separate components, ensuring seamless compatibility with third-party applications.

Whether you use us as your standalone CRM or integrate us with your existing software, we’re here to supercharge your capabilities!

A customer data platform (CDP) is the spider’s head within that standalone platform.

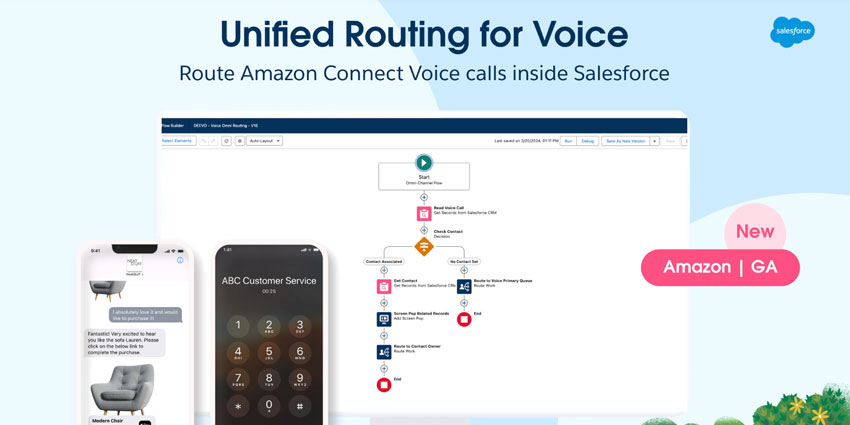

Meanwhile, its voice and various digital communication APIs are the legs, sending conversational insights up to the brain, which organizes cross-functional, first- and third-party data.

Yet, businesses may also blend those APIs with AI to design new customer contact strategies that – according to the CEO – will allow brands to communicate in the “best and most efficient way.”

“It’s your one-stop-shop, the 360 solution, the end-all-be-all,” concluded Vis.

The Possibilities Are “Limitless” But “Not Groundbreaking”

Building on Vis’s one-stop-shop comments, Tim Kroggel, VP of Sales at Bird, said:

The possibilities our customers gain from partnering with a vertically and horizontally integrated communication stack are limitless.

“Brands can seamlessly integrate via an API to enhance their existing stack, or they can opt to completely replace their Martech (e.g., Braze, Attentive, Klaviyo, Salesforce), Sales (e.g., Aircall, Dialpad, Talkdesk), or Customer Service (e.g., Zendesk, Front, Freshworks) stack with our solution and cut out the middleman.”

In making this move, Bird aims to differentiate its platform and shift further from the CPaaS market, which is becoming increasingly crowded.

Recognizing this, Rob Kurver, Founding Partner of the CPaaS Acceleration Alliance, believes that it’s “great” that Bird is exploring new opportunities to exploit the value of its broad CPaaS portfolio.

However, he pinpoints an overlap in its strategy with CM.com and questions whether the solution really is the “end-all-be-all”.

“Robert’s vision of transitioning from messaging to CDP and payments reminds me of CM.com, which has been excelling in this area for years,” Kurver noted.

While it could be a solid strategy (did you catch CM’s impressive numbers last week?), it’s not exactly groundbreaking.

Nevertheless, Bird may still claim to break ground with its pricing, as Vis promises that the CRM will deliver big savings compared to rival CX offerings.

Bird CEO: A 90 Percent Discount on Sinch, Twilio, & Zendesk

In closing off his post announcing the CRM, Vis made quite the claim:

Don’t spend too much money and enjoy our up to 90 percent discount to Twilio, Klaviyo, Zendesk, and Sinch.

While this statement may catch the eye, each CX vendor has divergent offerings. Indeed, Zendesk is the only company on that list that claims to be a CRM provider.

Meanwhile, only Klaviyo and Twilio combine their own CPaaS and CDP offerings.

Kurver also voiced his confusion. He said: “The mention of a 90 percent savings is puzzling; are they focusing on adding value or being the most cost-effective?”

However, Vis has a reputation for making such headline-grabbing statements.

In February, he stoked rumors that Bird could make an audacious bid to require Twilio, posting on LinkedIn: “Should I buy Twilio and take it private?”

Yet, that was never likely going to happen, with Twilio dwarfing Bird despite its financial struggles.

So, will Vis follow through and deliver that 90 percent discount? Also, which products from these rival vendors does he match Bird’s CRM up against?

CX Today has contacted Bird to find out but hasn’t received an immediate response.