To suggest that CPaaS is a growing market would be something of an understatement.

According to Gartner, by 2028, 90% of global enterprises will utilize CPaaS for customer experience and engagement, up from 50% in 2023.

While the sheer number of communications channels currently available would have been unfathomable even a decade ago, now they are commonplace.

Moreover, given the explosion of generative AI (GenAI) within the customer service and experience space, these channels are likely to continue to mutate and become even more sophisticated.

If companies want to use this multitude of channels to maximize the potential of their CX offerings, a CPaaS platform is a non-negotiable.

Unfortunately, the growing importance of CPaaS has led to a crowded market – complicating the process for buyers to identify and choose the best solution for their business.

That’s where Gartner steps in.

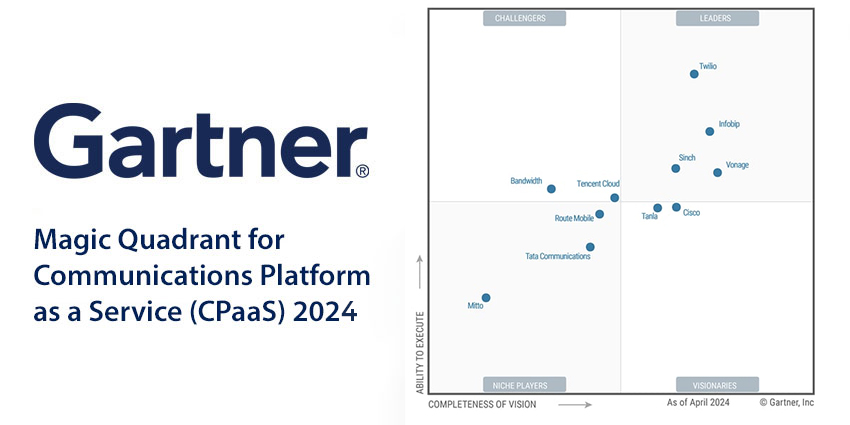

By analyzing and evaluating the credentials of the leading CPaaS providers in the sector, Gartner has whittled it down to the following 11 vendors.

The Definition of Communications Platform as a Service (CPaaS)

A CPaaS is a cloud-based solution that enables developers, IT teams, and nontechnical business roles to create various communications features using APIs, SDKs, documentation, and no-code/low-code builders.

For Gartner, the role of a CPaaS is to help enterprises enhance their communication workflows by offering easy access to various communication features and channels.

These channels are paramount to Gartner’s Magic Quadrant criteria, which is evident in some of its standard capabilities. These include APIs to:

- Make and receive voice calls

- Contact and are contactable via SMS and email

- Capacity to perform local and global direct inward dialing (DIDs)

- Identity confirmation such as 2FA/MFA and flash calling

The use of rich communication messaging platforms such as Apple Messages for Business, RCS, Google Business Messages, MMS, WhatsApp, and WeChat, is also expected.

In addition, Gartner considers the level of customer service and support for CPaaS capabilities when considering a company’s credentials.

While the above are examples of standard capabilities, optional capabilities include conversational bots; and APIs for voice, network, messaging channels, programmable video, and programmable wireless.

This is just a snapshot of the multitude of capabilities that Gartner evaluates before categorizing the 11 CPaaS providers into the following four groups: Leaders, Challengers, Visionaries, and Niche Players.

Here’s how each performed:

Gartner Magic Quadrant Leaders

Gartner considers its Magic Quadrant leaders to be the companies that possess the most influence over the market’s direction. In order to achieve this status, these organizations must showcase a clear vision for CPaaS deployment and be able to effectively execute this vision through their organizational capabilities, business model, and platform. This year’s Leaders are:

- Twilio

- Infobip

- Vonage

- Sinch

These are the same four companies that were named Leaders in the 2023 CPaaS Magic Quadrant. However, while Infobip, Vonage, and Sinch have returned similar results, Twilio has made a notable improvement in its ability to execute.

Twilio

As something of a CPaaS pioneer, Twilio continues to be one of the most substantial vendors in the sector. Gartner believes that the company is ideally situated for global enterprises looking to expand their operations, due to its “extensive” carrier network and “highly scalable” platform. Gartner also praised the company’s use of predictive and generative AI (GenAI) in its Segment CDP. This solution allows users to enhance targeting, boost campaign accuracy, and deliver superior business outcomes.

Infobip

With a varied suite of CPaaS capabilities, Gartner highlighted Infobip’s CPaaS X platform for its ability to simplify the integration process by assisting with onboarding and compliance. The emphasis on accessibility is also prevalent in the company’s solution-oriented go-to-market strategy, which uses its own and partners’ professional services to make CPaaS easier to use for customers who find developer-focused initiatives challenging. Infobip’s global reach and responsive support were also listed as major strengths.

Vonage

Vonage’s cross platform integration of AI is one of its strongest attributes, according to Gartner. The widespread deployment of this tech allows the company to expand its Network API offerings, and continuously enhance its anti-fraud capabilities and security measures. Vonage’s “strong” customer support and regional technical teams that consist of product generalists, specialists, and support engineers were also highlighted. In addition, the organization’s vertical focus across products, services, and sales was commended.

Sinch

First and foremost, Sinch boasts extensive CPaaS channel coverage, including emerging channels like RCS/RBM, regional channels like WeChat and Kakao, and advanced channels such as video, which Gartner claims is “rivaled by few other vendors.” Moreover, the company’s widespread geographic presence and diverse go-to-market model – which includes numerous direct offices and various partner types across major regions – enables Sinch to meet customers’ needs globally.

Gartner Magic Quadrant Challengers

Gartner’s Challengers are credible and established, consistently meet customer expectations, and possess strong technological capabilities. However, they are prevented from achieving Leader status through a combination of technology gaps, limited geographic reach, or a narrower range of supported use cases.

As with the Leaders, this year’s Challengers remained the same as last year:

- Tencent Cloud

- Bandwidth

Tencent Cloud

Described by Gartner as offering a “one-stop shop” for audio and video, these two capabilities feature heavily in Tencent Cloud’s CPaaS offerings. Not only can these features be scaled to support applications in gaming, meetings, education, and social media, but they have the ability to continue serving millions of userscan even under high packet loss conditions. Yet, despite these impressive innovations, the company has struggled to make an impact outside the APAC region. Users have also pointed to shortcomings concerning integration with third-party tools.

Bandwidth

As one of the few major CPaaS providers that owns its infrastructure, Bandwidth is a popular option for CCaaS and UCaaS vendors and messaging systems, due to its open, vendor-agnostic integration platform. Gartner also highlighted Bandwidth’s expanded presence in the enterprise sector – praising the company’s network resilience, SMS/MMS services, Maestro, and AI capabilities. The company’s major Achilles heel, however, is its overreliance on voice and lack of advanced features such as video and payment solutions.

Gartner Magic Quadrant Visionaries

Gartner views Visionaries as those that excel in delivering innovative CPaaS capabilities and tailored experiences, such as industry-specific solutions and e-commerce services. While they often represent emerging trends in the CPaaS market, they may also face challenges related to brand recognition, supporting large-scale customers, and market reach.

In the first significant shift from the 2023 Magic Quadrant, the number of Visionaries has dropped from four to two, with only the below companies able to maintain their status:

- Cisco

- Tanla

Cisco

Cisco’s go-to-market strategy primarily involves enhancing enterprise operational efficiency through automated communication workflows across digital channels. It achieves this through a number of CPaaS capabilities, with Gartner specifically outlining its visual flow builder, which enables non-developers to utilize communication channels to enhance operational efficiency. Yet, while Webex Connect (Cisco’s CPaaS arm) remains competitive in the market, Gartner believes that it is underachieving due to Cisco not fully leveraging its strengths in brand reputation, financial stability, global presence, and partner network.

Tanla

With an enviable suite of CPaaS features that includes basic and advanced messaging, conversational commerce, marketing automation, and chatbots, one of the capabilities that most impressed Gartner was Tanla’s anti-spam, anti-scam, and compliance products. Customers also praised the company for its agile product development, user-friendly interface, and robust privacy and security features. Unfortunately, Tanla still trails some of its contemporaries when it comes to SI and professional service partners.

Gartner Magic Quadrant Niche Players

Niche Players provide specific CPaaS features that appeal to certain users, yet their solutions may be limited in some aspects, such as proven financial success, brand awareness, and the capacity to support large-enterprise requirements.

The Niche section features the first newcomer to the 2024 Magic Quadrant, with the following companies making the cut:

- Route Mobile

- Tata Communications

- Mitto

Route Mobile

Route Mobile emphasizes a unified platform for analytics, communications, and interactions, tailored primarily for large enterprises in brand and customer management. Gartner commended the company for maintaining robust services in India and supporting African markets, stating that Route distinguished itself with tailored solutions and direct sales and support. However, the organization does have AI and roadmap shortcomings. While it covers most basic use cases, it lacks in-depth vertical and horizontal applications related to GenAI

Tata Communications

The newbie on the list entered the sector following the acquisition of Italian CPaaS provider Kaleyra in October 2023, and now offers capabilities that include SMS, WhatsApp, RCS, voice, chatbots, video, and 10DLC. The company’s operator experience also allows it to excel in security features, voice services, and network APIs, says Gartner. Where the organization struggles to keep pace with its rivals is the limitations of its communications channel strategy, which does not include the likes of Apple Messages for Business, Facebook Messenger, WeChat, and Telegram.

Mitto

Mitto’s CPaaS capabilities include Campaigns and Conversations APIs that support both custom-built and low-code/templated formats for transactional, marketing, and conversational use cases. The company’s value proposition also attracts businesses that require volume with global demand. Yet despite these features, Gartner claims that the company continues to lag behind its peers in adapting to the growing demand for advanced features such as CDPs and contact centers, as well as suffering from low visibility.

Delve deep into some of our other rundowns of Magic Quadrant reports below:

- Gartner Magic Quadrant for Voice of the Customer (VoC) Platforms 2024

- Gartner Magic Quadrant for Analytics and Business Intelligence (ABI) Platforms 2024

- Gartner Magic Quadrant for Content Marketing Platforms 2024

- Gartner Magic Quadrant for Digital Experience Platforms (DXPs) 2024

- Gartner Magic Quadrant for Customer Data Platforms 2024