Gartner predicts that B2B sales organizations leveraging GenAI-embedded sales technologies will – over the next two years – cut the amount of time they spend prospecting and prepping for customer meetings by more than half.

Given such statistics and use cases, embedding GenAI into their offerings is a critical objective for Sales Force Automation (SFA) Platform providers.

Yet, they must also be wary of several other trends, including the rise of natural-language-based interfaces, an increased focus on centralizing data, and the development of predictive AI.

That’s just for starters. Indeed, there are many more emerging elements of an SFA Platform. To get to grips with these, let’s first define the technology.

The Definition of a Sales Force Automation (SFA) Platform

At CX Today, we define a Sales Force Automation (SFA) Platform as an offering that comprises solutions to assist and automate sales tasks, admin, and workflows.

Typically, these include solutions to engage with customers, analytics modules, pipeline & forecast management features, and guided selling tools.

However, Gartner picks several more features it now considers “standard”. For instance, it highlights how many offer tools for end-users to collaborate with sales teams and share experiences.

Other capabilities “standard” capabilities include voice-activated assistants, partner relationship management, composability, and a proposal and quote builder.

Yet, some vendors may also offer more differentiative features. Some examples Gartner gives here include revenue intelligence and enablement, digital sales rooms, and sales engagement.

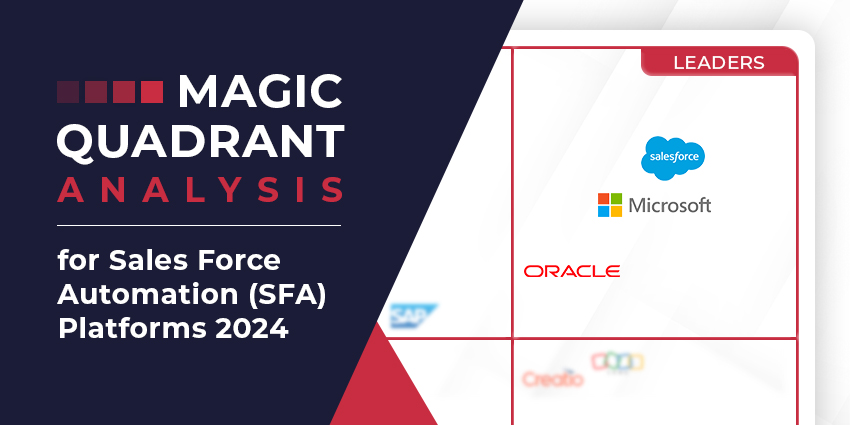

After diving deeper into these, Gartner divided 13 prominent SFA vendors into four groups: Leaders, Challenges, Visionaries, and Niche Players. Here’s how they performed.

Gartner Magic Quadrant Leaders

Leaders in the Magic Quadrant showcase – via business results – a worldwide, cross-sector ability to execute on an innovative vision for SFA Platforms. Moreover, they perform above the market average in customer experience while demonstrating product and thought leadership. This year’s Leaders are:

- Salesforce

- Microsoft

- Oracle

Salesforce

Gartner spotlights “roadmap”, “GenAI flexibility” and “forecasting” as the three core strengths of Salesforce Sales Cloud.

An excellent example of those roadmap and GenAI strengths is in Salesforce’s plans to build a sales-specific large language model (LLM): the XGen-Sales model.

Based on its open-source APIGen and family of large action models (LAM), the innovation aims to bolster the accuracy and effectiveness of GenAI use cases within the CRM.

Brands can also build custom AI Agents – which may soon leverage the XGen-Sales model – for the SFA on Agentforce, an adjacent platform. In doing so, they may automate more sales processes, including those unique to their business.

In terms of forecasting, Gartner highlights several impressive functionalities. It doesn’t, however, isolate team features – like Collaborative Forecasting and Opportunity Splits – which help ensure a fair and accurate view of the sales pipeline.

Microsoft

Gartner pinpoints “SFA and GenAI packaging”, “roadmap” and “usability for account and contact management” as the three core strengths of Microsoft Dynamics 365 Sales.

On that packaging, Microsoft is the undisputed king of the tech bundle. With its SFA, the tech giant offers the opportunity to couple its SFA with Copilot. The virtual assistant also works outside of Dynamics, within the apps that sales teams leverage daily – like Outlook and Teams.

With this packaging, Microsoft leverages the strength of its broader portfolio. That strategy is something it may double down on as it launches its first autonomous AI Agents in Dynamics.

Soon, these AI Agents will likely offer a chance to connect workflows that stretch beyond Dynamics 365 Sales and into other apps – another reason to be excited by Microsoft’s roadmap.

Lastly, Gartner notes that Microsoft is already improving the synchronization between Dynamics 365 Sales and its Office apps, bolstering this vision for a more connected CRM environment.

Oracle

Gartner isolates “mobile”, “market understanding” and “roadmap” as the three core strengths of Oracle Sales Cloud.

Indeed, its CX Sales Mobile app is a differentiator. Impressive features that Gartner doesn’t highlight include the ability to configure the homepage, plan sales activities around the user’s current location, and optimize task-based flows for the smartphone.

Such capabilities demonstrate its understanding of the SFA space. As does its ability to combine LLMs and broader AI models to refine generative AI use cases for sales. Its social collaboration tools and close integration with Oracle Marketing Cloud also exemplify this.

Finally, like its competitors, Oracle is working on AI Agents as a key part of its roadmap. In doing so, it’s building on those it released for sales teams in September. These include agents for researching customer accounts, scouring contracts, and planning incentive compensation.

Gartner Magic Quadrant Challengers

Challengers in the Magic Quadrant can compete on a global scale, exhibit a higher volume of new business than niche players for SFA, and often achieve high customer satisfaction scores. However, they may not perform consistently across industries and sectors. They could also lack a “strong” vision. This year’s Challengers are:

- SAP

- Pega

- SugarCRM

SAP

Gartner identifies “UI modernization”, “balanced AI roadmap”, and “add-ons and integrations” as the three core strengths of SAP Sales Cloud.

Thanks to that UI work – which includes new, rich visuals across its digital sales dashboard – “ease of use” now scores as the biggest pro for the solution on G2.

Meanwhile, in terms of AI, SAP already demonstrates a balanced approach, combining various forms of AI across its SFA. This includes NLP for embedded translation, predictive AI to recommend actions to increase forecast accuracy, and GenAI to spot and summarize case highlights.

Also, there’s the API-first design of Sales Cloud – alongside tight native integrations with SAP’s broader portfolio and Microsoft Teams – that enable a more robust SFA.

However, one caution Gartner presents is of SAP’s “mobile app limitations”.

Pega

Gartner notes “innovation”, “platform and composability”, and “activity management” as the three core strengths of Pega Sales Automation.

The analyst shares many examples of that innovation, including the Pega GenAI Knowledge Buddy. One AI use case it omits, however, is the ability to deliver Voice AI-powered suggestions during live sales calls, which provide ideas to enhance outcomes. That comes thanks to a video integration between the SFA and UC platforms like Microsoft Teams, Webex, and Zoom.

In terms of composability, this is a big differentiator for Pega, as the vendor provides a resource library and low-code applications to orchestrate its ideal sales process. Add the vendor’s expertise in workflow automation, and that’s a promising combination.

Pega could, however, expand its integration ecosystem to extend the influence of its composable platform and automate more processes. As such, it’s no surprise Gartner raises that as a caution.

SugarCRM

Gartner highlights “customer community”, “implementation and ongoing services”, and “strategic product partnerships” as the three core strengths of Sugar Sell.

The “SugarClub” community has 12,000+ members, with product forums, user groups, and social clubs alongside a certification program to offer a comprehensive learning experience.

Many of these educational resources focus on the vendor’s SMOOTH methodology, which aims to offer a blueprint for CRM implementation.

SugarCRM also strives to simplify the onboarding process with custom and quick-start options.

Finally, the vendor works closely with many adjacent technology vendors, even acquiring close collaborator sales-i in May. The move has helped bolster Sugar Sell’s revenue intelligence capabilities.

Nevertheless, Gartner picks holes in SugarCRM’s approach to AI innovation, raising its “AI-guided selling” and “AI/ML product strategy” as cautions.

Gartner Magic Quadrant Visionaries

Visionaries in the Magic Quadrant present innovative solutions and/or delivery models to clients, highlighting an acute understanding of evolving sales needs. As such, they sometimes influence the market’s direction. However, they may lack the execution and track record of Leaders. This year’s Visionaries are:

- Zoho

- Creatio

Zoho

Gartner highlights “predictive scoring”, “workflow automation”, and “lead management” as the three core strengths of Zoho CRM.

Customers can access the predictive scoring capability through the platform’s virtual assistant, Zia. Alongside predictions, it makes intelligent recommendations, detects anomalies, and scores leads.

The Zoho CRM’s lead management capability enables that feature, with the platform able to capture and unify leads across multiple channels.

Workflow automation is also big, especially in how the vendor can connect marketing and sales.

Another differentiator that Gartner doesn’t note is in the pricing of Zoho CRM, with the most expensive seat costing $52 per user per month – with capabilities extending far beyond SFA.

However, as with SugarCRM, the analyst spotlights “AI-guided selling” as a caution.

Creatio

Gartner highlights “product packaging and pricing”, “support for sales best practices”, and “innovation” as the three core strengths of Sales Creatio.

While the analyst shares many feature examples of this innovation, perhaps the best example is in its no-code workflow architecture. Paired with its new library of drag-and-drop mini-components, teams may automate and enhance many more sales workflows.

All customers can access that architecture as part of a base package and then layer over stand-alone capabilities from the SFA module. That’s part of the differentiative product strategy Gartner lauds.

Additionally, Creatio has a reputation as a consultative vendor, sharing those “best practices”. What Gartner doesn’t note, however, is its base of 700 partner organizations that play a massive role in helping the provider to scale that strategy globally.

Regarding cautions, the analyst pinpoints Sales Creatio’s “usability” and “activity management”.

Gartner Magic Quadrant Niche Players

Niche Players in the Magic Quadrant have developed a considerable market presence and can offer the best-placed solutions for particular sales use cases and organizations. Nevertheless, they may lag in meeting cross-industry requirements and/or their ability to support global enterprises. This year’s Niche Players are:

- BUSINESSNEXT

- HubSpot

- Neocrm

- Freshworks

- Vtiger

BUSINESSNEXT

Gartner considers “lead management”, “UI improvements”, and “AI strategy” the three core strengths of the BUSINESSNEXT platform.

MORE COMMENTARY TO COME SOON

HubSpot

Gartner isolates “viability”, “usability”, and “activity management” the three core strengths of the HubSpot Sales Hub.

MORE COMMENTARY TO COME SOON

Neocrm

Gartner pinpoints “AI/ML”, “innovation”, and “partner relationship management” the three core strengths of the Neocrm Sales Cloud.

MORE COMMENTARY TO COME SOON

Freshworks

Gartner identifies “pricing value”, “visualization”, and “omnichannel support” the three core strengths of Freshsales.

MORE COMMENTARY TO COME SOON

Vtiger

Gartner spotlights “activity management”, “collaboration and productivity”, and “SMB market focus” the three core strengths of the Vtiger One.

MORE COMMENTARY TO COME SOON

What Has Changed Since 2023?

Despite several trends converging on the Sales Force Automation market, little has changed from last year’s edition.

For instance, the three market leaders remain the same. As do the Niche Players, although Neocrm has notably improved its positioning in that square.

Elsewhere, Creatio switched from a Challenger to a Visionary, while SAP headed in the opposite direction.

Finally, the participating SFA vendors remain the same as in 2023.

Deep dive on some of our other rundowns of the Gartner Magic Quadrant reports below:

- Gartner Magic Quadrant for the CRM Customer Engagement Center 2023

- Gartner Magic Quadrant for Customer Data Platforms 2024

- Gartner Magic Quadrant for Multichannel Marketing Hubs 2023