Salesforce has revealed its Q2 results, enjoying revenue growth of 11 percent year-over-year (YoY).

While sharing such figures, the CRM leader raised its sales forecasts to amplify its optimism for the next six months.

The optimism comes after a prolonged focus on driving profitability and activist investor pressure – which may have contributed to layoffs, incentives to bring staff back to the office, and price hikes.

The benefits of these initiatives are now seemingly coming to life. However, is Salesforce out of the woods yet?

For now, that’s impossible to say. Yet, there are many fascinating threads to pull at from its earnings call – which share insight into the vendor’s future direction.

Here are five highlights from the call.

Benioff on Layoffs: We Hope That Is Behind Us

As Salesforce’s recent price hikes continue its push toward profitability, additional large-scale layoffs appear to be on the back burner.

Indeed, CEO Marc Benioff stated:

We’re not planning any other major restructuring efforts in the company today like what we saw earlier this year. We hope that that is one and done and behind us.

Benioff also noted how the company is now welcoming back many former employees and is investing in growing its headcount “in AI”.

However, he did warn of “normalized attrition” and noted that he wasn’t sure if layoffs had yet bottomed out.

Already, Salesforce’s employee base is down 11 percent from the start of the year.

Heathrow Airport Revamps Its Customer Service with Gen AI

While namedropping many prominent customers, Benioff singled out Heathrow Airport as an excellent example of the “transformative power of AI” in customer service.

The airport quickly jumped on the Salesforce GPT bandwagon, implementing several features now available within the vendor’s Service Cloud solution. Those included AI-assisted generated replies to service queries, case deflection, and automated case summaries.

Heathrow supports these capabilities with relevant data and business context from Data Cloud.

“This is saving their agents huge amounts of time and effort,” added Benioff. “[It shows] what our Service Cloud can do for customers, not only with delivering high-quality customer service, but delivering incredible new levels of productivity.”

No Change In the Tricky Macro-Environment

While its 11 percent revenue growth may seem positive – as it helped Salesforce beat estimates – the business has historically grown at 20-30 percent.

That long-term slowdown is most likely the result of the continued tricky macro-environment, which all CX vendors are enduring.

Indeed, Brian Millham, President and Chief Operating Officer at Salesforce, highlighted the trend during the call, stating:

The ongoing measured buying environment [and] compression of larger transformational deals continued in the quarter, affecting our professional services growth.

With that said, such trends could benefit Salesforce. After all, more brands are likely factoring the financial stability of prospective vendors into their buying decisions – which makes working with more prominent CX players – like Salesforce – more desirable.

NICE CEO Barak Eilam delved deeper into this emerging buyer consideration in a recent CX Today article.

MuleSoft Momentum Drives Revenue Growth

Amy Weaver, Chief Financial Officer of Salesforce, described its 11 percent revenue growth as “ahead of expectations, notably due to the momentum in MuleSoft.”

That news may surprise some, as MuleSoft – a tool that links Salesforce to legacy solutions – seemed the solution most detached from its future vision.

Indeed, Slack as the collaboration layer and Genie as the data layer that sandwiches its core CRM solutions appears the bridge to Salesforce’s future success.

Yet, MuleSoft’s momentum may highlight how enterprises are sticking with many of their legacy solutions, which sit adjacent to the CRM – perhaps including ERP systems.

Unfortunately, the CRM leader didn’t dive into more details. However, Millham did conclude:

As customers bring together data from all sources to fuel efficiency, growth, and insights, MuleSoft has become mission-critical for them and was included in half of our top ten deals.

Benioff on CRM AI: We’re Very Thirsty to Be No. 1

Over the years, Salesforce has established a healthy lead in the CRM market, outselling its nearest competitor, Microsoft, by four solutions to one – according to 2022 IDC data.

Yet, the generative AI megatrend has the potential to upset the apple cart, giving rival vendors a chance to catch the eye of prospective buyers and close the gap.

Benioff appears adamant about not allowing that to happen and is “thirsty” to get ahead of the AI wave and expand Salesforce’s market lead. He stated:

We are very thirsty to make sure that Salesforce is the No. 1 AI CRM, and we have done a lot organically to do that in the last six months.

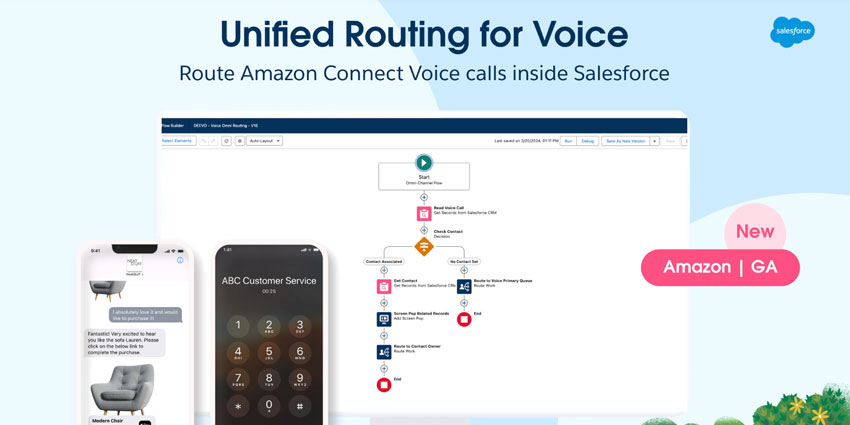

To catch up on some of those actions Salesforce has taken since the start of the year to lead the CRM market in AI, check out our articles:

- Salesforce Makes Service and Sales GPT Generally Available, Reveals Pricing

- Salesforce Announces AI Cloud – with a Lofty Price Tag

- All the Highlights from Salesforce’s Winter ‘24 Release