Seven years ago, when Opus Research first started to monitor the implementation of enterprise intelligent assistants (EIAs), the technology was relatively niche. Only companies with significant digital transformation budgets considered implementing the technology to gain a competitive edge.

Yet, thanks to technology advancements, reputation gains, and a clamor to reduce pressure on the contact center, the use of EIAs has soared in recent years.

Underpinning this new reality is a statistic within its 2022 Decision Makers’ Guide to Enterprise Intelligent Assistants report, which highlights that only 18% of the “bot-using” firms it surveyed in the “pilot” stage of deployment.

From this research, Opus uncovered many more fascinating findings, which include:

- Over half of EIAs (52%) now allow customers to update their personal information

- 68% of EIAs now offer personalization features to address users

- More than a third (33.7%) of EIA implementations come from within the banking and financial services sector

- 3% of EIA deployments take place on live chat, with 29.1% occurring on the voice channel

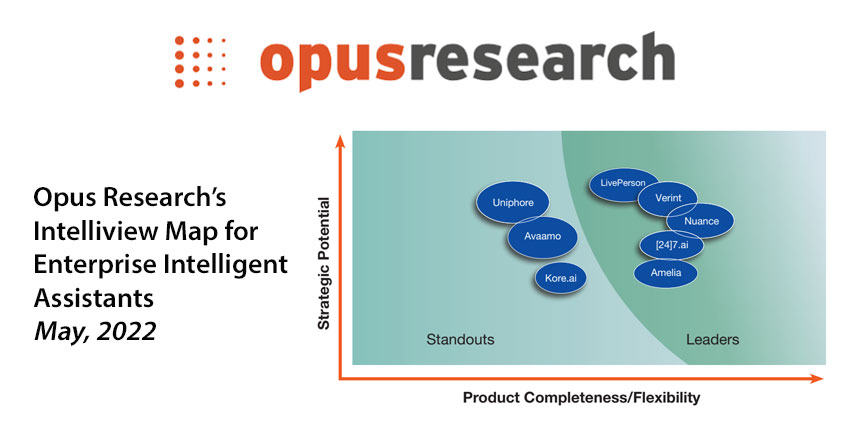

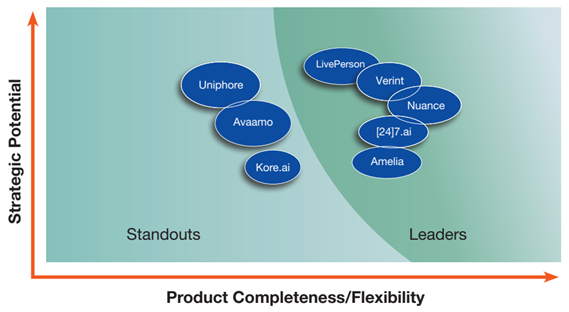

Yet, deeper within its report, the analyst also showcases its research into leading EIA vendors as part of its May 2022 Intelliview Map.

A Definition for Enterprise Intelligent Assistant

An EIA is a conversational AI application that communicates with the user to resolve queries and complete tasks. While these are most often customer-facing bots, some EIAs support customer service agents in fielding tricky contacts.

Many vendors now offer both within an enterprise EIA platform, alongside training and management capabilities, providing solutions that cover multiple modalities and channels. Typically, they will also supply a host of APIs and connectors to various enterprise systems to increase the functionality of each EIA.

According to Opus Research, best-in-class EIA platform vendors offer “comprehensive, scalable solutions that embrace the gamut of services and technologies necessary for successful Enterprise Intelligent Assistant deployments.”

Sticking to this summarization and considering product completeness, track record, and strategic potential, the analyst isolated five market leaders and three standouts to create its 2022 Intelliview Map for EIAs.

Leaders

Leaders in the Opus Research Intelliview Map provide a holistic approach to EIA implementation, recognize “tangible differences in high-value use cases,” and offer omnichannel solutions. In addition, they demonstrate an excellent track record of delivering value for clients, offer robust orchestration and management capabilities, and showcase a diverse partner ecosystem.

- Nuance

- Verint

- [24]7.ai

- Amelia

- LivePerson

Nuance

Recently acquired by Microsoft, Nuance is a “perennial leader” in the EIA space, according to Opus. The analyst highlights its ability to leverage the incredible depth of the Microsoft portfolio as a significant strength, alongside its omnichannel customer engagement strategy. Nuance also sets itself apart in its conversational AI expertise, covering many verticals – including healthcare.

Verint

Verint receives praise from Opus for its capability to connect the enterprise with business-focused conversational intelligence data, in addition to its open platform. Such a platform enables many integrations to supercharge its EIAs and tackle many challenging use cases that go far beyond responses to frequently asked questions (FAQs).

[24]7.ai

Amelia

A white-label offering made available by NICE, Amelia provides bot solutions to support digital employee and hybrid workforce, which receives particular acclaim within the Opus Research report. Formerly known as IPsoft, the company embeds robotic process automation (RPA) across all its offerings and is highly regarded for its expertise in conversational design.

LivePerson

Offering a “Conversational Cloud” solution, LivePerson offers unique natural language understanding (NLU) intent models to lessen the load on developers and speed up EIA time to market. Focusing heavily on the developer experience, the company aims to make personalizing automated conversations easier while offering helpful out-of-the-box analytics.

Standouts

While standouts may fall a little behind leaders in terms of strategic potential and product completeness, they showcase a deep EIA expertise and offer many advanced capabilities to maximize the value of data sources. In doing so, they can highlight many success stories of creating compelling customer experiences and driving value with AI and automation.

- Avaamo

- ai

- Uniphore

Avaamo

Opus Research describes Avaamo’s voice and multi-channel EIA offerings as “impressive”, offering the tools to automate customer, employee, and partner conversations. The vendor also sticks out for its ability to quickly train bots and speed up deployments, enabling brands to speed up digital transformation initiatives.

Kore.ai

A leader in the 2022 Gartner Magic Quadrant for Conversational AI, Kore.ai is fast becoming a significant player in the EIA space, with Opus Research calling its offering “formidable”. The analyst also lauds the vendor for its exceptional modeling, testing, and import/export options. Alongside this, Kore.ai is widely respected in terms of market understanding, traction, and client support.

Uniphore

With a burgeoning customer and partner base, Uniphore has added to its conversational AI with the recent acquisitions of Jacada and Colabo. The latter has enabled the provider to enhance its agent-assist functionality, surfacing knowledge from contact center systems to offer agents next-level support. Uniphore has also announced a new partner program to bolster its capabilities further.

What Else Did the Opus Study Uncover?

Diving further into the field of conversational AI, the Opus Research study also highlighted market leaders in AI-powered voice-first assistance and digital assistance.

Indeed, the market analyst highlighted Five9, Interactions, and PolyAI as its three leaders in voice first assistance.

Meanwhile, Opus pinpointed Cognigy, Creative Virtual, and Salesforce as its leading providers in digital assistance.

Itching to learn the leading providers within the data and analytics space? If so, check out our article: Gartner Magic Quadrant for Data and Analytics Service Providers 2022