Zoom’s earnings grew at their fastest rate in almost three years last quarter.

Indeed, its Q2 revenues rose 4.7 percent year-over-year (YoY) to $1.217BN.

A key driver behind that achievement is its contact center business, which continues to expand at a “high double-digit rate”.

Zoom execs shared several additional statistics during the earnings call, including “triple-digit growth” in its Elite tier contact center package geared toward enterprises.

Additionally, they highlighted how four in every five CCaaS wins now come through the channel.

However, Eric Yuan, CEO of Zoom, revealed perhaps the most surprising statistic:

Our top ten contact center deals were all displacements of leading competitors, and all but one were cloud displacements.

Why is that surprising? Because CCaaS transformations involve a lot of legwork. As such, hopping between vendors is not an easy choice to make.

Analysts on the call picked up on this. In response to their questions, Yuan highlighted that it wasn’t necessarily Zoom’s role as a market disruptor that drove the migrations; it was the shortcomings of rival vendors.

“Many customers have been unhappy with their existing contact center providers,” he said.

If they were completely satisfied, no matter what we did, they wouldn’t want to switch. The reality is, they’re not happy.

“Sometimes it’s due to quality issues, frequent outages, high costs, resistance to innovation, poor architecture, or very slow AI adoption. The reasons vary.”

Like Zoom, CX Today has picked up on this trend and several more reasons for CCaaS dissatisfaction.

For starters, numerous CCaaS players offered “sweetheart deals” at the beginning of the pandemic when many contact centers rushed to the cloud to simplify remote working. Yet, as they come up for renewal and vendors charge their normal prices, businesses are reconsidering.

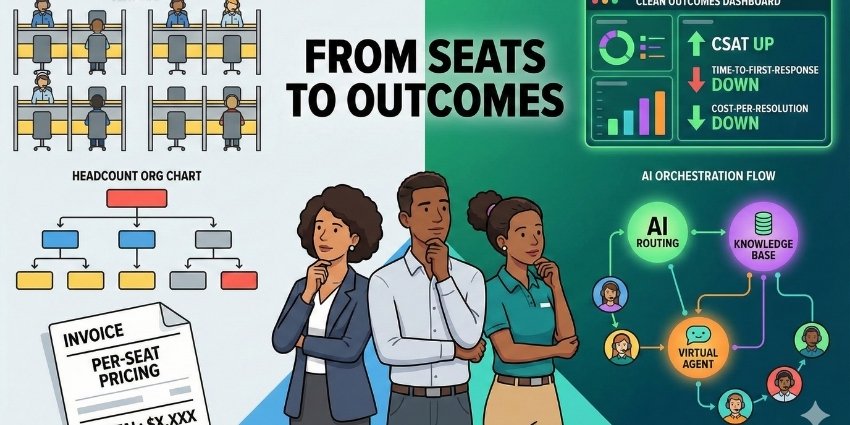

In addition to the ‘high costs’ Yuan mentioned, many providers require businesses to purchase a fixed number of seats annually under their CCaaS contracts. Companies with high seasonal demand now see an opportunity to reduce costs by switching to a more flexible pricing model.

On pricing, some vendors also locked contact centers into annual increases in seat numbers. As such, when service teams didn’t scale as quickly as anticipated, they paid a hefty price. That may have caused some resentment.

Another big reason is that many contact center leaders perceive they didn’t receive sufficient support post-deployment, which, as Yuan suggested, may have impacted AI adoption.

However, even those that did adopt AI have faced issues that reflect not so well on their vendors. For instance, many providers offer AI features at extra cost to their core offering. So, when contact centers add more, costs stack and the CFO takes offence.

Zoom can differentiate here, with its AI Companion included at no additional fee.

Nevertheless, Yuan believes that Zoom is winning customers not only because of its pricing model, reputation for being easy to work with, and high brand loyalty.

Discussing the CCaaS migrator wins, Yuan noted: “These customers are actively looking for modern contact center solutions. When they try Zoom, they often say, “Wow, I can’t believe this.”

“We offer nearly every feature they need, and more importantly, they trust us,” he concluded. “They trust the core Zoom platform and what it represents. Our company culture is focused on delivering happiness; we strive to delight our customers.”

Finally, Yuan noted Zoom’s product as a differentiator, highlighting how it built its platform entirely in-house to ensure a consistent user experience.

Other Big Takeaways from Zoom’s Earnings

Sticking with the Zoom Contact Center, the number of customers paying more than $100,000 annually for the platform grew by 94 percent (YoY) last quarter to 229.

As previously noted, new partnerships are helping drive that growth. One newly established collaboration is with PWC, which focuses on CCaaS and AI for the enterprise, per Yuan. He said:

Together, we have already co-sold several large deals, including a Fortune 50 technology firm for which PWC will provide advisory and implementation services.

Beyond the contact center, Zoom AI Companion monthly active users (MAUs) have grown over four times YoY. While the video communications pioneer didn’t share exact numbers, it noted that “millions” of employees now use the AI assistant.

They include 60,000 staff members at a Fortune 200 US tech company, which implemented the AI Companion last quarter.

Zoom Phone also sustained its “mid-teens” growth in recurring revenue, while WorkVivo has reached 168 customers paying more than $100,000 annually, up 142 percent YoY.

Much of that business has stemmed from the shuttering of Meta Workplace. For instance, Zoom won a 10,000-seat deal with Marubeni Corporation to migrate from Meta to WorkVivo.

Expect more news like this and innovation from Zoom’s September Zoomtopia event.

While recent innovations, such as the Zoom Virtual Agent 2.0, may take center stage, Yuan suggested many more significant announcements will come.