The customer-experience world is having its great divide moment. On one side, the legacy giants are still trying to patch AI into platforms built long before tools like ChatGPT existed. On the other hand, a new generation of AI-first CX companies are building from a clean slate, treating data, automation, and integration as the foundation, not an upgrade.

Few people know that tension better than Oscar Giraldo. The former Playvox CEO watched what happens when big players move slowly after NiCE acquired his company. “It’s been over a year since the acquisition, and they’re still not fully integrated.”

That frustration turned into inspiration for his next venture, Oversai: a full-stack AI platform built entirely for the new agentic era.

Across the market, the cracks are showing. NICE’s billion-dollar Cognigy deal shows that legacy vendors are scrambling to buy innovation they couldn’t build themselves. Meanwhile, most CX leaders say integration and data quality are their biggest AI headaches.

It’s starting to seem like the real winners won’t be those who talk loudest about AI; they’ll be the ones who built it right, from the ground up.

AI-First CX: From Retrofitted AI to Real Integration

If the rise of AI-first CX feels fast, it’s because the old guard is finally seeing just how far behind they’ve fallen. Giraldo doesn’t mince words when describing the difference between bolting AI onto old systems and building it in from day one.

“Companies announce partnerships with brands like Snowflake because they know they need data from everywhere – but they don’t own that layer.” Giraldo says. “Realistically, none of the legacy vendors started their companies after ChatGPT – they’re struggling to build a native data layer.”

This “retrofit trap” is what’s holding so many large CX platforms back. Their architectures were never designed for the data-hungry reality of modern CX automation. Instead, they stack new AI features on top of outdated databases and fragmented workflows, a structure that Giraldo compares to “installing smart bulbs in a house with no electricity.”

The numbers back him up. Gartner predicts that 40 percent of agentic AI projects will fail by 2027 because the underlying data systems can’t support real integration. When that happens, vendors lose trust. That’s where Oversai draws its line.

Giraldo’s new platform is built on a universal ontology: a shared data model that lets AI agents pull and act on information from CRMs, e-commerce sites, help desks, or claims systems in real time.

When asked why the industry feels stuck, Giraldo points to the acquisition frenzy. “If legacy vendors really want to compete, they need to acquire, that’s why NICE paid nearly a billion,” he says. “But you can’t buy modern architecture. You have to design it.”

Analysts agree. BCG estimates that organizations embedding agentic AI directly into core systems can accelerate business processes by 30 to 50 percent, while those relying on retrofits will see diminishing returns.

AI-First CX and The Agentic Enterprise

The shift from static automation to dynamic action is happening fast. For years, the industry has promised AI for customer experience, but most systems could only talk, not act. Now, a new generation of AI-first CX platforms is delivering on that promise, creating what Oscar Giraldo calls the agentic enterprise.

In Giraldo’s view, the next leap in CX automation isn’t about generating more conversation, but about enabling execution. Oversai, his new company, is built around the idea that an AI agent shouldn’t just answer a support query; it should resolve it from start to finish. “AI agents need access to everything, from inventory to claims systems,” he explains, “that’s the difference between AI that talks and AI that acts.”

That requires something legacy architectures were never designed for: true CX integration. Oversai connects systems through a shared ontology, which allows AI to retrieve, interpret, and act across multiple business tools. In practice, that means an OversAI agent could start a WhatsApp conversation, check stock in Shopify, generate an order in HubSpot, trigger an invoice, and post an update in Slack, all without a human in the loop.

Giraldo compares OversAI’s design to Tesla’s vertical integration: software, hardware, and batteries all built together for seamless performance. “We’re integrating from the data stack all the way to the agents on the front end,” he says, underscoring the advantage of full-stack AI platforms that own every layer.

The Need for a Full-Stack, Data-First Architecture

In today’s AI-first CX market, the real competitive edge isn’t a clever algorithm; it’s what lies beneath it. While every vendor has access to similar models, few control the quality, flow, and structure of their data. That, says Oscar Giraldo, is where the true moat exists.

“Oversai was born post-ChatGPT,” he explains. “We built the ontology and data stack from day one. Everyone has the same models; the moat is the data layer.”

It’s a sharp contrast to how most legacy platforms operate. Traditional systems rely on a patchwork of integrations, APIs, and middleware that pass data around but rarely unify it.

Oversai flips that model by building from the data layer up, allowing its AI agents to work seamlessly across applications. The result is a full-stack AI platform that controls every component without the friction of third-party dependencies and adapts to specific needs.

The benefits of that philosophy extend beyond just better automation. Oversai also includes workforce management and quality monitoring within the same architecture, ensuring companies can oversee not just what AI agents do, but how well they do it. “Now that AI agents are doing the work, you need oversight on how they perform; that’s why we built quality management in from the start,” Giraldo says.

That’s crucial at a time when companies need to balance the potential of AI with data governance, security, and oversight.

In a market flooded with tools claiming intelligence, Giraldo’s vision reframes the conversation. Intelligence, he suggests, isn’t about what the model can say; it’s about what the architecture can do and how much control companies continue to have.

Lean AI Startups: The David Advantage in AI-First CX

When Oscar Giraldo describes Oversai’s team, it sounds less like a Silicon Valley sprawl and more like a Formula 1 pit crew: small, focused, and built for speed.

“A small AI-native team can do more with less,” he says. “That translates to lower prices and faster innovation.” It’s a sentiment that defines this new wave of AI-first CX companies: leaner by design, not by constraint.

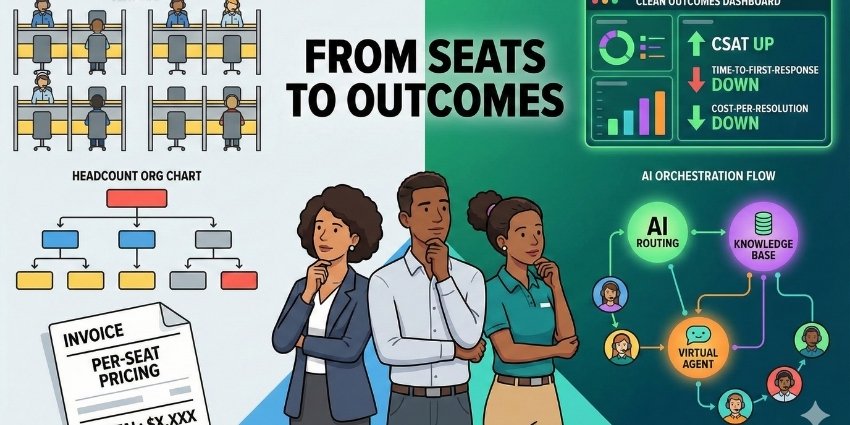

Legacy vendors are weighed down by decades of technical debt and bloated organizational structures. Their roadmaps often span years; AI-native startups can ship a new capability in weeks. Plus, because tools like Oversai have the data layer pre-built and the integrations ready to access, they can scale fast.

For buyers, that agility translates into affordability. “Why pay Salesforce millions when a leaner AI platform does it better?” Giraldo asks. He’s not alone in that thinking. Across the industry, vendors are re-evaluating value models as automation reduces the need for large per-seat licensing.

The economics are hard to ignore. According to PwC’s 2025 AI Adoption Survey, 79 percent of businesses are already using AI agents, with 66 percent reporting major productivity gains and 88 percent planning to increase investment.

McKinsey projects that agentic AI could unlock up to $4.4 trillion in annual economic value worldwide, much of it from process automation and data optimization.

Giraldo sees the timing as a “perfect storm.” Startups born in the AI era can move faster, charge less, and innovate more precisely. “Legacy vendors are struggling with data integration while AI adoption accelerates,” he says. “That’s when David has a real shot at beating Goliath.”

For companies shopping for AI for customer experience, that’s the emerging truth: small, smart, and AI-native may now be the safest bet in town.

Trust and Transparency

For all the excitement around automation, customer experience still comes down to something simple: trust. Every interaction, whether it’s a chatbot answering a billing question or an AI agent fixing a shipping issue, either builds confidence or breaks it. In the era of AI-first CX, that trust can vanish faster than ever.

Oscar Giraldo doesn’t believe empathy and automation should be at odds. “You can’t automate everything and expect customers to feel heard,” he says. “AI has to enhance empathy, not replace it.” That’s the mindset behind Oversai, a platform built to make automation transparent, not mysterious. Every action the AI takes can be tracked, reviewed, and corrected. Nothing happens in a black box.

Across the industry, that kind of openness is becoming a competitive edge. Gartner reports that 64% of consumers prefer brands that tell them when they’re using AI, and more than half of CX leaders say transparency is their top ethical concern. Yet, as many analysts warn, too few companies have the right controls in place to make that possible.

Oversai bakes those protections directly into its full-stack AI platform, giving companies built-in quality checks and compliance tools instead of bolted-on fixes. “Transparency will be the currency of the next AI generation,” Giraldo says, and it’s hard to argue.

In this new wave of AI for customer experience, customers aren’t just asking what AI can do. They’re asking whether they can trust it.

The Next Wave: AI-First CX Will Thrive

There’s a quiet sense of inevitability in how Oscar Giraldo talks about what’s coming next. The AI-first CX era is already here, and the gap between those who built for it and those still trying to retrofit is widening by the day.

“At the end of the day, what you really want is a connected enterprise, one data layer powering everything,” he says. “Now is the moment to build that future, not retrofit the past.” It’s the kind of statement that feels obvious once you hear it, but it also explains why so many legacy platforms are scrambling to keep up.

The contact center has already become the testing ground for this transformation. Autonomous agents that can take action are reshaping what service looks like. But even the smartest automation can feel cold if it’s not rooted in empathy or clarity from the right data. Customers don’t want to be “handled”; they want to be helped.

For Giraldo, that’s the defining moment: a market split between those who see AI as a bolt-on feature and those building it as a foundation. The next generation of CX integration tools won’t just talk about intelligence; they’ll prove it through seamless workflows, transparent data use, and real outcomes.

The winners of this decade may not be the companies with the longest product line or the biggest customer base. They may not even be the companies with the largest budgets for acquisition. They might just be the ones who were brave enough to start from zero.

Because when everyone has access to the same models and tools, the real differentiator is the data layer.