Just a couple of weeks into 2024, two prominent contact center tech providers have made acquisitions that will transform their go-to-market strategy.

The most eye-catching is Zendesk’s move for Klaus, the contact center quality management vendor, which paves the way for Zendesk to become competitive in the workforce engagement management (WEM) space. (More on this later!).

Elsewhere, Calabrio completed its acquisition of Wysdom, the virtual agent platform provider.

While this is unlikely a huge investment, it gives Calabrio considerable in-house AI expertise and perhaps offers a sign of what’s to come for vendors in the crowded conversational AI market.

Most critically, however, both deals will enable the contact center stalwarts to expand and differentiate their offerings amidst new market competition.

Spotting and executing on those opportunities is critical, and more CCaaS vendors are choosing acquisitions – alongside in-house innovation – to deliver that.

The following five biggest CCaaS acquisitions of 2023 exemplify this and showcase where the market leaders sense an opportunity for growth.

1. Five9 Snaps Up Aceyus

Aceyus is a central cog in many enterprise cloud contact center migrations.

Essentially, it acts as a bypass machine, which ensures the continuation of critical data flows during a contact center transformation project.

Building such a backstop into its portfolio is a coup for Five9, as enterprises kickstart slower, more cautious CCaaS transformations to safeguard customer experiences.

Genesys has excelled in offering such support for legacy customers in transitioning to CCaaS – which is a core reason why Gartner considers it a market leader in its Magic Quadrant.

Now, Five9 – also a Magic Quadrant leader – can offer something similar and perhaps surge further towards to the top-right of Gartner’s coveted grid.

Yet, Aceyus brings more to Five9 than a backstop. It also harvests various contact center systems to aid the creation of curated data sets. Such data sets will help to finetune the AI models the vendor embeds inside its CCaaS platform.

Finally, Aceyus works with many big-name brands, including Expedia, Marriott, and T-Mobile. That offers Five9 a foothold inside several massive enterprise contact center environments.

2. NICE Acquires LiveVox

NICE billed its acquisition of LiveVox as the best of inbound meets the best of outbound CCaaS.

Many analyst reports support such sentiment, with Gartner, Forrester, and Ventana Research amongst the high-profile research firms labeling NICE as a market leader. The latter even ranked the vendor highest in a 23-vendor market evaluation for its “overall product capability”.

Yet, the CCaaS provider has done little to evolve its outbound proposition since the 2013 launch of its Personal Connection Outbound Dialer.

To address this, Barak Eilam, CEO of NICE, created a master plan. He told CX Today:

There are several players in the outbound business, and we wanted to join forces with the best… and LiveVox has by far the best technology.

That technology includes proactive outreach tools that leverage cross-channel data and predictive analytics to determine the best channel to contact outbound targets.

NICE may supplement this with its own data, AI, and omnichannel stack to advance the solution and unlock further value from its portfolio.

Moreover, in collaboration with LiveVox, it expands its pool of contact center experts, services, and customers. The latter includes PayPal, Commerce Bank, and Royal Caribbean.

3. Zendesk Rolls Up Tymeshift

2022 proved a tough year for Zendesk, as its attempt to snap up Momentive Global and shift into the voice of the customer (VoC) space failed.

That kickstarted a saga that led to its $10.2BN all-cash acquisition by global investment firms Permira and Hellman & Friedman LLC.

The $10.2BN figure was $6BN+ less than a private equity bid made to the company four months earlier. Ouch.

At the time, Zeus Kerravala, Founder and Principal Analyst at ZK Research, told CX Today: “Acquisitions will be the path back to growth for Zendesk.

We live in a world now where competitive differentiation is based on what you do with data. The question for Zendesk is what do they do with the data they have, and what data do they bring into complement that?

The 2023 acquisition of workforce management (WFM) provider Tymeshift presented the answer: workforce engagement management (WEM) data.

Now, Zendesk has taken this even further with the acquisition of Klaus. In time, this will allow Zendesk to add an automated quality score to every ticket – alongside additional interaction insights.

That capability benefits quality analysts and supervisors. Yet, it also aids workforce planners who can use these insights to tweak schedules and shift patterns to maximize performance.

As such, the acquisition of Tymeshift proved significant in signaling Zendesk’s arrival in the WEM market. There, it may start challenging the likes of Verint and Calabrio for large enterprise deals, once it pieces its WEM offering together.

When it does so, WEM will become another growth engine for Zendesk to land more customers and potentially cross-sell CRM, helpdesk, and conversational AI solutions.

4. Verint Snaps Up Qudini

Of all the contact center stalwart vendors, Verint perhaps had the busiest 2023, launching its Open CCaaS platform and specialist bot strategy.

Those mega-announcements led to the emergence of “Verint 4.0”, as David Singer, Global VP of Go-to-Market Strategy at Verint, terms it. He told CX Today:

Verint 1.0 focused on recording, 2.0 was WFO – which combined workforce management and quality assurance – 3.0 was WEM– which brought knowledge management, analytics, and more into the equation… Now, we’re launching Verint 4.0.

Yet, as it moves into the 4.0 era, Singer understands Verint must hold onto its loyal WEM customer base – and the acquisition of Qudini underlines its long-term commitment to this group.

Indeed, Qudini offers Verint the opportunity to support planners taking workforce scheduling beyond the conventional contact center confines.

With new clienteling, task management, and virtual queuing features, Qudini allows planners to also consider external use cases for scheduling, like virtual and in-store customer appointments.

Recognizing this opportunity, Verint is now trialing a new approach to shift scheduling, which may help preserve its WEM leadership while breaking new ground in CCaaS.

5. Zoom Acquires Workvivo

In April, Zoom swooped in for WorkVivo, an employee app with a social intranet, forums, directories, reward and recognition features, live video streaming, and more.

At first, the move seemed a natural extension of its UCaaS platform. Yet, it may also bolster the tools within Zoom’s contact center WEM suite.

Consider the automated quality assurance (QA) solutions. They help to spotlight the best performing and most improved agents.

Moreover, auto-QA may pinpoint instances of agents going above and beyond for a customer, recording high-CSAT hot streaks, and reaching various other performance milestones.

WorkVivo may help to gamify and shed light on these outcomes.

In addition, a contact center may leverage the podcast, survey, and learning management solutions within Workvivo to share knowledge in new ways. Again, this may bolster its WEM proposition.

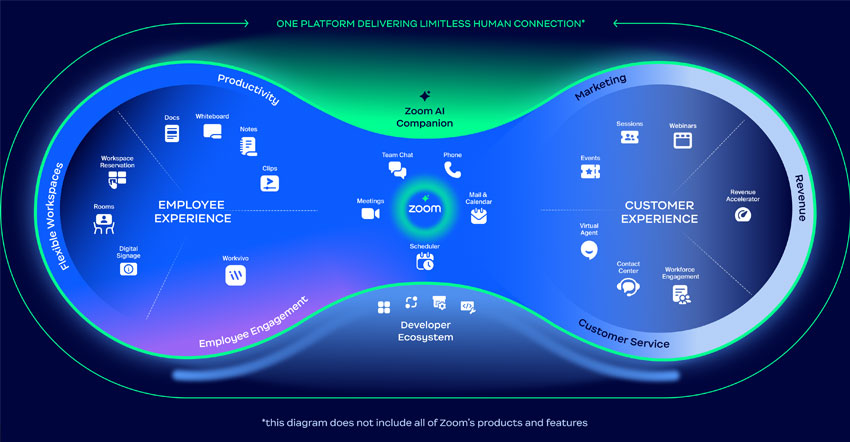

While this may seem tricky to pull together, Zoom has an advantage by unifying all its solutions onto one platform – as highlighted below.

As such, the vendor may expand its business into new areas and tie solutions together without it seeming clunky or forced.

The 2022 acquisition of Solvvy – now the Zoom Virtual Agent – is an example of this, which now interoperates with the Zoom Contact Center, Revenue Accelerator, and WEM suite. Expect Zoom’s maneuvers with WorkVivo to follow suit.

Expect More to Come

2023 proved a big year for acquisitions across the contact center space.

Another significant example is Salesforce snapping up Airkit.ai, a low-/no-code bot-building platform that specializes in customer service use cases.

Yet, as part of the Salesforce stack, don’t expect it to stay inside Service Cloud. It’s also likely to automate cross-function workflows and unify the customer experience team. More on this here.

Other CCaaS providers that made acquisitions in 2023 include Enghouse Systems purchasing what’s left of Lifesize, Puzzel rolling up S2 Communications, and Diabolocom acquiring Phedone.

Now, as 2024 begins, such acquisitions may accelerate. Indeed, Steve Blood, VP & Analyst of the Gartner Sales & Customer Service Practice, predicted:

As it matures, the CCaaS market will emulate legacy premises – a few major providers and a long tail of smaller companies specializing in regions or verticals.

If this is the course of action, those major providers may start to nip away at the competition and consolidate the market.

While that trend appears only at its advent, 2024 could signal the spark that lights its flame – particularly if the past two weeks are anything to go by.