IDC has named Salesforce the biggest CRM provider in the world for the 12th year running.

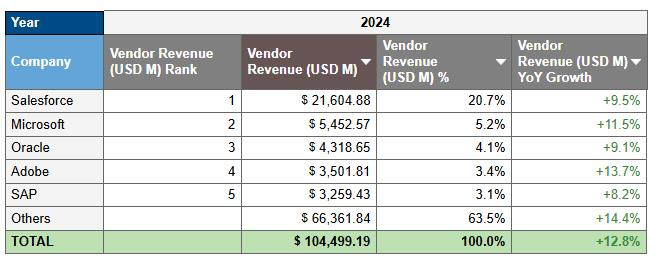

Figures from its 2025 Worldwide Semiannual Software Tracker show that Salesforce earned over $21.6BN in CRM revenues last year.

That’s over $5BN greater than its four closest competitors combined. They are: Microsoft, Oracle, Adobe, and SAP.

Microsoft is the nearest rival, earning $5.45BN in 2024, almost four times less than Salesforce.

The IDC study analyzed CRM vendors from 50+ countries across six continents, with Salesforce claiming first place at a canter.

Commenting on the results, David Schmaier, President and Chief Product & Impact Officer at Salesforce, credited the company’s “clear and evolving vision for the future of CRM” and its “commitment to customer success.”

He continued: “At Salesforce, we believe that the trinity of apps, agents, and data are the key to unlocking the next wave of customer success.

Our deeply integrated platform empowers businesses of all sizes to leverage AI and data to make every customer interaction smarter, automate their processes, significantly reduce costs, and increase employee productivity at scale.

“We could not be more excited to partner with our customers on this journey and help them redefine what’s possible.”

Overall, Salesforce owns 20.7 percent of the market. Notably, that’s down from 21.7 percent in the previous study.

Also, while Salesforce’s CRM revenue rose by 9.5 percent in 2024, earnings across the entire market grew faster, by 12.8 percent.

The only “big five vendor” to exceed that rate was Adobe, boasting a CRM revenue growth rate of 13.7 percent.

Interestingly, that underscores how the CRM market remains highly fragmented.

Indeed, while Salesforce may dominate in revenue, it occupies just over a fifth of the market. That leaves plenty of opportunity for smaller vendors.

However, any threat to its market leadership is likely long-term, not short-term.

Additionally, market analysts believe that Salesforce still delivers market-leading CRM technology.

For instance, over the past 12 months, Salesforce led both the Forrester Wave for CRM Software and the Gartner Magic Quadrant for CRM Customer Engagement Centers (CEC).

Salesforce Credits Agentforce for Its Continued CRM Leadership

While Schmaier was fairly vague with his comments about what fuels Salesforce’s leading performance in CRM, the company’s official release also included a section about Agentforce, suggesting that the agentic AI platform helped the vendor pick up the top spot.

Although this should be taken with a pinch of salt, given how strongly Salesforce has been pushing Agentforce and the fact that the company performed similarly in 2024, before Agentforce had been released, there is no denying that AI agents are now a critical component of its CRM offerings.

Indeed, the platform integrates with Salesforce’s existing CRM ecosystem and enables customer-facing teams to mechanize many of the existing processes they’ve mapped out within Salesforce.

Moreover, it allows them to build workflows outside the Salesforce ecosystem to connect front-office teams with the middle- and back-offices.

That’s a significant shift and requires Salesforce to bring new expertise into the business. While it may have prevented some short-term obstacles, Salesforce seemingly believes this is a long-term business winner that is already boosting its sales efforts.

Playing Catchup

Given the dominance of Salesforce’s performance, it is easy to overlook how the other vendors fared.

Yet, while the top five CRM providers did remain the same as in 2023, Adobe leapfrogged SAP to move from fifth to fourth place.

Interestingly, despite being named a leader in both the Gartner Magic Quadrant and Forrester Wave, there was no place for Pegasystems in the top five.

ServiceNow and HubSpot are other companies many may have expected to see towards the top of the tree.

Notably, ServiceNow has stated its aim to eventually become the CRM market leader, claiming to bring several differentiators to the market.

However, it – and every other vendor – has a long way to go in mounting a serious challenge to Salesforce’s decade-plus CRM market reign.