The contact center technology market is crowded, with more players from a CRM, UCaaS, and even CPaaS heritage sensing an opportunity to win business in the space.

Most, if not all, are banging the AI drum. In 2024, some thudded much harder than others. Yet, in 2025, AI integration is much deeper in the tech stack and more consistent across vendors.

The use cases aren’t surprising, including self-service, AI assistance, conversational intelligence… these were all big last year too, but now are more embedded and refined.

Still, some are ahead of others, but the gap in terms of capability is closing, and spotting what sets the vendors apart gets trickier.

Against this backdrop and the explosion in contact center options, the ISG Buyers Guide goes deeper into the changing market and the vendors leading from the front.

ISG’s Inclusion Criteria and Methodology

ISG prides itself on offering a broader scope of the contact center industry, evaluating 33 vendors, which all provide technologies that route customer interactions to human and AI agents.

ISG prides itself on offering a broader scope of the contact center industry, evaluating 33 vendors, which all provide technologies that route customer interactions to human and AI agents.

All evaluated providers offer that base capability, agent desktops, and other “elements of yore”. Yet, ISG also honed in on the “expanded universe of tools that support and extend” the modern contact center platform.

Those include advanced analytics, conversational AI for self-service, knowledge management, and workforce optimization (WFO) tooling.

Either through first- or third-party systems, there are potentially hundreds of vendors that meet these requirements. So, ISG also specified that providers must have at least $50MN in annual or projected revenue, 50 employees, and 25 customers spread across two or more continents, alongside other criteria.

With its shortlist of vendors, ISG evaluated each across seven core categories. The first five relate to the product experience:

- Adaptability

- Capability

- Manageability

- Reliability

- Usability

The final two relate to customer experience:

- Validation

- Total Cost of Ownership/Return on Investment (TCO/ROI)

In doing so, ISG sorted through product demos, documentation, and a lengthy questionnaire to score the participants, shedding light on how their offerings match up.

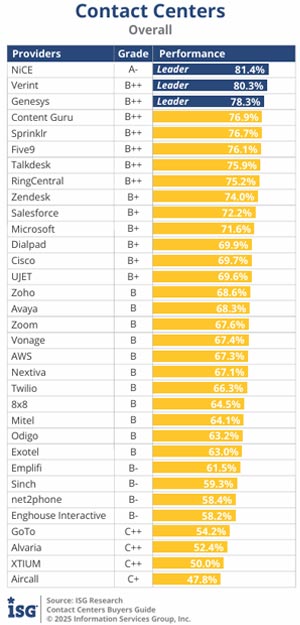

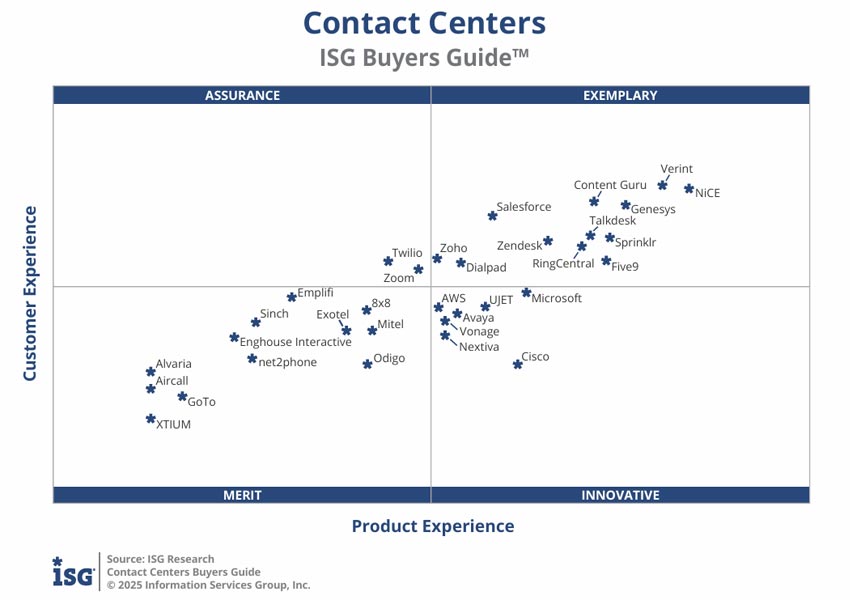

The matrix below unpacks how each provider performed, while ISG’s overall scores are also available in the table to the right.

Top Takeaways from the ISG Buyers Guide 2025

Alongside its overall scores, ISG provides more information in its report regarding each vendor’s strengths and weaknesses.

Yet, the additional industry insights it shares most differentiates the analyst’s evaluations, giving buyers greater context on which to consider vendors and the broader market.

The following seven top takeaway extracts some of that insight, with additional commentary from the report’s lead author, Keith Dawson, Director of Research for Customer Experience at ISG.

1. Contact Center Buyers Have More and More Options

Vendors with a background in CRM, UCaaS, and other adjacent fields are making a beeline for the CCaaS space. That has given buyers a much broader range of options, from companies with very different origins and approaches. This means buyers can orient their decisions differently.

Dawson noted: “Some may still start with routing engines, but others begin with data infrastructure, CRM, or CDP, then build outward. A big decision point now is whether to focus on voice or digital first. That choice is leaving some traditional vendors behind.”

To that point, while voice remains crucial, digital is becoming the dominant channel. “It’s the present as much as the future,” summarized the analyst. That shift is happening faster than many legacy brands seemingly anticipated.

2. CCaaS Decision Making Is Shifting

Contact centers used to have their own IT offshoots, focused primarily on telecoms. IT leaders would happily leave customer support in a silo because it meant dealing with voice and phone numbers, which was tricky and, frankly, mind-numbing.

Yet, enterprise IT and the CTO now play a central role in CCaaS buying decisions. They arbitrate across marketing, sales, and service to ensure tech stacks integrate properly. That means buying decisions are increasingly collaborative.

“You can’t just buy a contact center solution in isolation anymore. IT, marketing, and service all need to be involved, because compatibility and integration are critical,” said Dawson. “A poor choice can hold an organization back for years.”

3. CCaaS and ITSM Are Converging

With IT playing a greater role in buying decisions, they will likely lean into contact center platforms that closely align with their solutions. That trend may boost Genesys and Zoom, as CCaaS vendors move toward tightening the gap between customer service and IT service management (ITSM).

Yet, from a broader perspective, with IT taking a leading role, they can see technology overlaps between the contact center and other departments that the old telecom-focused IT groups didn’t care about.

“Now, enterprise IT is looking across the whole structure, including contact centers, and asking why ITSM applications can’t also be applied in customer environments,” said Dawson. “The natural linkages are much clearer.”

4. The Standout Performers Have Embraced Industry Consolidation

Most vendors ISG evaluated can deliver a strong, basic contact center system. The gap there isn’t huge. The speed at which they’ve consolidated new technologies into their platforms separates the standouts from the middle of the pack, per Dawson.

“AI is the big one, but also advanced analytics and openness to integrations, especially with back-office systems,” he said. NiCE is perhaps the best example of a business building out those back-office integrations, with many big announcements so far in 2025.

Meanwhile, CCaaS solutions built on other platforms, most often Microsoft Teams, lag a little in the matrix, due to their reliance on external systems and related innovation limitations. However, Dawson stresses that they still may be the best for mid-sized buyers looking to converge systems.

5. CCaaS Leaders Recognize an Opportunity for Deeper Analytics

The likes of AWS, Microsoft, and Salesforce are increasing their presence across the CCaaS space. Notably, these all have powerful business intelligence (BI) tools.

Recognizing this, Dawson said: “If BI tools evolve into customer interaction analytics, the whole market could shift dramatically.”

Indeed, BI solutions could bring powerful new capabilities to contact center platforms. Just consider what is on the roadmap for platforms like Microsoft Power BI and Tableau; they’re going agentic. That means they are creating AI agents that spin up dashboards on command, even without predefined parameters.

As these capabilities drift into the contact center, Dawson stresses that it will become easier for business leaders to extract insights from data they didn’t use before.

Yet, the analyst suggests that the future of contact center analytics won’t be about just presenting insights but corresponding actions, too.

6. Agent Assist Adoption Is Lagging Expectations

From the ISG evaluation, vendors are innovating significantly around agent experience. Yet, according to Dawson, the take-up of agent-assist tools seems to be trailing expectations.

“Agent assist requires a strong knowledge management infrastructure and a data strategy, which may be slowing adoption,” he said. “Not every organization is ready for that investment yet.”

The analyst also cites an overriding emphasis on customer-facing automation and the need for extensive change management as possible adoption blockers.

“There are also questions about whether the incremental improvement justifies the disruption and costs,” added Dawson. “Some organizations will move faster than others.”

7. Questions Linger Over Contact Center AI

The next 12 months will ask CCaaS vendors many questions about whether they can deliver on their promises, especially those around cost savings and containment.

Essentially, does it reduce headcount, and if so, how does that impact customer experience?

As those questions start receiving answers, Dawson hopes that the mentality of many contact center buyers will shift away from cutting costs and that they’ll start asking more strategic questions about revenue, loyalty, and the contact center’s role in customer experience.

“Modern tools can enable that shift, but it’s up to leaders to recognize and act on the opportunity,” said Dawson.

Eager to learn more from Dawson and the ISG team? If so, check out CX Today’s top takeaways from the ISG Customer Experience Management Advanced Buyers Guide 2025